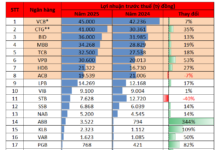

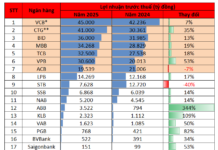

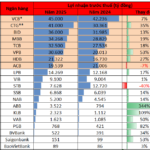

The race to attract more non-term deposits is heating up among Vietnamese banks as they strive to improve their cost efficiency and maintain competitive lending rates. While Techcombank has led the pack for many years, it recently slipped to second place, with MB taking the top spot.

Vietcombank maintains its third position with a CASA ratio of 34.2%, a slight increase of 0.3 percentage points from 33.9% at the end of last year. MSB holds on to fourth place with a CASA ratio of 26.2%, despite a minor dip of 0.1 percentage points. VietinBank has climbed up the ranks, surpassing ACB to secure fifth place with a CASA ratio of 22.5%, reflecting a 0.1 percentage point improvement from 2023.

The top 10 CASA performers for the first half of 2024 also include ACB, TPBank, Sacombank, BIDV, and VPBank. Notably, SeaBank, though outside the top 10, witnessed remarkable growth, ending the first half of the year with a CASA balance of VND 20,038 billion, a substantial 59% increase compared to the same period last year, accounting for 13.4%.

As the economy continues to face challenges and businesses seek lower interest rates, a high CASA ratio provides a significant advantage for banks, enabling them to reduce input costs and offer competitive lending rates while ensuring future profitability.

Banks with a strong CASA position, superior credit quality, and effective risk management will be better positioned to maintain attractive lending rates. Conversely, those with high non-performing loans and low CASA ratios may face pressure to increase lending rates, compromising their competitiveness.

The competition to attract CASA deposits is expected to intensify, and it won’t be an easy feat for any bank. ACB’s CEO, Từ Tiến Phát, acknowledged the advantage that a large CASA base offers in managing capital costs.

Techcombank’s CEO, Jens Lottner, attributed the decline in their CASA to affluent customers diversifying their idle money into various asset classes, such as real estate and bonds. Given the significant proportion of these customers, Techcombank’s CASA is more susceptible to fluctuations compared to its peers.

Recognizing this as beyond their control, Lottner emphasized the need to focus on factors within their influence, such as business accounts, auto-earning features, and rewards, to boost CASA. He shared their strategy for the second half, which includes increased marketing spend, reward programs, and cashback credit cards, expressing confidence in surpassing a 40% CASA ratio.

MSB, meanwhile, attributes its CASA performance to its strategic focus on individual and small-to-medium enterprise customers. The bank aims to enhance its CASA ratio by offering more attractive features and services, working towards a target of 35-40% by 2027.

VPBank, leveraging its digital strengths, innovative payment solutions, and comprehensive customer segmentation, is confident in its ability to achieve a breakthrough in CASA attraction. With a robust technological foundation and a massive customer base, the bank is poised for substantial CASA growth in 2024.

Experts emphasize the need for banks to adopt innovative approaches to attract CASA deposits. This includes creating a comprehensive online transaction ecosystem, investing in technology to digitize services, partnering with e-wallets, financial companies, and insurers, and offering fee waivers and cashback incentives. By encouraging customers to maintain higher balances in their transaction accounts, banks can boost their CASA ratios.

Additionally, retail banks should strive to enhance customer convenience and reduce costs associated with their financial products and services. By winning customers over with superior service and product offerings, banks can retain their clientele and, in turn, improve their CASA positions. This strategy is particularly crucial for smaller banks that may find it challenging to compete with the CASA growth rates of larger institutions.

Deposit Interest Rate Reaches 40.1% by 2023, MB Holds Top Spot in CASA for 2nd Consecutive Year

Thanks to our pioneering efforts in digital banking, 2023 marks the third consecutive year that MB has attracted over 6 million new customers annually, bringing the total number of customers served to 27 million.