Profitability Target at the Company Level by Q4 2024

Specifically, MWG’s board member shared that the EraBlue chain aims to be profitable at the company level by Q4 this year, and everything is still on track.

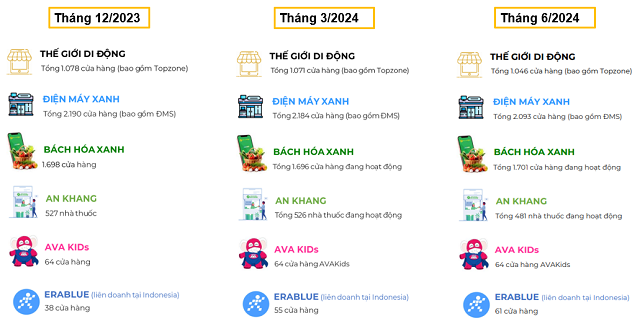

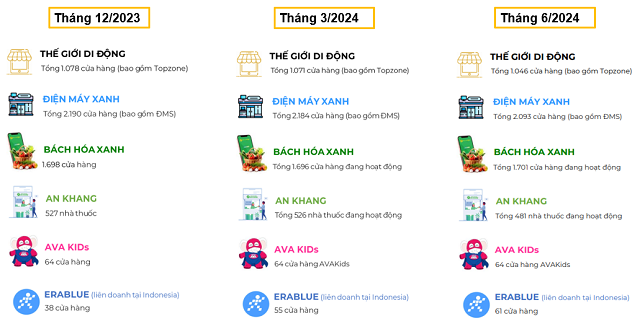

According to MWG’s disclosure, as of the end of June 2024, the company was operating a total of 5,446 stores, including 61 EraBlue stores. Compared to the beginning of the year, the number of EraBlue stores has shown an increasing trend, alongside Bach Hoa Xanh. While other chains have remained stagnant or declined.

EraBlue chain maintains a growing number of stores

|

Regarding the challenges of investing in Indonesia, Mr. Hieu Em mentioned encountering certain difficulties related to customs, consumer behavior, leasing, construction, and more. But, in the last year and a half, they have overcome all of these obstacles.

“Indonesia is an archipelago, but we focus on doing well on the island of Java, which has a large land area and population, resulting in a scale comparable to that of Vietnam”, said Mr. Hieu Em.

Why does Erablue’s revenue double that of Dien May Xanh, but it is not yet profitable?

According to MWG’s leadership, Erablue’s revenue in the mini and supermini formats is very high, ranging from one and a half to double that of similarly-sized Dien May Xanh stores in Vietnam. Specifically, each mini-store brings in over 4 billion VND, while supermini stores bring in over 2.5 billion VND.

As for why they are not yet profitable with this revenue, Mr. Hieu Em attributed it to initially high costs. However, he emphasized his confidence that as they continue to open more stores, many issues will be resolved.

“The number of EraBlue stores is still relatively small, so we haven’t received maximum support from brands. As we grow in scale, sales, and market share, we will receive more support”, Mr. Hieu Em shared.

An EraBlue store in Indonesia – Photo: MWG

|

MWG’s leadership also shared that compared to the Vietnamese market, the Indonesian market is quite fragmented, but customer demand is huge. Additionally, factors such as transportation, shopping behavior, and purchasing habits are quite similar. At the same time, he mentioned that they are opening EraBlue stores outside of shopping centers, which is more in line with local customs.

According to Mr. Hieu Em, EraBlue stores will primarily compete with traditional Indonesian stores, leveraging their unique offerings and competitive pricing. Moreover, the high-quality service provided in Vietnam has been successfully replicated in Indonesia.

He provided an illustrative example, stating that in the Indonesian market, customers purchasing and installing a basic air conditioner would typically have to wait 7-10 days, as there is usually no ready stock, and the process involves transferring the product to the brand, then connecting with a third-party partner for delivery and installation. However, with EraBlue, if a customer purchases in the morning, they can have it delivered and installed by the afternoon.

Factors such as replicating Vietnam’s service culture and having a strategic partner like Erajaja have helped expedite the development of the EraBlue chain, according to Mr. Hieu Em.

He also added that the EraBlue chain has launched a website for online business, achieving promising results with approximately 2,000 daily visits. However, as the stores are concentrated in a specific area, their service coverage is limited.

In terms of market share, the online segment in Indonesia is about 20% higher than in Vietnam.

Learning from the Cambodian market, an IPO is an effective way to evaluate the collaboration with Erajaja

During the meeting, a shareholder asked about the lessons learned from the previous failure in the Cambodian market. Mr. Hieu Em responded, “The results of our model in Cambodia weren’t too bad, but the market was too small. The experience we gained from Cambodia gave us valuable insights and boosted our confidence as we entered the Indonesian market.”

He also emphasized that MWG has a strategic partner, Erajaja, in Indonesia, which helps navigate the market’s unique characteristics.

Additionally, Mr. Hieu Em shared that during their collaboration with Erajaja, they set joint targets, such as reaching 500 stores by 2027. There are multiple ways to assess this partnership, including conducting an IPO for the electronics segment in Indonesia, which would be a very effective evaluation method.

|

EraBlue is MWG’s new overseas venture, launched in late 2022. It is a chain of consumer electronics retail stores in Indonesia, similar to Dien May Xanh in Vietnam. EraBlue is a joint venture between Mobile World Investment Corporation and PT Erafone Artha Retailindo (Erafone). Erafone is a subsidiary of Erajaya Group, a leading technology retailer in Indonesia. |

Exposing the Tricks that Help Startup Founders Earn Big Before IPO

By employing this tactic, companies virtually guarantee that company executives will have a surprising profit on the first day of stock trading.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…