Hanoi’s real estate market is showing signs of “outpacing” Ho Chi Minh City in terms of demand.

It’s not just apartments; Hanoi’s land, townhouses, and villas are also witnessing a surge in demand, “leaving behind” Ho Chi Minh City.

A comparison between the supply and transactions in these two markets reveals a contrasting picture: Hanoi’s real estate market is exhibiting signs of “overheating,” while Ho Chi Minh City’s recovery trajectory appears more stable and even slower-paced compared to the 2020-2021 period.

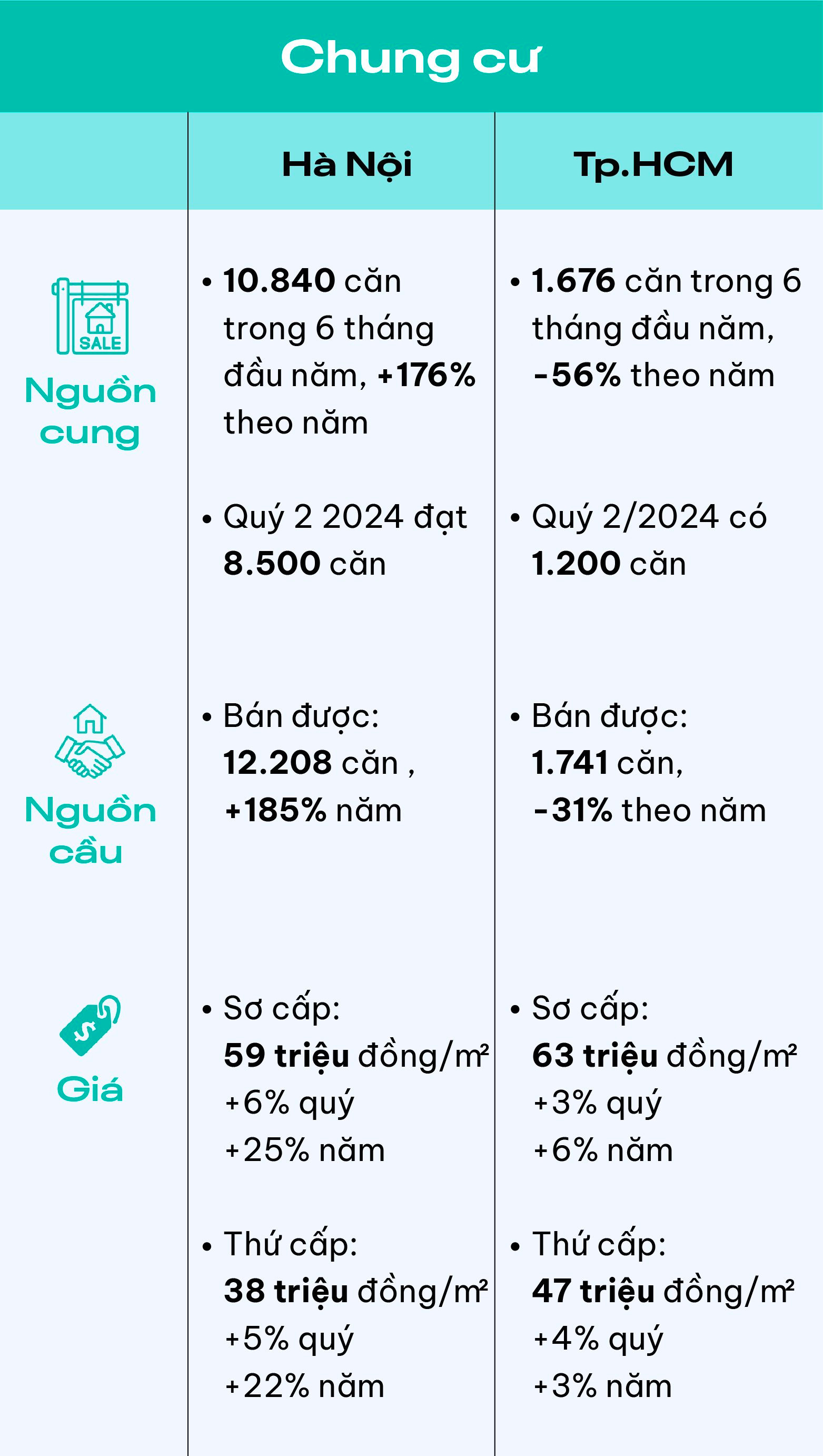

The condominium segment in Hanoi and Ho Chi Minh City is experiencing a “phase shift” in terms of key indicators. Data compiled from CBRE Vietnam.

Back in 2021, industry insiders predicted this “phase shift” between the two major cities. Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn’s Southern Region, anticipated that Ho Chi Minh City’s real estate market recovery would lag behind Hanoi’s.

This prediction proved accurate in the third quarter of 2021, as Hanoi witnessed a decline in interest, ranking lowest compared to Danang (48%) and Ho Chi Minh City (50%). However, in September 2023, Hanoi experienced a strong rebound in interest, reaching 75% compared to the beginning of the month, while Danang and Ho Chi Minh City trailed at 44% and 30%, respectively.

At that time, Batdongsan.com.vn attributed this to Hanoi being the least affected by the COVID-19 outbreak, while Ho Chi Minh City bore the brunt of it. The entire market was virtually halted during that period. In Q3 2021, interest in various segments in Ho Chi Minh City, such as land, detached houses, and condominiums, plummeted by 40-60%. In contrast, Hanoi witnessed a decrease in interest, but the decline was less pronounced.

Perhaps, Hanoi’s real estate market gained better “momentum” coming out of the COVID-19 pandemic compared to Ho Chi Minh City. This trend has persisted, leading to an earlier revival of dynamism in Hanoi, despite both markets experiencing prolonged periods of fluctuation.

Abundant Supply

Explaining the contrasting trends between Hanoi and Ho Chi Minh City, Mr. Vo Huynh Tuan Kiet, Director of Residential Sales at CBRE Vietnam, attributes it to the opposing supply trends in the two cities.

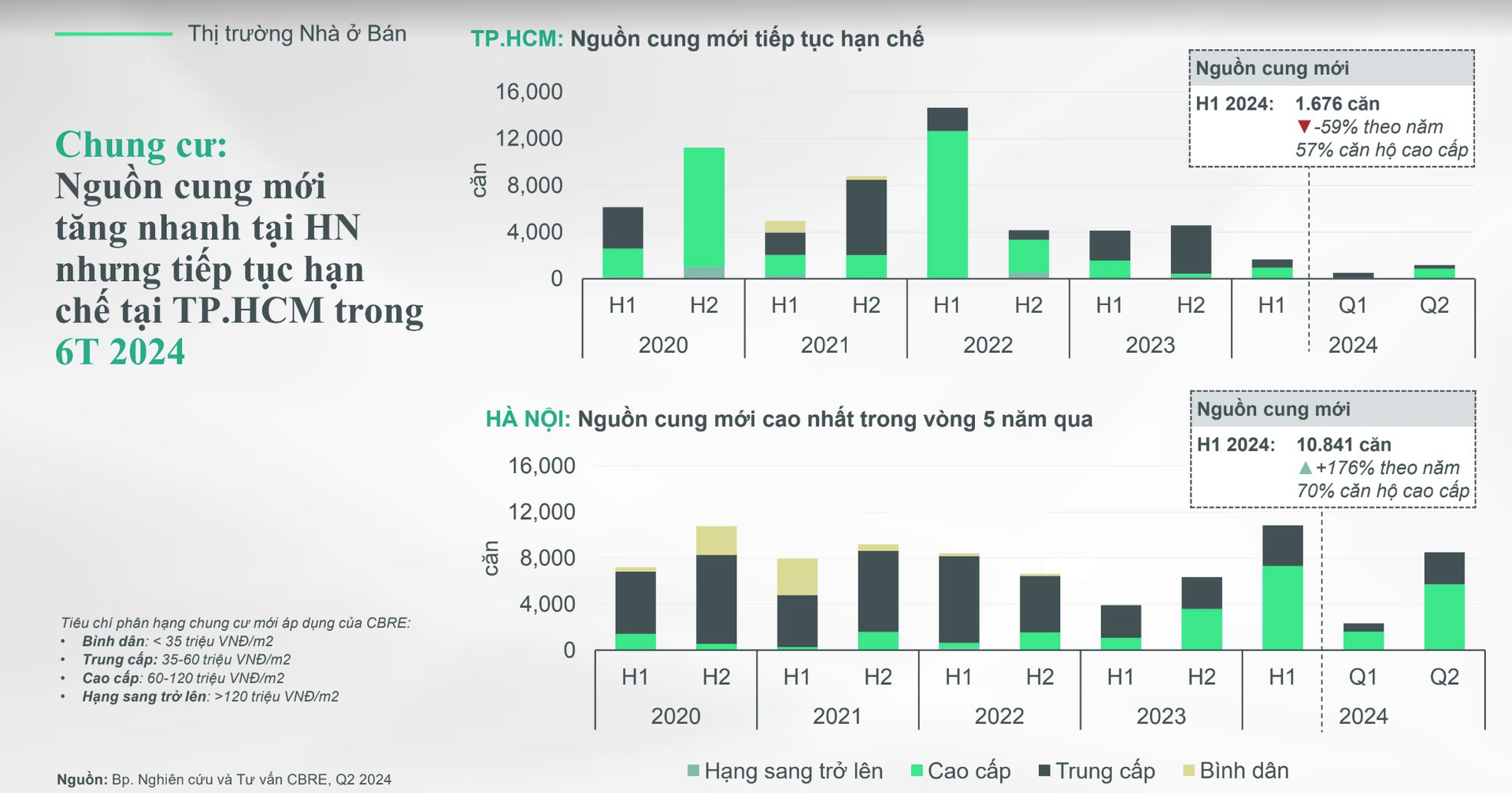

Specifically, in the first half of 2024, Ho Chi Minh City saw the launch of only about 1,600 condominium units, while Hanoi witnessed nearly 11,000 new units entering the market. Additionally, Hanoi’s absorption rate mirrored this increase, with 12,000 units sold during the same period, compared to a meager 1,700 units in Ho Chi Minh City. “These figures clearly illustrate the vibrancy of Hanoi’s market, outpacing Ho Chi Minh City by a significant margin,” emphasized Mr. Kiet.

Hanoi’s supply surpasses Ho Chi Minh City’s in the first half of 2024.

Looking ahead, from now until the end of 2024, Hanoi is expected to continue its momentum with over 9,000 new condominium units slated for launch, bringing the total number of new units offered for the year to nearly 20,000. This will be the highest number of new condominium units launched in Hanoi in the past five years, since 2020.

Prices Still Lower Than Ho Chi Minh City

Currently, Hanoi’s condominium prices, both in the primary and secondary markets, are gradually catching up with Ho Chi Minh City’s. The price gap has narrowed from 25% in 2022 to around 10% in early 2024. This indicates that Hanoi has the advantage of more affordable prices, leaving room for further price appreciation.

It’s understandable that primary prices in Hanoi have been increasing at a rate of 20-25% per year to “catch up” with Ho Chi Minh City’s price levels, given that there was a period when Hanoi lagged behind Ho Chi Minh City in various aspects.

Ho Chi Minh City’s real estate market experienced a period of significant price increases. Photo: Ha Vy

Recently, 70% of new supply in Hanoi belonged to the high-end segment, contributing to the upward trajectory of primary condominium prices.

Moreover, the number of completed and delivered units within the past 1-2 years has been relatively limited, ranging from 15,000 to 20,000 units, falling short of meeting the rising demand for housing. In contrast, during the 2019-2020 period, the number of delivered units reached 30,000 – 40,000 units per year. As a result, the continuous increase in housing demand has propelled primary prices in Hanoi to rise steadily in the first few months of 2024.

Hanoi Investors’ Psychology: “Unleashing” After a Period of Suppression

Mr. Vo Hong Thang, Deputy General Director of DKRA Group, offers another perspective on the accelerating pace of Hanoi’s real estate market, attributing it partly to the “suppressed” psychology of investors.

According to Mr. Thang, the market fluctuations during the period from 2020 to 2023, influenced by factors such as the COVID-19 pandemic and market adjustments, inadvertently created a “suppressive” effect on the real estate investment appetite of investors in Hanoi and the Northern region in general.

These investors are the main driving force behind a significant portion of real estate purchases nationwide. Given the market’s inherent risks and unpredictable variables, along with the increasing demand for housing in Hanoi’s core areas, these investors tend to prioritize properties closer to where they live instead of “distant ventures” as in the past.

According to experts in the field, the contrasting developments between Hanoi and Ho Chi Minh City’s markets have underlying reasons. From left to right: Mr. Vo Hong Thang, Mr. David Jackson, and Mr. Vo Huynh Tuan Kiet.

Consequently, this “consolidation” of investors in Hanoi, instead of venturing into other provinces and cities, has fueled the market’s rising temperatures.

In Ho Chi Minh City, in addition to the continued trickle of new supply, primary prices have also risen modestly. An annual increase of 3-5% is quite modest for a real estate market that is one of the most vibrant in the country. Limited supply reduces choices for buyers, and slow price growth does not attract investors. This is one of the reasons why Ho Chi Minh City’s real estate market recovery is lagging behind Hanoi’s.

Mr. Vo Huynh Tuan Kiet shared that businesses in Ho Chi Minh City are cautious about raising prices at this stage, as there was a period when condominium prices in the city continuously set new records. Prices have already reached a high level, and developers must maintain a safe increase to ensure product absorption.

Furthermore, 2024 is a pivotal year for the implementation of new Laws, and businesses are awaiting changes stemming from these Laws rather than focusing on price increases. “Developers don’t want to sell at the same price, but they also don’t want to push prices too high and risk facing challenges in a market that is still dealing with liquidity issues and eroded trust,” said Mr. Kiet.

Photo: Ha Vy

In recent times, real estate projects launched in Ho Chi Minh City have continuously offered attractive sales policies and promotions, indicating that developers are facing pressure on prices. Enhancing sales policies is a strategy employed by developers to attract buyers and compensate for the period of skyrocketing prices. When real estate prices have already escalated, it is challenging for developers to reduce prices directly, so they resort to offering attractive policies instead.

In reality, Ho Chi Minh City’s real estate market is also on the path to recovery. Specifically, the townhouse and condominium segments have maintained stability. Since the beginning of 2024, secondary condominium prices have stopped declining, as observed in 2022-2023, and have shown a slight upward trend compared to mid-2023. Although still 10% below the peak prices of late 2021, this is a positive sign indicating that the market has moved past the “bottoming-out” phase.

In the land segment, transactions for land in Ho Chi Minh City’s peripheral areas and neighboring provinces are starting to pick up, especially for properties priced below VND 2 billion, which are more affordable for many buyers. After a 20-30% decrease from the peak prices in 2021, land prices have edged up slightly by 10%.

Looking at the overall market, Mr. Kiet believes that buyers will not have the opportunity to wait for real estate prices in Ho Chi Minh City to drop. It is challenging for prices to decrease unless the market focuses on developing a new segment.

One noticeable trend is that after a period of market fluctuations, the demand for real estate in Ho Chi Minh City for actual use has taken center stage. During this phase, Ho Chi Minh City is regarded as a market driven by end-users.

Assessing Hanoi’s real estate market, Mr. David Jackson, General Director of Avison Young Vietnam, opined that the “price fever” in Hanoi’s condominium segment during the initial months of 2024 reflected an investment and speculative motive that overshadowed the demand for housing.

For instance, some condominium projects in Hanoi witnessed price increases ranging from VND 300 million to VND 700 million within just 1-2 months. Similarly, a villa project in Hoai Duc district, located 16km from the center of Hanoi, experienced a price surge of 40% in eight months.

Considering the context of an unremarkable recovery in the real estate market, volatile interest rates, an economy still in the process of rebounding, and the need for time to absorb the trio of new Laws related to real estate, this “overheating” trend warrants caution.

On the other hand, in Ho Chi Minh City and its neighboring provinces, buyers seeking practical housing have a wider range of options at reasonable prices. The robust development of infrastructure in the peripheral areas has empowered buyers to access projects with prices ranging from VND 50 million per square meter and below.

“Consequently, Ho Chi Minh City’s market, as a whole, is recovering towards a more balanced state. Price growth is steady, market sentiment remains positive, and transactions are stable,” affirmed the Avison Young expert.

According to Mr. David Jackson, the “price fever” in Hanoi’s condominium segment during the early months of 2024 reflected an investment and speculative motive overshadowing the demand for housing. Illustration.

With the trio of new Laws—the Land Law, Housing Law, and Real Estate Business Law—now officially in effect, Ho Chi Minh City’s real estate market is expected to continue its transformation and witness more positive recoveries in the medium and long term.

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…