In July 2024, The Gioi Di Dong’s (stock code: MWG) Bach Hoa Xanh chain brought in more than VND 3,600 billion, a slight increase from the previous month and a 28% jump from July 2023. The average revenue per store remained at VND 2.1 billion.

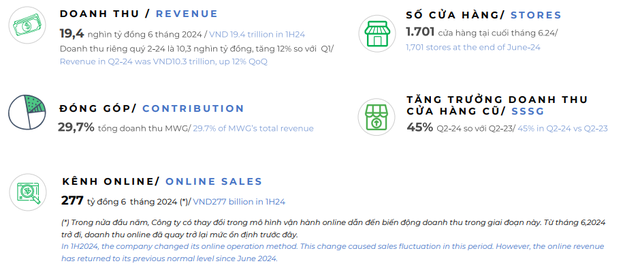

Looking back at the first six months, Bach Hoa Xanh contributed 29.7% to MWG’s revenue, equivalent to approximately VND 19,400 billion. In Q2 2024 alone, it generated VND 10,300 billion, a 12% increase from the previous quarter. Notably, the chain turned a pre-tax profit of about VND 7 billion in the last quarter.

On a per-store basis, average revenue reached VND 2 billion in Q2 2024, up 43% year-on-year. Fresh produce and fast-moving consumer goods (FMCGs) saw growth rates ranging from 30% to 60% during this period. The total number of invoices for the first six months of 2024 increased by 38% compared to the same period last year.

In terms of geography, stores outside of Ho Chi Minh City contributed 80-90% of the revenue of stores within the city, indicating a relatively small gap between the two regions.

Reflecting on the first half of the year, Mr. Pham Van Trong, CEO of Bach Hoa Xanh, shared that the chain has focused on enhancing the quality of its merchandise and improving the in-store shopping experience. This includes increasing the number of cashiers to expedite the checkout process and optimizing the parking lot to make shopping more convenient.

Additionally, Bach Hoa Xanh has been working on increasing revenue per store, which is a crucial step in improving absolute profits. The company has also been concentrating on two key initiatives: reducing operational costs at the store level and logistics expenses.

Regarding logistics costs, the CEO of Bach Hoa Xanh stated that they have achieved the target set at the beginning of the year by reducing warehouse space while still accommodating revenue growth. The company has also decreased travel time and improved vehicle load capacity. According to Mr. Trong, the cargo capacity of their vehicles has improved compared to the previous average of 60-70%.

EACH STORE’S REVENUE GROWTH MAY NOT BE AS STRONG AS IN THE PAST

Discussing Bach Hoa Xanh’s growth prospects, Mr. Pham Van Trong believes that the chain still has room to increase store revenue in the coming periods, but not as significantly as in the previous phase. Mr. Trong attributes this to the fact that each Bach Hoa Xanh store, with an area of 150-200 square meters, has already reached its maximum capacity in terms of merchandise volume and customer service.

From now until the end of the year, Bach Hoa Xanh will continue to explore ways to reduce operational costs and enhance revenue to meet the overall profit target set by the company’s leadership. Regarding the consumer market, Mr. Trong predicts a growth rate in the second half, although not significant.