The stock market ended the trading week on a positive note, with green dominating the session from the opening bell. Among the gainers were real estate stocks, which saw a surge of buying interest with several stocks hitting the maximum intraday increase of nearly 8%. Notable performers included L14, DXS, NVL, HDC, KBC, NTL, and NVL.

Stocks such as PDR of Phát Đạt, DIG of DIC Corp, DXG of Đất Xanh Group, and NHA of the Hanoi Urban and Industrial Development Corporation, witnessed strong buying pressure, resulting in a surge to the upper circuit breaker, with some even facing a “sell-side drought.” The CEO stock also neared its upper circuit breaker, recording an impressive 8% gain.

After languishing at the lows for several months, stocks like DXG, CEO, DIG, HQC, QCG, and KBC have witnessed a strong rebound since the beginning of August. However, these stocks still trade significantly lower, ranging from 10% to nearly 40%, compared to their prices at the start of the year.

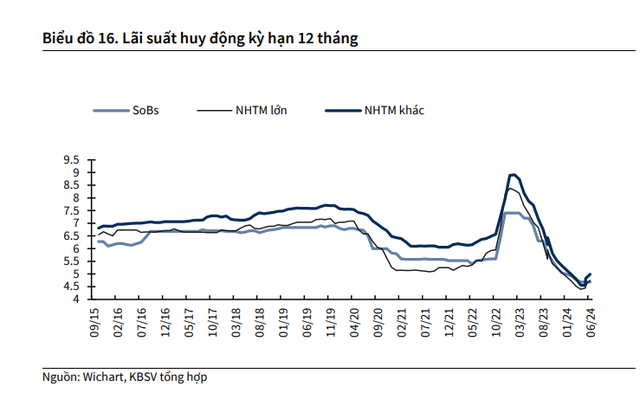

In a recent report, KBSV Securities anticipated that lending rates are unlikely to decline further in the near term. The research team expects the low-interest-rate environment to stimulate home-buying demand among the population.

Additionally, KBSV foresees an improvement in the sales performance of real estate businesses in the second half of the year. The improved market sentiment, coupled with expectations of sustained low-interest rates, is expected to motivate developers to launch new projects in the upcoming quarters.

Numerous listed companies have plans to introduce new projects or continue with subsequent phases of existing projects in the latter half of 2024, including Wonder Park and Co Loa (Vinhomes), Clarita and Emeria (Khang Dien), Gem Sky World and Gem Riverside (Dat Xanh), Akari City, Mizuki Park, Southgate, and Central Lake (Nam Long).

KBSV notes that amidst challenges in capital raising through bond issuances and bank loans, real estate businesses are turning to equity financing to restructure their debt obligations and fund project development.

Moreover, the refinement of the legal framework is anticipated to bolster the industry’s growth in the medium to long term. During the 6th session and the 5th extraordinary session of the 15th National Assembly, the Law on Real Estate Business (amended), the Law on Housing (amended), and the Law on Land (amended) were officially adopted and will come into force on January 1, 2025.

However, the government has proposed to the National Assembly Standing Committee to advance the effective date of these laws to August 1, 2024. KBSV believes that this effort by the government demonstrates its commitment to addressing the challenges faced by the real estate market and fostering its sustainable development in the long run.

“The three new laws introduce numerous new provisions that are expected to boost home-buying sentiment and reduce the time required for developers to complete legal procedures, thereby enhancing supply. We believe this presents an opportunity for developers with strong financial health and project execution capabilities. However, it will take time for these policies to fully take effect, and certain legal issues still require more specific guidance,” the report emphasized.

In summary, KBSV anticipates a noticeable recovery in the performance of real estate businesses in the second half of 2024, attributed to improved homebuyer sentiment and increased supply from new projects and subsequent phases of existing ones.

Echoing a similar sentiment, VIS Rating asserted that the early enforcement of the three real estate-related laws, effective from August 1, 2024, would expedite project approval processes and enhance supply starting in 2025. They foresee high demand for housing in the latter half of 2024, driven by favorable interest rates, which will boost sales for developers launching new projects.

VIS Rating’s team of experts highlighted that the high demand for housing is expected to drive sales for developers introducing new projects. Consequently, they anticipate a mild improvement in sales and cash flow for developers over the next 12-18 months as new projects are introduced.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.