Billions of VND spent on roads connecting Ho Chi Minh City and Long An

There has hardly been a time when the west of Ho Chi Minh City, particularly Long An, has been mentioned as much as it is now. The continuous flow of positive information about transport infrastructure investments has helped to bridge the gap between Ho Chi Minh City, Long An, and other regions.

Recently, Ho Chi Minh City allocated VND 17,200 billion for the construction of two new roads connecting to Long An. The first project involves extending Vo Van Kiet Street (in Ho Chi Minh City) to Duc Hoa (in Long An) with a total investment of approximately VND 8,400 billion. This route will also include a fully integrated interchange with Ho Chi Minh City’s Ring Road 3. The Ho Chi Minh City Department of Transport will prepare a pre-feasibility study report for submission to the competent authorities for investment policy approval for the 2024–2030 period.

The second route is a new road in the northwest, approximately 8 km long and 40 m wide, with a total investment of about VND 8,800 billion in the form of a public-private partnership (PPP).

These two routes, once established, will facilitate travel from the west to the center of Ho Chi Minh City via Vo Van Kiet Street, while also helping to alleviate frequent traffic congestion in Binh Chanh and Hoc Mon districts (Ho Chi Minh City) and Duc Hoa district (Long An). They will form a cross-city axis connecting Ring Road 2 to Ring Road 4 and the dynamic Duc Hoa axis.

This will contribute to more efficient cargo transportation from local industrial parks to important ports in Ho Chi Minh City and Long An.

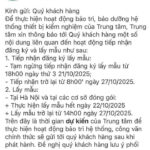

Transport infrastructure investments have helped to reduce travel time from the west to the center of Ho Chi Minh City. Illustration

In the northwestern region, to enhance connectivity with Long An, the Ho Chi Minh City Department of Transport also proposed a project to widen Nguyen Van Bua Street to 32-40 m (from Ngã Ba Giồng to Tỉnh lộ 9 Bridge) and to build two large bridges, each 58 m long and 17.5 m wide. In addition, the existing Tỉnh lộ 9 Bridge will be widened. The total investment for this project is over VND 2,421 billion, funded by the Ho Chi Minh City budget, and will be implemented during the 2024–2028 period.

Most recently, Long An Province announced that in 2024, it was allocated VND 2,886 billion for investment in local transport infrastructure projects. In particular, the focus is on key projects with regional connectivity characteristics, such as Ho Chi Minh City’s Ring Road 3 and Ring Road 4, as well as provincial roads 823D and 830E, National Highway 50B, and National Highway N1.

Among these, the 823D provincial road, with a starting point in Duc Hoa district and Ho Chi Minh City, and an ending point at the Hau Nghia roundabout in Duc Hoa district, is being expedited by Long An Province for completion in 2024.

In addition to efforts to improve transport infrastructure for easier and faster connections with Ho Chi Minh City and other regions, Long An has continuously attracted investments into its industrial parks, providing a boost to the local socio-economic landscape, including the real estate sector.

Specifically, Long An has planned and implemented investment attraction for a list of 27 technical infrastructure projects for industrial clusters in the province. With a vision to develop 51 industrial parks by 2030, covering a total area of 12,490 ha, the province also aims to supplement approximately 37 industrial parks with a total area of nearly 20,000 ha and plan 28 new industrial clusters with a total area of more than 1,800 ha.

With this number of industrial parks, Long An becomes the second locality in the country (after Binh Duong) in terms of industrial park area, providing great conditions and opportunities for investment attraction.

Real estate market expected to rebound from the end of this year

Long An’s real estate market, which was once quiet due to general fluctuations, has now been revitalized thanks to infrastructure development, large-scale projects, and the province’s investment promotion policies, which have boosted investor confidence. Real estate transactions in early 2024 showed signs of a “reversal” compared to the same period last year. This trend is expected to continue in the last months of 2024 and beyond, as Long An currently enjoys multiple advantages.

The Long An Real Estate Market Report for June 2024 showed that in terms of the local housing market, Ben Luc, Duc Hoa, and Can Giuoc were the three localities with the highest increases in rental property demand in the past month, with increases of 10%, 15%, and 21%, respectively, compared to the previous month.

According to local brokers, while the real estate market in Long An was slow last year, transactions have improved this year. Property prices in Long An remain stable, with most investors adopting a long-term investment strategy and fewer speculating on short-term price fluctuations. Price increases are based on growing demand and improvements in local infrastructure and the economy.

Apartment prices range from VND 20-24 million/m2. Land prices range from VND 16-55 million/m2. Townhouses in Long An are priced from VND 4.5-8 billion/unit. Villas have an average price range of VND 8-15 billion/unit, while luxury villas with river views range from VND 18-40 billion/unit…

Interest in Long An real estate has shown signs of increasing in the first months of 2024. Source: batdongsan.com.vn data

In terms of supply, although Long An has abundant land funds, there are relatively few well-planned projects developing large-scale residential areas or new towns. In recent years, Long An has become a playground for businesses with a long-term development orientation. Some new projects are creating highlights in the local real estate market.

For example, the An Huy My Viet project in Duc Hoa (Long An) by An Huy Real Estate Joint Stock Company is about to enter the market. This 60-hectare project includes 2,500 land, villa, townhouse, and shophouse products. Thanks to its prime location adjacent to major transport routes such as National Highway 22, National Highway N2, Ring Road 3, Ring Road 4, Provincial Road 10, National Highway 1A, Provincial Road 823, and Provincial Road 824, the project offers easy connections to Ho Chi Minh City’s center. Moreover, the residential area is located within a planned 7,000-hectare industrial park zone, featuring a well-planned green space and a diverse range of living experiences, contributing to the appeal of real estate in Ho Chi Minh City’s western region. Here, residents can enjoy a green living environment with abundant job opportunities, business prospects, and long-term investment potential.

Indeed, over the past decade, Long An has quietly proven its potential with existing residential areas and townships. In Duc Hoa, Can Giuoc, and Ben Luc, there are already large-scale projects that have been operational for many years. Some of these townships have high occupancy rates and have witnessed significant price appreciation. These projects have transformed the landscape of the Long An market, backed by the relentless efforts of local real estate businesses.

Recently, the expected surge in land prices in Ho Chi Minh City has also encouraged buyers to look towards satellite areas with high development potential, such as Long An. With its existing advantages, Long An’s real estate market is expected to gain momentum from the end of this year. The appeal lies in projects with complete legal procedures and well-developed infrastructure.

Mr. Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam, said that urban areas adjacent to rivers and industrial parks in the outskirts of Ho Chi Minh City have created a trend in the local real estate market. Townhouses, in particular, are favored by individual investors who tend to be early adopters and pioneers in shaping market demand.

“Improved transport connections have brought Ho Chi Minh City and its surrounding areas closer together. As a result, the trend of choosing a second home, such as a townhouse or villa in a large-scale urban area, has become the new ‘taste’ of Saigonese,” said Mr. Kiet.

He also emphasized that while the supply of real estate in the west of Ho Chi Minh City has always been limited, the demand for real housing in this area is significantly higher than in other regions. When there is high demand for real housing, individual investors can expect stable returns on their investments.

Nevertheless, the market will undergo a process of purification. Investors should be cautious about projects that lack legal completeness and avoid excessive use of financial leverage for investment.