Chinese car brands are facing a challenge in Vietnam, with their vehicles priced between 1 and 2 billion VND, and not offering very attractive discounts or promotions. This makes them less appealing to customers when compared to cars from Korea and Japan.

High Prices to Assert Quality

Dealerships of Lynk & Co and BYD have stated that they do not offer price discounts, and their vehicles are sold at the manufacturer’s listed price to “assert quality from the outset.” As a result, a used Lynk & Co 09 can still be sold for 2.199 billion VND, while the Lynk & Co 01 and 05 models are priced at 999 million VND and 1.599 billion VND, respectively…

Chinese car dealerships are struggling to attract customers. Photo: GIA HƯNG

Positioning their products in the premium segment, Lynk & Co plans to buy back used vehicles with a low depreciation rate, only reducing the value by 10% each year. Meanwhile, BYD assures customers with an extended warranty of up to 8 years for three models currently on sale, priced from 659 million VND to 1.359 billion VND.

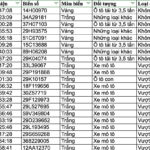

On the other hand, some Chinese car brands are slashing their prices by hundreds of millions of VND to attract customers. A dealership in Thu Duc City, Ho Chi Minh City, is offering the Haval H6 hybrid vehicle at 840 million VND, a discount of 146 million VND from the listed price. If customers show genuine interest, the dealership might consider a further reduction of a few tens of millions of VND. The staff there shared that without this strategy, they would not be able to achieve their monthly sales target of eight cars.

MG dealerships are also offering significant discounts on most of their models. For instance, the RS5, with a listed price of 739-829 million VND depending on the version, is being offered with a discount of 160 million VND. The MG5 and HS models are also being sold at reduced prices, with discounts of 67 million VND and 110 million VND, respectively. Similarly, TMT Motors has recently reduced the price of the Wuling Mini EV LV2-120 and LV2-170 models by 58 million VND and 48 million VND, respectively.

Mr. Vo Van Hoang, in charge of a car showroom in Thu Duc City, Ho Chi Minh City, opined that in previous years, there were not many Chinese cars entering the Vietnamese market, so competition was minimal. This year, with an influx of new models from various Chinese brands, vehicles like MG and Wuling are facing intense competition, forcing them to lower their prices significantly. Moreover, the Wuling, once considered unrivaled, now competes with VinFast’s VF 3 model.

Amid the wave of Chinese car arrivals, two new brands, Omoda and Jaecoo, have organized test drives at Dai Nam Racetrack in Binh Duong Province. They are also working with partners to open dealerships in September, aiming for a network of 20 dealerships by 2024. Tan Chong Group has also confirmed that they have been authorized by Chinese carmaker GAC Motor to import and distribute their vehicles in Vietnam through their subsidiary, TC Services Vietnam.

Lack of Customers but Remain Confident

Mr. Hoang commented that Lynk & Co and BYD’s insistence on maintaining high prices in the Vietnamese market serves a clear purpose. In Thailand, for instance, Chinese cars are prevalent, and price reductions are common to gain market share. However, early buyers who purchased before the discounts suffered significant financial losses and sued the car brands. He attributed the lack of customers at Chinese car dealerships in Vietnam to consumers’ expectations of price reductions, similar to what happened in Thailand.

Mr. Vo Minh Luc, Executive Director of BYD Auto Vietnam, believes that the domestic car market is large enough for them to confidently launch their products. He also reassured consumers that Vietnam would not face a situation like Thailand’s, as Thailand supports imported cars with a 0% import tax rate, while taxes account for 70% of the price of cars imported into Vietnam. BYD is currently selling vehicles in Vietnam at a loss of 30%-35%, offering the best possible price, and further reductions are not feasible.

According to Mr. Nguyen Dang Quang, Director of Business and Dealer Development for Omoda and Jaecoo, these two car brands will win over the Vietnamese market with their high quality, European safety certifications, and competitive pricing. He added that the company is investing in building a factory in Vietnam to commence production and assembly from 2026, along with offering an extended warranty of up to 10 years or 1 million kilometers to give customers peace of mind.

The $3.2 Million Car Park in Danang: Is the Price Too High?

The flawed calculation method for parking fees has resulted in an unattractive pricing structure for the VND 76 billion parking lot located at 116 Hai Phong, Danang. This has led to a significant lack of demand for the facility, with many drivers opting for alternative parking options.

The Golden Dilemma: Can Information Gathering Curb Gold Bar Smuggling and Speculation?

“Many investors believe that buying and selling gold is a personal freedom, and while jewelry stores have the right to request information for invoicing, passing on personal details to the police has caused concern. Meanwhile, many gold shops are wary of displaying their gold for fear of confiscation during inspections, leading to a further decline in an already dull and lackluster market.”