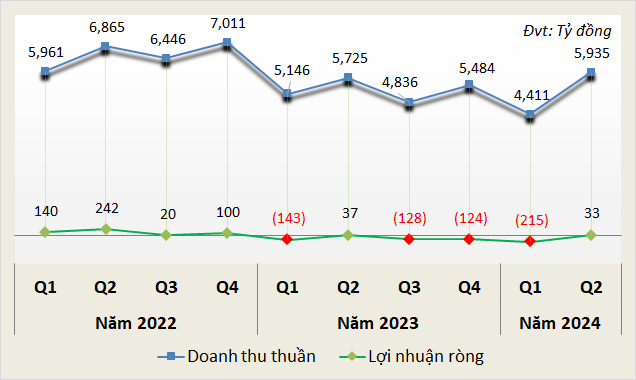

According to statistics from VietstockFinance, the cement industry has turned a profit after three consecutive quarters of losses, earning over 33 billion VND, a 9% decrease from the previous year, while revenue reached 5,935 billion VND, a 4% increase.

According to statistics from VietstockFinance, the cement industry has turned a profit after three consecutive quarters of losses, earning over 33 billion VND, a 9% decrease from the previous year, while revenue reached 5,935 billion VND, a 4% increase.

In the past, due to global influences and the increasingly tense and unpredictable Middle East war, while the domestic real estate market has not really flourished, cement supply far exceeded demand, and raw material and fuel prices remained high. Domestic consumption and exports declined, inventories increased, and some plants had to reduce capacity or shut down, causing many businesses in this sector to struggle and sink into losses.

|

Revenue and Profit of Cement Enterprises from Q1/2022 – Q2/2024

Source: VietstockFinance

|

More companies reported profits

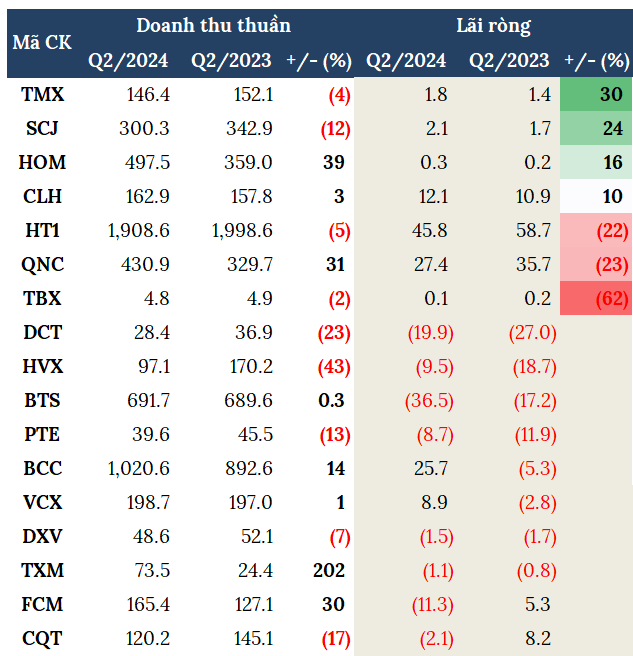

According to statistics, out of the 17 cement companies that published their Q2/2024 financial statements, 4 companies increased profits, 3 decreased, and 2 turned a profit after losses. The remaining 8 companies incurred losses, with 2 profitable companies turning unprofitable and 6 continuing to lose money.

Although many companies are still losing money, the number of profitable companies has increased compared to the first quarter, when only one company reported a profit.

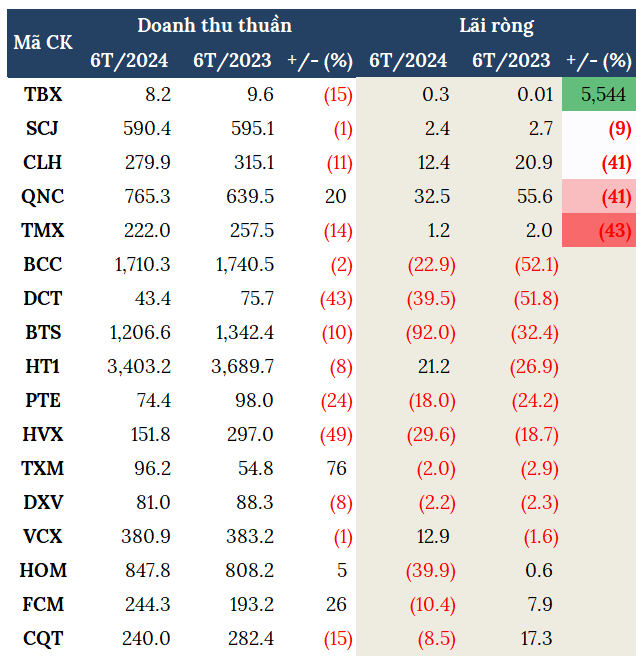

Leading the growth was CTCP VICEM Trade Cement (HNX: TMX) with a net profit of nearly 2 billion VND, a 30% increase over the same period last year. However, the cumulative 6-month net profit of TMX decreased by 43%, amounting to over 1 billion VND.

Sài Sơn Cement (UPCoM: SCJ) also made a profit of more than 2 billion VND in Q2, a 24% increase, thanks to stable plant operations, reduced input material costs, and lower interest expenses as SCJ repaid its medium-term capital. However, similar to TMX, SCJ‘s 6-month net profit was just over 2 billion VND, a 9% decrease.

Despite a decline in cement demand, La Hiên VVMI Cement (HNX: CLH)’s Q2 net profit still increased by 10%, reaching over 12 billion VND, but the 6-month cumulative net profit decreased by 41% to 12 billion VND.

While other companies in the industry have experienced losses in recent quarters, CLH has bucked the trend, reporting a loss only once in Q3/2017 (over 2 billion VND). CLH stated that the real estate market in Q2/2024 was subdued, cement demand declined, and there was more rainfall, leading to reduced consumption and lower product prices. However, the company implemented solutions such as increasing equipment productivity and saving production costs. Additionally, as the repair of major equipment was mainly concentrated in Q3/2024, the company also reduced financial expenses, resulting in higher profits.

Apart from the companies with profit growth, there were two additional companies that turned a profit: Bỉm Sơn Cement (HNX: BCC), with a profit of nearly 26 billion VND (compared to a loss of over 5 billion VND in the same period last year), and Yên Bình Cement (UPCoM: VCX), with a profit of nearly 9 billion VND (compared to a loss of nearly 3 billion VND in the same period last year).

|

Financial Performance of Cement Enterprises in Q2/2024 (in billion VND)

Source: VietstockFinance

|

But most are still in a bind

With a loss of over 36 billion VND in Q2/2024, VICEM Bút Sơn Cement (HNX: BTS) extended its losing streak to the seventh consecutive quarter (since Q4/2022).

In a similar situation, VICEM Hải Vân Cement (HOSE: HVX) also incurred losses for the fifth consecutive quarter (since Q2/2023) with a net loss of nearly 10 billion VND. HVX attributed the decrease in profit primarily to a reduction in cement consumption, with a decline of nearly 48,000 tons in Q2 (including 27,800 tons of clinker), equivalent to a 31% decrease compared to the same period last year.

Q2/2024 marked the thirteenth consecutive quarter of losses for Phú Thọ Cement (UPCoM: PTE), with a loss of nearly 9 billion VND. The cumulative loss for the first six months was 18 billion VND. PTE stated that 2024 continues to be a challenging year for the cement industry, with declining cement demand in the market and intensifying competition, resulting in reduced profits.

Two other companies newly joined the losing group: Mineral Joint Stock Company FECON (HOSE: FCM), with a net loss of over 11 billion VND, and Quán Triều VVMI Cement (UPCoM: CQT), with a loss of more than 2 billion VND, while in the same period last year, they made profits of over 5 billion VND and over 8 billion VND, respectively.

The cement giant Hà Tiên reported more favorable results, with a net profit of nearly 46 billion VND, a 22% decrease. The 6-month net profit was over 21 billion VND, compared to a loss of nearly 27 billion VND in the same period last year.

Similarly, Quảng Ninh Cement and Construction (UPCoM: QNC) also recorded a Q2 profit of over 27 billion VND, a 23% decrease. For the first half of the year, QNC‘s profit was nearly 33 billion VND, a 41% decrease.

|

Financial Performance of Cement Enterprises in the First Half of 2024 (in billion VND)

Source: VietstockFinance

|

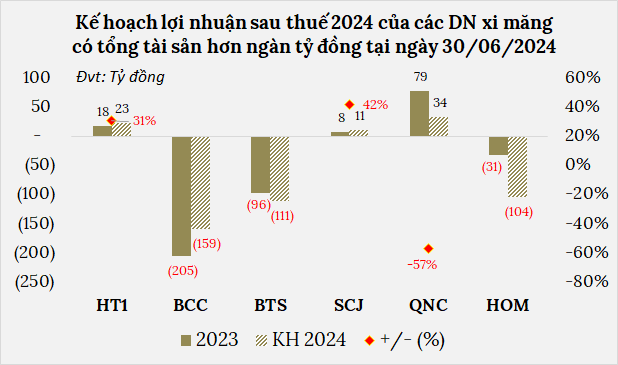

The results for Q2 and the first half of 2024 reflect the ongoing challenges and obstacles facing the cement industry. This comes as no surprise, as cement companies have acknowledged and anticipated these difficulties, with many expecting to continue incurring losses in 2024.

Typically, Bỉm Sơn Cement projected a loss of nearly 159 billion VND for 2024, while VICEM Hoàng Mai Cement (HNX: HOM) planned for a loss of nearly 104 billion VND, and BTS expected a loss of 111 billion VND.

HT1 and SCJ appear more optimistic, targeting after-tax profits of over 23 billion VND and over 11 billion VND, respectively, representing increases of 31% and 42% compared to 2023. QNC set a more conservative after-tax profit target, aiming for a 57% decrease to 34 billion VND.

Source: VietstockFinance

|

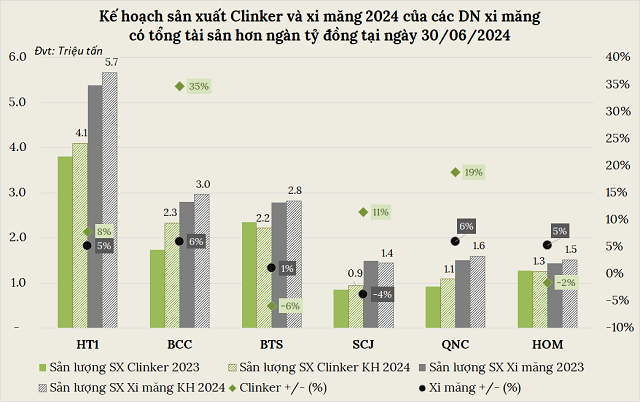

In terms of production volume, most companies have planned for growth. HT1, for example, expects to produce nearly 4.1 million tons of clinker and 5.66 million tons of cement, increases of 8% and 5%, respectively, compared to the previous year. Similarly, BCC has set a target to produce over 2.3 million tons of clinker, a 35% increase, and nearly 3 million tons of cement (including outsourced production), a 6% increase.

Source: VietstockFinance

|

Not enough to initiate a new growth cycle

According to the Ministry of Construction, clinker and cement production have significantly declined since 2023. As a result, the total output last year reached only 92.9 million tons, equivalent to 75% of the total designed capacity. The total consumption in 2023 reached 87.8 million tons, a 12% decrease compared to 2022.

In 2023, domestic cement consumption reached only 56.6 million tons, a decrease of over 16% compared to 2022, the most significant decline ever recorded in the cement industry.

In the first half of 2024, the total consumption of clinker and cement reached approximately 44 million tons, similar to the same period last year. Clinker exports also reached about 5.4 million tons, nearly equal to the first half of 2023.

The continuous decline in export volume is due to the stagnant Chinese real estate market, which has resulted in a cement surplus that is expected to compete with Vietnamese cement in export markets such as the Philippines, Central America, and South Africa. Additionally, high maritime freight rates and technical barriers in most export markets have impacted exports.

Moreover, the industry’s financial situation is challenging due to the substantial capital investments required by construction material production companies, especially cement manufacturers. In the initial stages of operating a plant, companies must repay loans, along with high-interest expenses, resulting in substantial pressure to repay both principal and interest. Slow consumption has led to some companies halting production lines, causing inefficiencies and losses in the cement sector. The unpredictable global economic situation and the intensifying Middle East war further compound these challenges.

The information presented indicates that the future of the cement industry remains uncertain. Despite an increase in the number of profitable companies, it is not enough to conclude that a new growth cycle has begun for the industry’s prospects in the coming period.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.