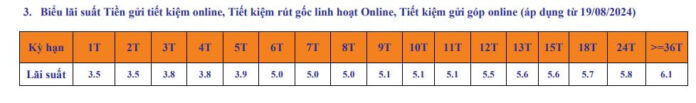

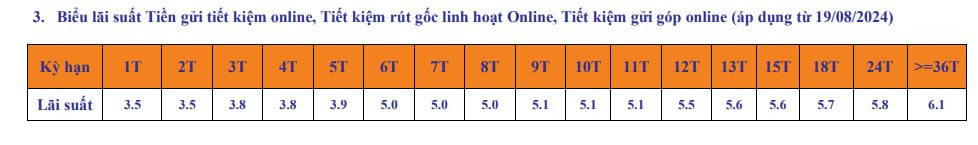

Saigon-Hanoi Commercial Joint Stock Bank (SHB) has introduced a new interest rate for deposits, effective today (August 19). This is the second time the bank has raised its deposit rates in the past three weeks.

Specifically, for online deposits – SHB’s highest-interest product, the bank has increased rates for 3-4 month and 18-month tenors by 0.2% per year. Deposits with tenors of 4 to 15 months will enjoy a 0.3% annual increase.

As a result, the interest rate for 3-4 month tenors has been adjusted to 3.8% per annum, while the 5-month tenor offers a competitive 3.9%.

The bank has also increased interest rates for 6-8 month and 9-11 month tenors to 5% and 5.1% per annum, respectively. New competitive rates of 5.6% and 5.7% per annum are now available for 12-15 month and 18-month tenors.

SHB maintains its interest rate for 1-2 month tenors at 3.5% per annum, while the 24-month tenor stands at 5.8%. For tenors of 24 months and above, the bank offers an attractive 6.1% per annum.

This 6.1% interest rate, applicable to deposits of 36 months and above, is not only SHB’s highest offering but also the most competitive in the market today.

In addition to SHB, several other banks are also offering competitive rates, with HDBank, ABBank, BaoViet Bank, BVBank, and Saigonbank among them, providing rates ranging from 6% to 6.1% per annum.

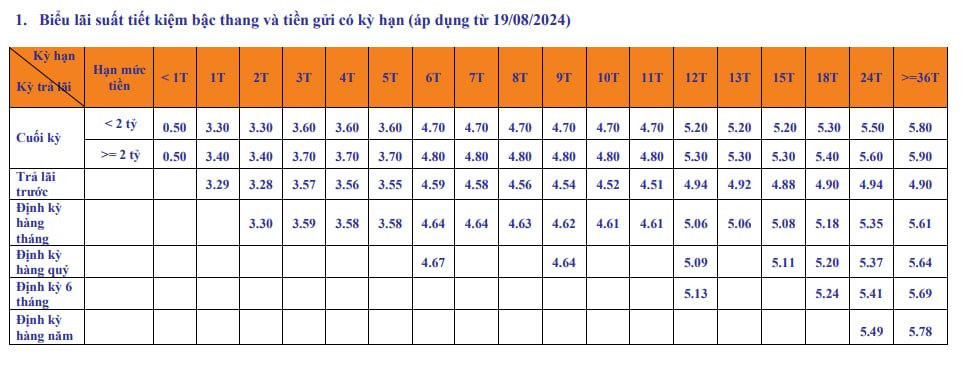

Along with online deposits, SHB has also increased interest rates for various tenors of over-the-counter deposits, with adjustments ranging from 0.1% to 0.3% per annum. Currently, the highest interest rate offered by SHB for over-the-counter deposits from individual customers is 5.9% per annum for deposits of 2 billion VND and above with tenors of 24-36 months.

SHB is the latest bank to join the race to increase deposit rates in August. Since the beginning of the month, 13 banks have raised their deposit rates, including Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, Dong A Bank, VPBank, Techcombank, VietBank, and SHB.

On the other hand, the market has also witnessed three banks lowering their deposit rates, namely Bac A Bank, SeABank, and OCB.

Compared to previous months, the pace of deposit rate increases has shown signs of slowing down, both in the number of banks making adjustments and their frequency. However, deposit rates are still expected to face upward pressure in the remaining months of 2024.

In a recently published analysis report, MBS Securities attributed the aggressive deposit rate increases by banks to the rapid growth in credit, which is currently expanding three times faster than capital mobilization. By raising deposit rates, banks aim to enhance the competitiveness of savings accounts compared to other investment channels in the market.

The analytics team predicted that the upward trend in deposit rates would continue in the second half of 2024 due to the expected increase in credit demand as production and investment accelerate in the latter half of the year.

“We forecast that the 12-month deposit rate of large commercial banks may increase by another 0.5 percentage points, returning to the range of 5.2-5.5% per annum by the end of 2024,” the MBS report stated.

Rong Viet Securities (VDSC) also concurred that an increase in deposit rates is a likely scenario, given the expectations of exchange rate movements and monetary policy adjustments.

However, VDSC emphasized that the increase would not be as drastic as in 2022 due to differing macroeconomic conditions. Unlike 2022, there are no significant shocks to credit demand or abrupt changes in monetary policy in 2024 that could cause a sudden spike in interest rates. Additionally, the pressure on foreign currency outflows is expected to ease significantly if there is a “convergence” effect on interest rates, with the Fed lowering rates while the State Bank of Vietnam (SBV) raises them in the second half of the year. Therefore, VDSC predicts that a moderate increase in interest rates to return to pre-COVID-19 levels is a reasonable scenario.