The Battle for a Slice of the Billion-Dollar Pie: An Insight into Vietnam’s Competitive Coffee Shop Landscape

According to a Vietdata report from June 2024, while the pre-2020 era witnessed the entry of new players into the market, the past two years have seen established brands solidifying their positions and expanding their market share.

In 2021, prominent coffee shop brands such as Trung Nguyên Legend, Highland Coffee, Phúc Long Coffee & Tea House, The Coffee House, and Starbucks captured approximately 33% of the coffee shop business market share in Vietnam. The remaining share was divided among smaller chains (Guta, Passio, Cộng cà phê, Milano, Effoc, Gemini, and Napoli Coffee) and family-owned cafes.

By the end of 2023, Vietdata estimated that the market share of the top five players in the industry had grown to 42%.

Highland Coffee, the chain with the most branches in Vietnam, increased its market share from 7.4% to 11.6%. As per their website, they currently operate 800 stores in Vietnam and 50 in the Philippines. Compared to the end of 2022, Highland Coffee has expanded by almost 200 new outlets. Instead of focusing on menu diversity, the brand chose to strengthen its identity by increasing its store count and brand visibility in prime locations.

Similarly, a recent Mibrand statistic affirmed that Highlands is the largest coffee chain in Vietnam. Their report stated, “The number of stores reflects Highlands Coffee’s effort to expand its scale and market coverage.”

Another established player, Phúc Long, maintained and expanded its presence, increasing its market share from 2% to nearly 4.4%. According to their website, they operate approximately 165 stores and 66 kiosks across Vietnam.

In recent years, Phúc Long has targeted high-end, affluent customers by introducing flagship stores with premium services. One such example is the Phúc Long Premium store in Thao Dien, which spans 2,000 square meters. In addition to its impressive space, this outlet offers table service and an expanded menu of drinks, baked goods, and dishes like beef steak, spaghetti, and pad Thai.

The prices at this premium location are higher than those at regular Phúc Long outlets, with drinks starting at 75,000 VND per cup and dishes ranging from 100,000 to 350,000 VND.

Aside from established brands, the industry has also witnessed the rise of a formidable newcomer, Katinat. In a recent Mibrand statistic, this up-and-coming chain was ranked among the top five brands alongside veteran names. As of August 17, Katinat boasts 73 stores across major cities such as Hanoi, Ho Chi Minh City, Danang, Binh Duong, and Dong Nai, as per their website.

Back in late 2021, Katinat was a small coffee chain with only about 10 outlets in Ho Chi Minh City. However, their rapid expansion into prime locations has allowed them to conquer the tea and coffee market in Vietnam and pose a threat to established players.

Katinat’s success can be attributed to their well-executed marketing strategies and ability to quickly adapt to trends, resulting in long lines of customers eager to try their new menu items.

According to a YouNet Media report, by the end of 2023, Katinat had surpassed The Coffee House in terms of social media mentions. This newcomer ranked third with 212,025 discussions, a 17.89% increase from 2022, climbing one spot higher than the previous year.

While most chains focus on the domestic market, a few have ventured beyond Vietnam’s borders. Trung Nguyên, for instance, has been actively opening stores in China and the US. Currently, nearly 800 Trung Nguyên E-Coffee outlets blanket Vietnam and have a presence in the US and Iceland. Additionally, the corporation claims to have signed over 1,000 successful franchise agreements.

However, the industry landscape isn’t all sunshine and rainbows.

As some competitors rise, others face challenges. In July, The Coffee House locations in Can Tho closed their doors, and in August, three remaining branches in Danang are also planning to cease operations. Consequently, The Coffee House will withdraw from these two cities after years of market expansion.

In other major cities like Hanoi, Haiphong, and Ho Chi Minh City, The Coffee House has started downsizing. As per their website, they currently operate 115 stores, a reduction from approximately 150 outlets at the end of 2023.

The brand’s representative explained that this downsizing strategy aims to optimize costs and improve business operations to adapt to changing conditions.

Revenue vs. Scale: A Complex Relationship

Vietdata’s report revealed that Vietnam’s F&B market, particularly the coffee shop segment, experienced remarkable growth in 2023. By the end of that year, the market for on-site dining was estimated at 21.6 billion USD, an 11% increase from 2022.

Earlier, the 2023 F&B market report by iPOS.vn indicated that the F&B industry’s revenue reached 590 trillion VND, with the beverage sector contributing 16.52%.

However, it’s noteworthy that while sales grew rapidly, profits tended to narrow in 2023 due to intense market competition. To retain loyal customers, chains engaged in promotional programs and refrained from raising prices despite surging coffee bean costs (a primary input).

In terms of revenue, Highlands Coffee experienced a remarkable post-pandemic acceleration. In 2023, the chain achieved a record-breaking revenue of nearly 4 trillion VND, capturing a 12% market share, according to Vietdata. This solidified their position as the largest coffee franchise in Vietnam.

Previously, in 2021, Highlands Coffee generated over 1.7 trillion VND in revenue. During the 2019-2020 period, their annual revenue hovered around 2 trillion VND.

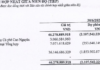

For Phúc Long, now under the Masan umbrella, the parent company assessed that the coffee and tea chain had “grown significantly.” In 2022, the chain generated 1.579 trillion VND in revenue, with an EBITDA of 195 billion VND, ranking second in revenue and first in gross profit margin among domestic coffee and tea chains.

The corporation aims to propel Phúc Long to become the number one tea and coffee company in Vietnam in the next few years, leveraging its “superior efficiency per store, coupled with the acceleration of new store openings.”

However, this ambition faces challenges. In Q2 2023, Phúc Long experienced its first quarterly revenue decline and struggled to find a successful model for its kiosks. The situation improved in the first half of 2024, with revenue increasing by about 5.3% year-on-year to over 390 billion VND, thanks to the contribution of 15 new stores opened in the previous year.

In tandem with its market expansion, Katinat achieved a revenue of nearly 470 billion VND in 2023, capturing approximately 1.35% of the market share.

At The Coffee House, revenue has fluctuated. In 2019, their net revenue reached nearly 862 billion VND, dropping to 735 billion VND in 2020 and further declining to 475 billion VND in 2021. Last year, the beverage chain recorded 700 billion VND in revenue but continued to incur cumulative losses.

Following the aforementioned giants, several coffee shop franchises, such as Cà phê Ông Bầu, GUTA Cafe, Cộng Cà phê, Milano, Napoli, and E-Coffee (Trung Nguyên), occupy a similar segment in terms of pricing, scale, store size, and brand positioning.

The revenue scale of these “sidewalk-style coffee” brands ranges from 15 billion to about 50 billion VND, despite their years of establishment.

Specifically, Cộng Cà Phê, after more than 17 years of development, has 64 stores nationwide but reported only 15 billion VND in revenue in 2023, a 44% increase from the previous year.

GUTA Cafe, established in 2011, now operates over 100 outlets in Ho Chi Minh City. Their 2023 revenue is estimated at over 35 billion VND, a slight 7% increase from the previous year.

Cà phê Ông Bầu’s 2023 revenue hit its lowest point in the last three years (2021-2023), reaching about 50 billion VND, a 45% drop from 2022. This brand has consistently incurred losses, although the annual loss has gradually decreased.

Competing for Customers: Strategies and Innovations

In a recent analysis, Mibrand highlighted two prevalent competition styles among coffee shop chains: horizontal and vertical competition.

Horizontal competition sees brands racing to expand their store count and scale. Statistics show that businesses are focused on capturing market share and attaining a leading position. This competition isn’t just about the number of outlets but also encompasses geographic coverage, convenience, and customer experience.

Coffee shop owners are also focusing on creating unique, experience-oriented concepts.

On the other hand, vertical competition involves smaller players competing based on their “cafe ideas.”

Nowadays, many coffee shops are diversifying their concepts, spaces, and customer experiences. Owners are experimenting with various architectural styles, from classic and retro to modern and industrial, creating a rich tapestry of options for customers.

Additionally, owners are devising unique, experience-oriented concepts. Models like “Dining with Animals,” “Book Cafe,” and “Tech Cafe” are attracting attention and patronage.