Despite the low-interest rate environment, VIB’s attractive offers have helped tens of thousands of townhouses and apartments find new owners.

Introduced in Q2 2024, VIB’s loan packages for 1 million apartments and 30,000 billion VND for townhouse purchases have been well received, especially in major cities such as Ho Chi Minh City, Hanoi, Hai Phong, Binh Duong, Dong Nai, Can Tho, and Da Nang.

Mortgage: What are the options to borrow 2 billion VND but only pay 12.5 million VND/month for the first 24 months?

Mr. Le Minh, a resident of District 9, Ho Chi Minh City, is taking out a mortgage of 2 billion VND with a monthly payment of 25 million VND for principal and interest at another bank. After learning about VIB’s new mortgage product with interest rates of 5.9% – 6.9% – 7.9% for 6-month, 12-month, and 24-month fixed-rate periods, and an additional 0.4% discount for loans to repay other banks, he visited VIB District 9 and met with a VIB consultant. Mr. Minh was offered an optimized financial plan, with a monthly payment of just 12.5 million VND for the first 24 months. His loan request was submitted in the morning, and by the afternoon, the loan was approved.

Mr. Minh’s loan has a 30-year term, with no principal payments for the first 5 years and a 2-year fixed interest rate. Since the loan is for repaying another bank, the fixed interest rate is reduced to 7.5% per annum. Thus, for the first 24 months, he does not have to pay any principal, and the interest cost is only (2 billion VND * 7.5%) / 12 months = 12.5 million VND/month.

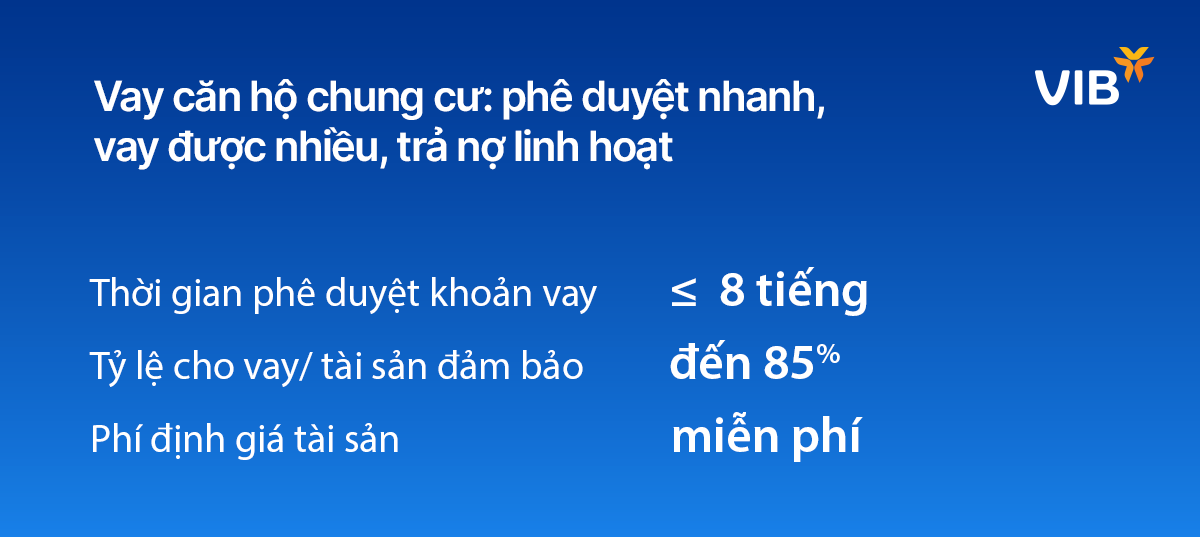

To approve Mr. Minh’s loan within 8 hours, VIB has built a diverse and rich database with valuation data for over half a million apartments in major cities. In addition, VIB continuously upgrades and simplifies the approval process to minimize loan approval time.

Townhouse Loans: Attractive Interest Rates, No Principal Payments for 4 Years, and Early Disbursement to Settle Existing Loans Quickly

Similar to the apartment loan package, the townhouse loan package also offers attractive interest rates of 5.9% – 6.9% – 7.9% for 6-month, 12-month, and 24-month fixed-rate periods, with an additional 0.4% discount for loans to repay other banks.

Furthermore, for customers who wish to transfer their loans to VIB, unlike the market practice of settling existing loans and withdrawing collateral documents or providing additional collateral before disbursement, VIB offers early disbursement to settle the existing loan. This benefit gives customers complete financial control when choosing to transfer their loans to VIB, eliminating the need to worry about borrowing funds for settlement and minimizing risks and additional costs.

Additionally, for loans to repay other banks, VIB offers a loan term of up to 30 years and a loan limit of up to 80% for collateralized townhouses, villas, apartments, and adjacent houses with ownership certificates. VIB is currently waiving property appraisal fees for customers transferring their loans. Moreover, VIB offers flexibility in income verification for borrowers.

Why is it a golden opportunity to take out a mortgage with VIB?

Mortgage interest rates have been low since the beginning of the year until early August 2024, but some banks have started to increase their deposit rates. It is essential to choose the right time to borrow to reduce future financial burdens.

Furthermore, as VIB is ranked in the highest group by the State Bank of Vietnam, it has been granted a higher credit room than many other banks. This means VIB has more flexibility in offering favorable terms, such as interest rates, interest payment periods, and principal repayment schedules, to meet the needs of its customers.

Register for consultation on apartment and townhouse loans with VIB here.

![[Infographic] A Comprehensive Overview of Bank Performance in H1 2024](https://xe.today/wp-content/uploads/2024/09/info-kqkd-ngan-hang-6T-100x70.jpg)