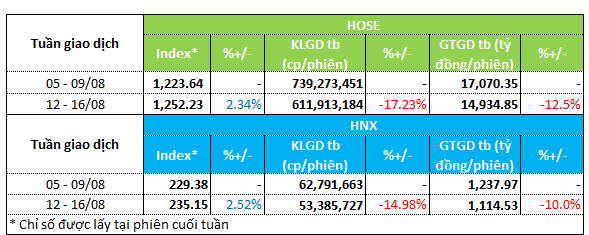

The market witnessed a positive score in terms of points in week 12-16/08, with the VN-Index increasing by over 2.3% to 1,252.23 points. The HNX-Index also rose by 2.5% to 235.15 points.

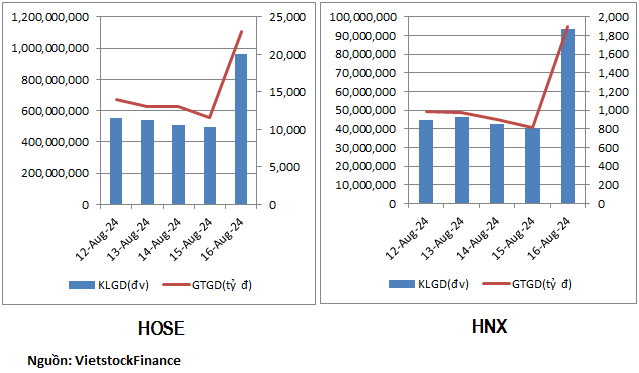

However, liquidity declined this week. On the HOSE floor, trading volume decreased by 17% to nearly 612 million units/session, and trading value accordingly fell by 12.5% to nearly VND 15 trillion/session.

On the HNX floor, trading volume dropped by 15% to 53.3 million units/session, and trading value decreased by 10% to over VND 1.1 trillion/session.

|

Market liquidity overview for the week of 12-16/08

|

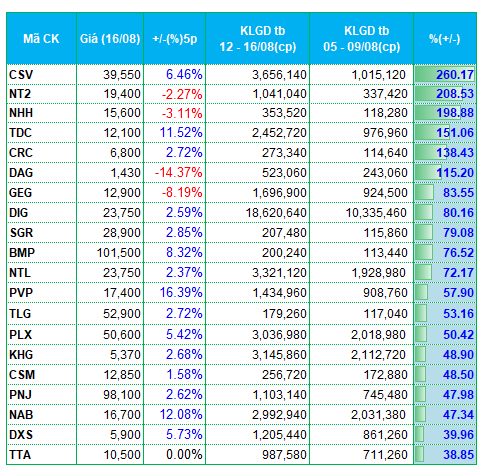

Plastic stocks were the standout performers in terms of attracting money last week. NHH and DAG saw their trading volumes surge several times compared to the previous week. Additionally, some other plastic stocks, such as BMP and NTP, also witnessed significant increases in liquidity.

Among the stocks with higher trading volumes, the real estate group had several prominent representatives, including TDC, DIG, SGR, NTL, KHG, DXS, DTD, and TIG.

DIG stood out with a trading volume of over 18 million units/session. Almost all of the above-mentioned real estate codes witnessed price increases following the inflow of money.

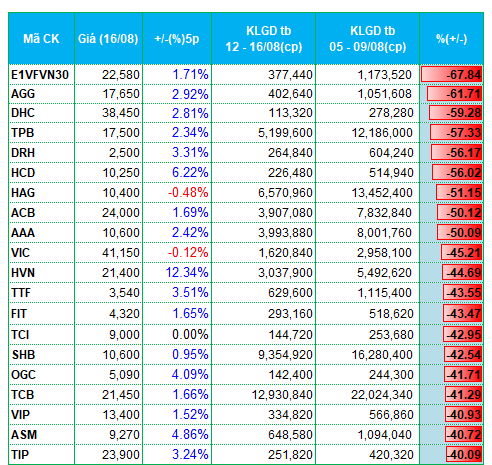

However, there were also real estate stocks that experienced capital outflows. AGG, DRH, VIC, TIP, NRC, and API saw their trading volumes decline by 35-60% compared to the previous week.

The banking sector was the focal point of capital outflows on the HOSE, with TPB, ACB, SHB, and TCB recording trading volume decreases of 40-60%.

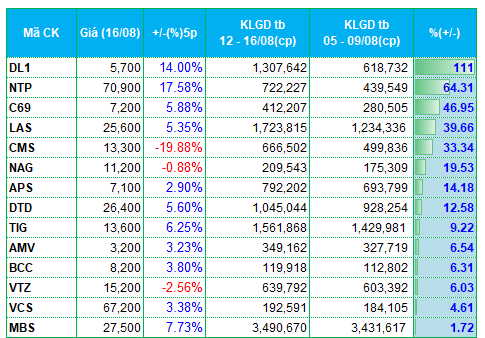

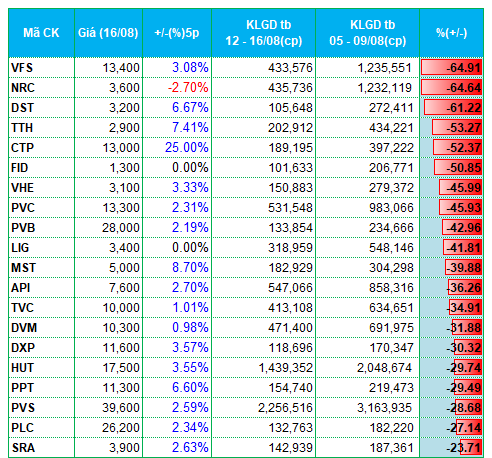

On the HNX, the decline was mainly in the oil and gas group, with representatives including PVC, PVB, and PVS.

|

Top 20 codes with the highest increase/decrease in liquidity on the HOSE floor

|

|

Top 20 codes with the highest increase/decrease in liquidity on the HNX floor

|

The list of codes with the highest increase/decrease in liquidity is based on an average trading volume of over 100,000 units/session.