Illustrative image

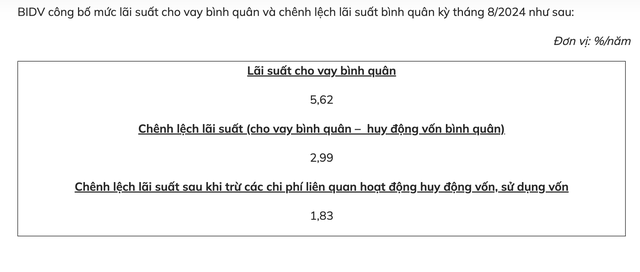

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has just announced an average lending rate of 5.62% per annum for August 2024. The difference between the average lending and deposit rates is 2.99% per annum, and after deducting related costs of capital mobilization and usage, the net interest margin stands at 1.83% per annum.

Compared to July, BIDV’s average lending rate has decreased by 0.1 percentage points. Meanwhile, the difference between the average lending and deposit rates remained unchanged at 2.99% per annum.

As compared to the initially published data in March 2024, BIDV’s average lending rate has decreased by 0.97 percentage points, from 6.59% to 5.62% per annum. The gap between the average lending and deposit rates has also narrowed from 3.12% to 2.99% during this period.

BIDV is currently the largest bank in Vietnam in terms of operating scale and transaction network. As of the end of June 2024, BIDV’s outstanding loans to customers reached nearly VND 1,883 million billion, leading the banking industry and far surpassing other giants such as Agribank (VND 1,592 million billion), VietinBank (VND 1,573 million billion), and Vietcombank (VND 1,370 million billion).

BIDV appoints new batch of senior staff members.

BIDV, the Vietnam Joint Stock Commercial Bank for Investment and Development, has recently announced the decisions made by its Board of Directors and the Supervisory Board regarding the appointment of high-level personnel.

Revealing the Income of Bank Employees

In 2023, amidst the challenging times for many businesses with labor cuts and reduced salaries, the banking sector continues to maintain a strong income level. Among them, Techcombank stands out with the highest average income of 540 million VND per person per year. Few banks have reduced salaries and benefits for their employees.