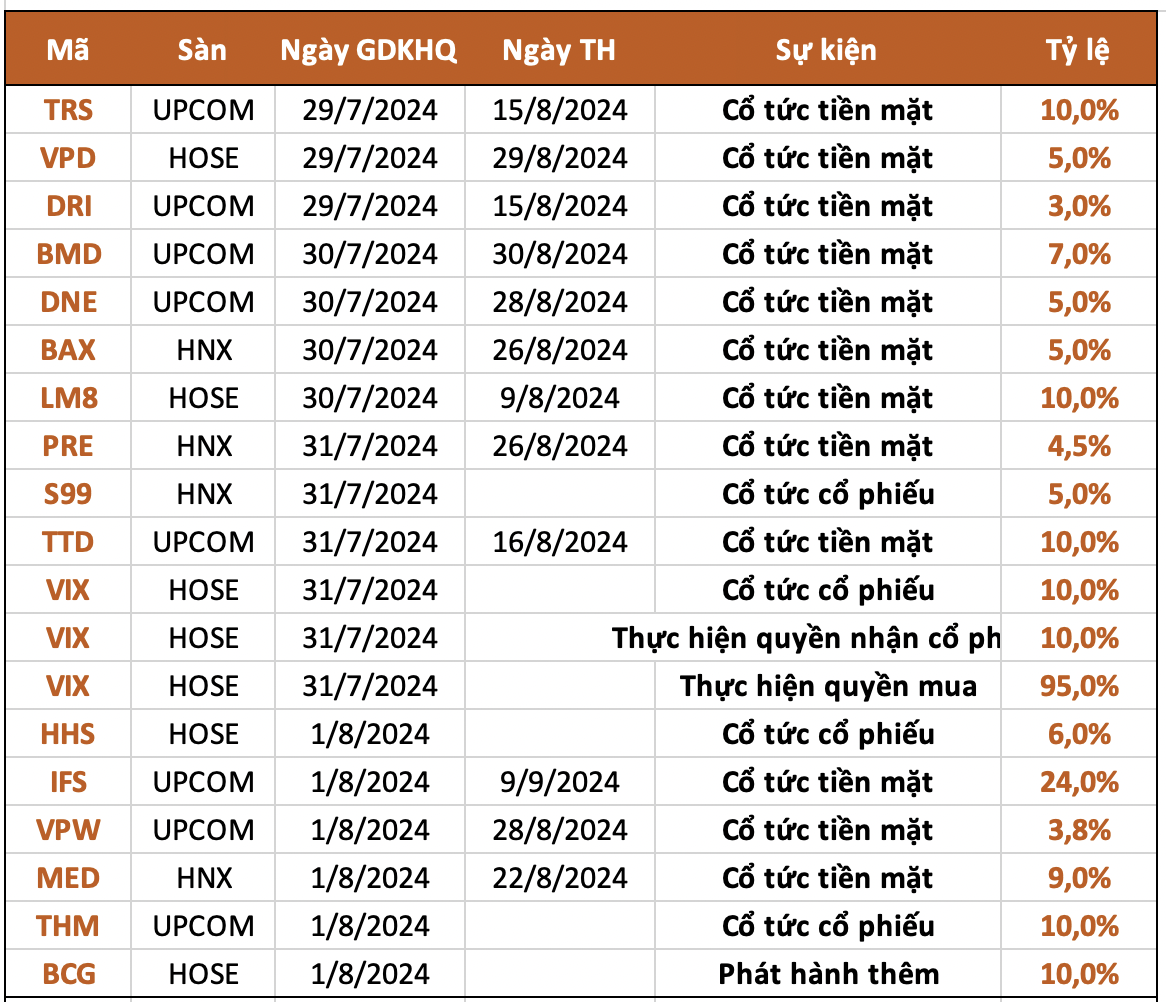

Many stocks fell this afternoon, despite the breadth remaining favorable and the VN-Index maintaining its height thanks to the support of the pillar group. The matched trading liquidity of the two floors in the afternoon session decreased by 17% compared to the morning session. This is a signal of more cautious buyers, while the sellers have a reserve of goods ready to close at an increasing rate.

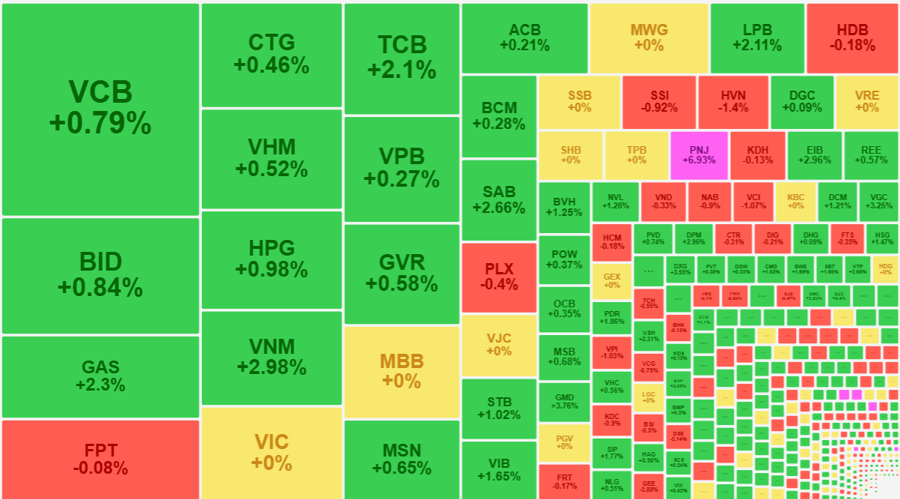

The change in breadth is still the clearest indicator of a slight weakness: At the end of the morning session, the VN-Index had 278 codes increasing and 131 codes decreasing. By the end of the session, there were 267 codes increasing and 152 codes decreasing. The index did not change much, closing at an increase of 0.75% (+9.39 points), while at the end of the morning session, it had increased by 9.41 points. This shows that there is a suitable rotation of pillar stocks.

The VN30-Index closed up 0.57% from the reference price, even stronger than in the morning (up 0.47%) despite the worse breadth (18 codes increasing and 4 codes decreasing compared to 22 codes increasing and 4 codes decreasing). Thus, the change comes from the structural pillar rotation. TCB emerged as a new pillar, and this code is very large in the VN30-Index. At the end of the morning session, TCB was only at the reference price, and even in the first 45 minutes of the afternoon session, it only ticked up by 1-2 price steps. Suddenly, in the second half of the session, the price was pushed up extremely quickly and closed up 2.1% from the reference price. TCB alone contributed 2.05 points to the VN-Index out of a total increase of 7.36 points. Meanwhile, with the VN-Index, TCB only pulled 0.78 points. VNM is another pillar that did well, increasing by 0.53% this afternoon, closing up 2.98%. SAB increased by 1.58% in the afternoon, bringing the total daily increase to 2.66%.

Statistics from the VN30 basket of blue-chips show that 11 stocks improved in price this afternoon, but 13 other codes fell. Some of the falling codes that had an impact were HPG, which decreased by 0.58% in the afternoon and closed up 0.98%. MSN fell by 0.64% to +0.65%. BID fell by 0.42% to an increase of 0.84%. Overall, the price volatility of the VN30 basket this afternoon was relatively mild, and among the 13 declining codes, the weakest was POW, which lost only 0.74% compared to the closing price in the morning session, and the rest were very mild.

On the other hand, the overall decline in the price of this group was not significant. Excluding SAB and VNM, which closed at the day’s high, all other stocks in the basket fell to some extent, with 9 codes falling by more than 1% from their highs. BCM had the worst performance, losing about 2.03% from its peak, but this was mainly due to a very strong push in the morning session. In fact, BCM also stabilized in the afternoon session. HPG is similar, and the most profitable sell-off occurred only in the middle of the morning session for a few dozen minutes.

The matched trading liquidity on the HoSE floor this afternoon decreased by nearly 18% compared to the morning session, a clear signal of more cautious buyers. Meanwhile, the decline in stock prices is common, confirming that selling pressure is increasing, mainly due to price suppression in the green region. This is not surprising, as the margin of increase at the end of last week was very good, so the T2.5 account also made a profit, not to mention the remaining buying volume at the bottom.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.