The market saw more volatility this morning, but the underlying trend was upward. There was some profit-taking pressure as many stocks reached levels that satisfied investors, but inflows remained strong, maintaining a steady upward trajectory.

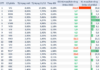

The VN-Index, which posted the weakest gains, still managed to climb above the reference level by about 4.3 points, ending the morning session up 9.41 points, or 0.75%. The index breadth at the bottom showed 233 gainers and 94 losers, and by the end of the session, it stood at 278 gainers to 131 losers, indicating a relatively balanced ratio. This suggests that while some stocks faced profit-taking pressures and declined, many others rebounded successfully.

This is a typical outcome of short-term trading dynamics: investors may choose to take profits in stocks that have seen significant gains, creating short-term dominant pressure. Conversely, funds can be redirected or channeled into other stocks, driving their prices higher. The differentiation and overwhelming upward momentum continue to foster a positive trading environment.

Indeed, out of the 278 stocks that were in positive territory, 106 posted gains of more than 1%. While this group accounted for just over 30% of the total number of stocks traded on the HoSE this morning, they represented 51.3% of the total trading value on the exchange. In other words, while some stocks declined, the flow of money into specific sectors drove prices higher. PNJ, for instance, hit its daily trading limit, setting a new all-time high, and also led the market in liquidity with VND 481.6 billion. VNM also reached an 11-month high, climbing 2.44% with the second-highest liquidity on the market at VND 344.9 billion. Other stocks that witnessed gains of over 2% and traded volumes exceeding VND 100 billion included PDR, which rose 2.93%; GAS, up 2.3%; GMD, which climbed 4.51%; HSG, with a 2.7% increase; DXG, up 4.26%; and DBC, which gained 2.01%.

The VN30-Index ended the morning session with a more modest gain of 0.47%, despite having 22 gainers and only 4 losers. The underperformance of this index compared to the VN-Index can be attributed to the relatively weak performance of large-cap banking stocks. While VNM, GAS, VIB, HPG, BID, and MSN were among the best performers in the basket, they are not the largest stocks by market capitalization. CTG and TCB remained unchanged, FPT fell 0.23%, VPB inched up 0.54%, and GVR rose 0.43%, slightly dragging the index’s performance.

Midcap stocks are currently showing the strongest signals. The representative index for this basket rose 1.29%, and the breadth was positive, with 55 gainers and only 12 losers. PNJ and HAX hit their daily trading limits, while other stocks like NHA, GMD, DXG, LDG, NKG, SMC, VGC, and VTP climbed more than 3%. Out of the 23 stocks on the HoSE that recorded liquidity of over VND 100 billion, a significant number belonged to the midcap category, and most of them also experienced substantial price increases. Midcap stocks accounted for 45.4% of the total trading value on the HoSE, while VN30 stocks contributed 40.2%, and small-cap stocks made up only 11.8%.

The group of declining stocks this morning continued to be those with minimal trading activity. A few stocks with larger trading volumes, such as SSI, FPT, and MWG, also fell into the red. Specifically, out of the 42 stocks that declined by more than 1%, the highest trading volume was KDC, which stood at nearly VND 19.1 billion, with its price dropping by 1.26%. The total trading value of these 42 stocks amounted to approximately VND 65.8 billion, equivalent to 0.8% of the HoSE’s total trading value.

The VN-Index’s upward momentum slowed down this morning, and the market experienced more volatility than usual as selling pressure increased. Importantly, liquidity remained robust, with the total trading value on the two exchanges reaching approximately VND 8,520 billion. While this represents a 22% decrease from the surge at the end of last week, it is still significantly higher than the average of the previous two weeks (approximately VND 6,424 billion per session).