Buy PC1 with a target price of VND 34,060/share

VPBank Securities (VPBankS) announced that, for the construction and industrial manufacturing segment, Power Construction Joint Stock Corporation (HOSE: PC1) has set a 2024 plan with a revenue target of VND 5,000 billion and new contract value of VND 7,500 billion. Notably, the contract value for the Quang Trach – Pho Noi 500KV power line project alone is expected to reach VND 2,100 billion, including construction and equipment supply.

In the first half of the year, new contract values reached VND 2,682 billion and VND 1,456 billion, respectively, while revenues were VND 1,752 billion and VND 1,068 billion, the highest in the last three years. With a backlog of VND 4,392 billion as of June 2024, along with new projects, VPBankS forecasts a 35%-40% growth in revenue from construction and industrial manufacturing, reaching VND 3,520-4,000 billion.

In the following years, VPBankS remains optimistic about the prospects for the company’s electrical construction and industrial manufacturing sectors. The approved Implementation Plan of the Power Development Master Plan VIII will detail key investment projects for the 2021-2030 period, including transmission and distribution grid projects worth $15 billion and renewable energy projects (onshore and offshore wind power) with a total capacity of 24,220 MW and an investment value of up to $70 billion. The company is also expanding its construction business to include infrastructure and industrial park development, a strategic shift made over the last three years.

In the power generation sector, PC1‘s electricity output in Q2 2024 reached 227 million kWh, a 69% increase from the previous year, thanks to a strong recovery in hydropower (up 149%) with a production of 147 million kWh, and wind power generation of 80 million kWh, a 7% increase. In the first six months, electricity output reached 390 million kWh, a 23% increase.

In the medium to long term, by 2026, PC1 aims to stably operate 350MW of renewable energy and successfully develop 1,000MW of offshore wind power by 2035.

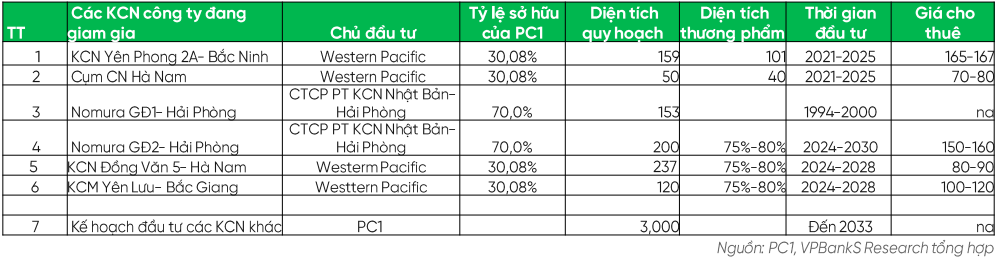

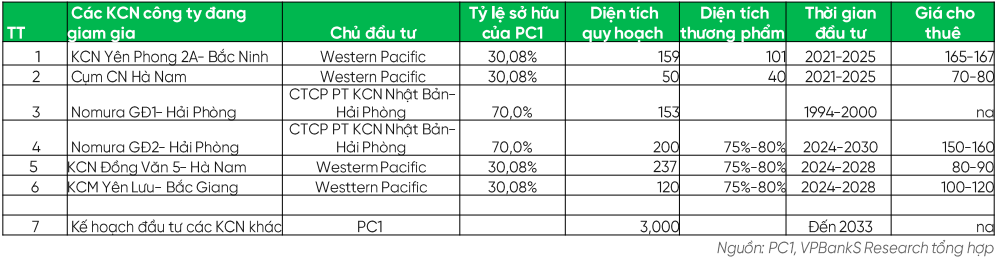

In the industrial real estate sector, Western Pacific (WP), a subsidiary of PC1, will hand over and recognize revenue and profits from the Yen Phong 2A Industrial Park project in 2024. In the first half of 2024, WP handed over land to customers and recorded VND 545 billion in revenue and VND 191 billion in after-tax profits. With a 30.08% ownership stake in WP, PC1 recognized a profit of VND 42 billion from this associated company using the equity method (a decrease of about VND 7 billion in Q2). In Q2, WP also received approval for two additional industrial park projects in the first half of 2024 (Dong Van 5, Ha Nam – 237ha; and Yen Lu, Bac Giang – 120ha)

The expansion of Phase 2 is currently focused on legal work and has obtained approval for 1/2000 planning. The company expects to obtain an investment decision by the end of 2024, with investments made by 2026 and commercial products available.

In the residential real estate sector, PC1‘s commercial real estate revenue in this period was low as most projects have been completed. In Q3 2024, the company plans to commence the Golden Tower – Gia Lam project, for which it previously won the auction with an investment value of VND 570 billion. Apart from the small-scale Gia Lam project, VPBankS believes that PC1‘s other real estate projects will continue to be postponed to 2025-2028.

Finally, in the mineral exploitation sector, Q2 2024 revenue reached VND 338 billion (down 28% from the previous quarter), with a gross profit of VND 37 billion (down 72%). The gross profit margin decreased to 11% compared to 28.2% in Q1, mainly due to the decline in Nickel prices in the global market. In the first six months, revenue reached VND 816 billion, with a gross profit of VND 171 billion. The company exported nearly 32,000 tons of ore in the first half and plans to export an additional 32-34,000 tons in the second half, exceeding the planned 50,000 tons.

Nickel prices in the global market fluctuated significantly in the first seven months, surging in Q2 from $17,000/ton to $21,500/ton, but then dropping sharply to below $16,000/ton in late July 2024.

For 2024, VPBankS forecasts PC1‘s revenue and pre-tax profit to reach VND 9,895 billion and VND 683 billion, respectively, up 28.3% and 75.4% from 2023. Net profit is expected to reach VND 560 billion, with a profit attributable to the parent company of VND 379 billion, resulting in an earnings per share of VND 1,218/share, a 168% increase from 2023.

Using the partial valuation – SOTP method, VPBankS recommends buying PC1 shares with a target price of VND 34,060/share.

Read more here

Buy TCM with a target price of VND 58,500/share

Phu Hung Securities (PHS) reported that, in Q2 2024, Thanh Cong Textile Garment Investment Trading Joint Stock Company (HOSE: TCM) witnessed a positive recovery in its business results, with a 18.5% increase in net revenue year-on-year to VND 847 billion and a 31-fold surge in after-tax profit to VND 72 billion. This improvement was driven by a rebound in textile and garment orders, particularly from the Korean and Japanese markets, along with a low comparative base in the previous year.

For the first seven months of 2024, PHS estimates that TCM achieved a net revenue and after-tax profit of VND 2,214 billion (up 17%) and VND 165 billion (up 116% year-on-year), respectively, completing 60% and 102% of its full-year business plan.

Additionally, the gross profit margin and net profit margin in Q2 2024 improved significantly to 18% (up 470 basis points from the same period last year) and 8.5% (up 820 basis points), respectively. This improvement can be attributed to: (1) a 20.4% decrease in cotton raw material prices as of the end of July 2024 due to abundant supply, (2) TCM‘s limited exposure to rising freight rates as its primary market is Asia, and (3) TCM‘s second-tier FOB production model, which offers high added value thanks to its complete Textile – Dyeing – Garment value chain.

South Korea, Japan, and the United States remain the top three export markets for TCM, accounting for 28%, 20%, and 20% of its revenue structure as of July 2024. In the first seven months of 2024, export revenue to South Korea and Japan witnessed strong growth, reaching VND 617 billion (up 27.3%) and VND 448 billion (up 9.6%), respectively. Meanwhile, TCM‘s export revenue to the US narrowed to VND 447 billion (down 8.8%).

PHS observed that TCM tends to prioritize orders from Japan and South Korea due to stable orders from its parent company, Eland Korea, and the faster recovery in clothing and accessory retail sales in these two markets compared to the US. As of the end of June 2024, the growth rate of fashion, apparel, and accessory retail sales in South Korea and Japan rebounded to 8% and 4.8%, respectively, while clothing sales in the US remained sluggish, with a retail sales index of just 0.6%.

Given these positive factors, PHS recommends buying TCM shares with a target price of VND 58,500/share.

Read more here

MSN: Fair Value of VND 96,400/share

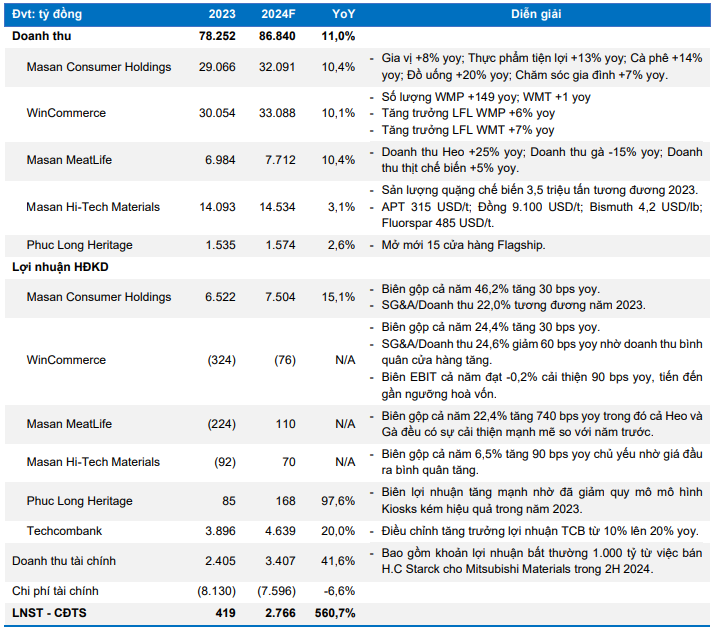

Bao Viet Securities (BVSC) forecasts that in 2024, the net revenue of Masan Group Joint Stock Company (HOSE: MSN) will reach VND 86,840 billion (up 11% year-on-year) and its net profit will be VND 2,766 billion (up 560.7%). This forecast includes some key changes: (i) an increase in profit contribution from Techcombank; and (ii) the inclusion of an extraordinary profit of approximately VND 1,000 billion from the sale of 100% of Masan Hi-Tech Materials’ shares in Starck to Mitsubishi, expected to be recorded in the second half of the year. This implies an expected profit of VND 650-700 billion/quarter for the remaining two quarters, excluding extraordinary items, which is 30-40% higher than Q2. BVSC summarizes the main assumptions in this forecast as follows:

|

Summary of BVSC‘s Assumptions for MSN‘s Financial Results

Source: BVSC

|

Source: BVSC

On the other hand, as of the end of Q2 2024, MSN‘s net debt stood at VND 45,895 billion, a decrease of VND 6,758 billion from the end of 2023, mainly due to the receipt of a VND 250 million investment from Bain Capital. BVSC believes that MSN is in a good financial position to meet its financial obligations in the next 12 months. The net debt/EBITDA ratio is expected to improve to 3.5x in 2024 and 2.9x in 2025.

BVSC is of the view that the strong recovery in core business performance, coupled with the extraordinary profit from Masan Hi-Tech Materials, will provide positive momentum for MSN‘s share price in the second half of 2024. Therefore, using the SoTP method, BVSC determines a fair value for MSN shares of VND 96,400/share.

Read more here

VPBankS wins award for “Most Innovative Stock Trading App 2023”

VPBankS, a subsidiary of VPBank, has recently been awarded the “Most Innovative Stock Trading Application” by the International Finance Magazine. This prestigious accolade distinguishes VPBankS as the only securities company in Vietnam to receive such recognition in 2023.