Corporate Bond Issuance Triples

New corporate bond issuance has increased by 63% year-to-date compared to the same period in 2023. The Ministry of Finance revealed that the average trading value of the corporate bond market reached VND10.59 trillion, a 62.5% increase from the previous year. According to the Bond Market Association, there were 183 successful issuances in the first seven months, raising a total of VND174 trillion, a 2.78-fold increase from 2023.

The real estate group had the second-largest volume of new corporate bond issuance. (Illustrative image)

Banks led the way in terms of issuance value, with approximately VND96.2 trillion (average interest rate of about 5.4%/year, 4-year term). Techcombank issued bonds worth VND17 trillion, followed by ACB with VND12.7 trillion and MBBank with VND8.9 trillion.

The Ministry of Finance revealed that the average trading value of the corporate bond market reached VND10.59 trillion, a substantial 62.5% increase from the previous year. In the first seven months of the year, there were 183 successful issuances, raising a total of VND174 trillion, marking an impressive 2.78-fold increase from 2023.

Trailing behind were real estate companies, with a volume of about VND32.6 trillion. Real estate businesses continue to offer some of the highest interest rates in the market, averaging 12%/year, albeit with shorter terms of around 2.7 years.

Mr. Nguyen Quang Thuan, Chairman of FiinGroup Financial Data Company, commented that after a period of stagnation and challenges, the bond market has made a soft landing, especially for older bonds (real estate and renewable energy). The market is entering a new phase, with increased participation from transparent and high-quality enterprises, including infrastructure, water, and waste management bonds. The involvement of underwriting organizations has contributed to the positive outlook for the market’s steady and profound development.

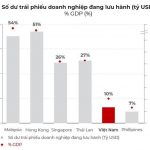

“The government aims to increase the size of the corporate bond market to 25% of GDP by 2030. This is an ambitious target that requires significant work on policies,” said Mr. Thuan.

After more than a year of operation, the private corporate bond trading system has made significant progress. Ms. Vu Thi Thuy Nga, Deputy General Director of Hanoi Stock Exchange (HNX), shared that the exchange has received and traded 1,146 bond codes from 301 enterprises, with a value of nearly VND832.2 trillion. Liquidity has improved, with an average trading value of VND3.704 trillion per session, mainly driven by credit institutions (38.3%) and securities companies (nearly 32%).

Investors Still Face Risks

While the corporate bond market is warming up with more diverse issuances across different sectors, investors, especially individuals, still face risks. The Securities Law of 2019 and its decree have raised the standards for professional investors. However, meeting these criteria does not guarantee the ability to assess bond risks (the current definition only considers capital, requiring individuals to maintain an average portfolio value of at least VND2 billion for a minimum of 180 days, excluding borrowed funds).

Mr. Nguyen Anh Minh, Deputy Head of Bond Registration Management, Vietnam Securities Depository (VSD), pointed out that determining professional investors currently relies solely on confirmation from securities companies. This approach carries risks, as investors may make purchases based on broker recommendations or advice from acquaintances, leading to adverse consequences if the issuing company fails to fulfill its repayment obligations. Individual investors inevitably bear the brunt of these defaults, while issuers focus solely on selling as many bonds as possible, regardless of whether investors have the necessary knowledge or understanding of the company.

Leaders of the State Securities Commission of Vietnam (SSC) emphasized the urgent need to adjust the standards for professional investors in the 2019 Securities Law. Investor qualifications should consider not only capital and trading experience but also their understanding of business operations.

Ms. Vu Thi Chan Phuong, Chairwoman of SSC, requested relevant units to improve the quality of goods in the market by enhancing the quality of issuing organizations and implementing fundamental solutions to control bond quality through the promotion of credit rating applications.

“Consider raising the standards for private bond issuance to reduce the risk of newly established companies or those without operations issuing bonds with values many times higher than their equity,” emphasized the Chairwoman.

Ms. Phuong affirmed that the SSC would strengthen the management and supervision of securities companies providing services in the market. It will also strictly handle violations by securities companies and issuing organizations based on the monitoring results of HNX.

Caution on the “Debt Bomb” of Delayed Repayments

The number of enterprises delaying bond repayments at maturity is on the rise. In the second half of 2024, the pressure of bond maturities remains significant, with approximately VND95.3 trillion in bonds due for payment.

According to MB Securities Company (MBS), in July 2024, three more enterprises announced delays in principal payments, bringing the total number of delayed enterprises to 116. The total value of delayed corporate bond payments is estimated at around VND209.8 trillion, accounting for 21% of the corporate bond market’s outstanding debt. The real estate sector continues to account for the largest proportion of delayed payments, at about 68%.

“We estimate that more than VND95.3 trillion in bonds will mature in the last six months of 2024. Of this, the real estate sector accounts for VND61.9 trillion, or 65% of the total maturity value. The banking group accounts for about VND14.2 trillion (15% of the maturity value),” said an MBS expert.

In 2023, according to a report by the Hanoi Stock Exchange, 139 enterprises delayed principal and interest payments on corporate bonds, totaling about VND83.6 trillion.

Dr. Can Van Luc warned that the risk of corporate bond maturities and overdue payments remains high. He cited data from VIS Ratings, indicating that about 27% of maturing bonds are at risk of defaulting within the next 12 months (including 65% of bonds that had previously delayed payments). With the economy expected to grow strongly in 2024-2025 and businesses, especially listed companies, recovering their production and business activities, this risk is likely to diminish.

According to Dr. Le Xuan Nghia, the solution to addressing the issue of non-repayment of principal and interest on bonds at maturity, which erodes investor confidence, is bankruptcy. If a company cannot repay its debts and its situation is dire, it should be allowed to go bankrupt, and investors need to learn to accept risks and losses.

“Regarding the issue of non-repayment of principal and interest on bonds at maturity, which erodes investor confidence, I believe that the fundamental solution is bankruptcy. If a company cannot repay its debts and its situation is dire, it should be allowed to go bankrupt, and investors need to learn to accept risks and losses,” said Mr. Nghia.

Q.Nga – V.Linh