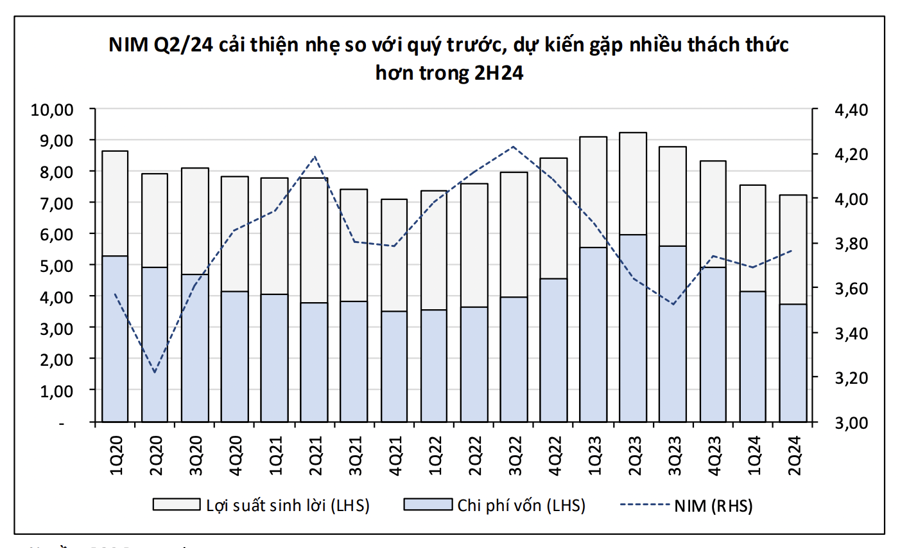

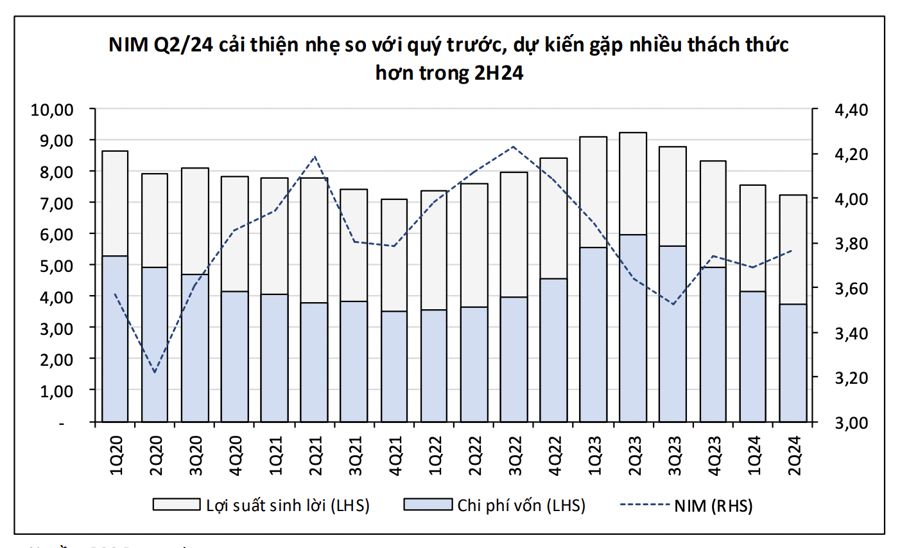

The banking sector’s NIM witnessed a slight improvement of 7bps in Q2/2024, attributed to a rapid decline in funding costs, approaching the lows of late 2021–early 2022. Additionally, the industry trend of extending the net LDR to its highest level in the past five years contributed to this improvement.

However, according to BSC’s recent update on the banking sector outlook, the industry’s NIM is expected to face significant pressure in the second half due to the slow recovery in retail credit demand, leading banks to continue competing for customers by reducing lending rates.

At BID, the NIM for Q2 reached approximately 2.6%, an increase of 12bps from the previous year. BSC attributes this to the consecutive launches of loan packages with more attractive interest rates than private banks, especially the early repayment loans in accordance with Circular 06. While this strategy helped BID compete for customers and accelerate credit growth, it also put pressure on the yield of earning assets.

BSC maintains its profit before tax forecast for 2024 at VND 32,000 billion, a 16% increase, corresponding to a P/B 2024F of 1.5x and a target price of VND 56,500 per share. The main catalyst for the stock is the plan to issue 9% of shares, with an expected private placement of 2.9% in 2024. BID is currently trading at a P/B of 2.2x, close to the seven-year average.

For TCB, the bank expects NIM to face challenges in the second half of the year compared to the first half, as competitive pressures on output yields continue while the positive impact of improved funding costs will likely diminish compared to the previous two quarters. TCB anticipates maintaining an NIM of >4% for the full year.

Following a better-than-expected performance in 1H24, the bank remains cautious about its business outlook in 2H24 due to concerns over NIM and credit demand. As a result, they have not revised their profit plan of VND 27.1 trillion. With a P/B TTM of 1.2x and a P/B 2024F of 1.1x, TCB’s valuation is on par with other private banks.

Similarly, VPB reported a stable NIM of 5.8% for the past four quarters, with a quarterly increase of 8bps. VPB previously stated that the most significant improvement in funding costs occurred in the first half of 2024, so the NIM trend in 2H24 may slow down, driven primarily by enhanced asset quality and increased collection of accrued interest.

VPB’s Q2/24 profit performance aligns with the bank’s expectations, indicating that the portfolio restructuring and risk appetite adjustments at FECredit are yielding positive results. BSC maintains its latest forecast and buy recommendation, with an expected pre-tax profit of VND 17.8 trillion (+65%) for 2024F, corresponding to a P/B 2024F of 1.0x and a target price of VND 24,500 per share.

CTG’s NIM remained stable at 3.0%, a 3% increase from the previous quarter and in line with the full-year forecast of 2.9%. The most notable aspect of CTG’s Q2 results was asset quality, which led to higher-than-expected credit cost provisions according to BSC. Previously, BSC had projected a pre-tax profit of VND 28.5 trillion for 2024F, a 14% increase, corresponding to a P/B 2024F of 1.1x and a target price of VND 42,000 per share.

BSC also highlights positive news from MBB, which expects to exceed its pre-tax profit plan of VND 28.4 trillion, an 8% increase. The bank intends to maintain its NIM in the second half compared to the first six months. BSC forecasts a pre-tax profit of VND 29.0 trillion for 2024F, a 10% increase, corresponding to a P/B 2024F of 1.1x and a target price of VND 29,300 per share.

Meanwhile, ACB’s NIM in Q2 fell short of expectations and showed no signs of short-term recovery. ACB’s NIM continued to decline to 3.77%, a decrease of 5bps QoQ. Due to weak credit demand in 1H24, ACB offered lower lending rates to attract customers, resulting in a narrowing spread between the average lending and deposit rates to 4.7%, a reduction of 36bps. Additionally, with ACB’s impressive credit growth of 12.4% and a modest 6% increase in deposits, the bank anticipates the need to raise deposit rates in the future.

ACB’s management acknowledges the challenges in improving NIM, as funding costs will likely increase with rising deposit rates, and there is a high possibility that deposit rates will rise by 0.5–1% by the end of the year. Moreover, competition in lending rates is intense, and ACB has had to reduce lending rates to boost credit growth. As a result, NIM is expected to remain flat or slightly decline in the near term.

Despite the lower-than-expected NIM in 1H24, BSC believes ACB will adhere to its profit plan for 2024, supported by promising credit growth prospects and effective cost management. BSC forecasts ACB’s pre-tax profit for the full year 2024 to be approximately VND 21.7 trillion, a 7.9% increase, a slight adjustment from the initial report earlier this year.

With a target P/B of 1.4x, ACB maintains its buy recommendation for ACB, with a target price of VND 30,300 per share for the next 12 months, representing a 29% upside compared to the closing price on August 15, 2024.

Another bank, STB, reported a decline in NIM to 3.66%, a decrease of 34bps YoY and 9bps QoQ, primarily due to a continued drop in lending rates to 7.62%, while deposit rates fell only 20bps from the previous quarter. The bank expects NIM to recover to the 4.0%-4.2% range in the coming year.

BSC forecasts STB’s 2024 financial results to show a total operating income of VND 28,343 billion, an 8% increase, and a pre-tax profit of VND 10,564 billion, a 10% increase. Currently, STB is trading at a P/B of 1.1x, equivalent to the average of private joint-stock commercial banks in the industry. BSC maintains its buy recommendation for STB, with a target price of VND 36,700 per share for the next 12 months, representing a 25% upside.

Finally, TPB, despite its modest credit growth compared to its peers, appears to have weathered the most challenging phase. However, as deposit rates are trending upwards, the bank may continue to face difficulties in accelerating credit growth and sustaining NIM improvement in the near future.

Additionally, there remains a potential risk associated with TPB’s exposure to corporate bonds. BSC forecasts TPB’s 2024 financial results to show a total operating income of VND 18,570 billion, a 14% increase, and a pre-tax profit of VND 7,157 billion, a 28% increase. TPB is currently trading at a P/B of 1.1x, equivalent to the average of private joint-stock commercial banks in the industry.

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.