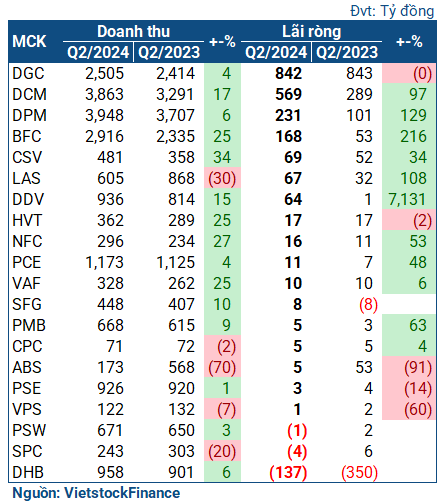

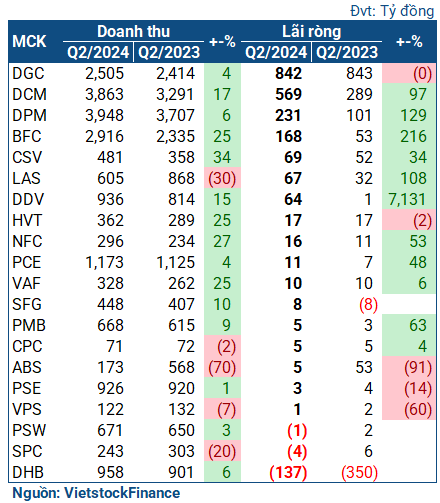

According to statistics from VietstockFinance, out of the 20 enterprises in the fertilizer and chemical industry that announced their second-quarter financial statements, 12 enterprises achieved profit growth, 5 declined, and only 3 cases incurred losses.

|

Business results of fertilizer and chemical enterprises in Q2/2024

|

Major fertilizer companies reap huge profits

Considering the top four leading companies in the industry, most of them had a good second quarter. Ca Mau Fertilizer (or Ca Mau Nitrogen, HOSE: DCM) increased its revenue by 17%, reaching nearly VND 3,900 billion, and earning a pure profit from business activities of VND 422 billion, up by 32%.

Especially, an additional profit of VND 176 billion – mainly from the surplus profit of the “bargain” purchase of Han Viet Fertilizer Plant (KVF) in May 2024 – acted as a boost for Ca Mau Nitrogen. Thanks to this, the giant fertilizer company earned a net profit of VND 569 billion, nearly double that of the same period last year.

| Business results of Ca Mau Fertilizer |

Similarly, Phu My Fertilizer (HOSE: DPM) earned a net profit of VND 239 billion in the second quarter, twice as much as the previous year. The growth momentum came from the recovery of fertilizer prices, which improved the gross profit margin from 10.5% to 13.8%. In addition, Phu My Fertilizer successfully controlled selling expenses and management expenses, which decreased by 5% and 7%, respectively, to nearly VND 220 billion and VND 120 billion.

Binh Dien Fertilizer (HOSE: BFC) – a member of the Vietnam Chemical Corporation (Vinachem) – even achieved a record profit with a net profit of VND 232 billion, 7.5 times higher than the same period last year. This profit level was even higher than that in the 2021-2022 period, when the fertilizer and chemical industry benefited from the global commodity boom.

| Binh Dien Fertilizer had a record-high profit quarter, surpassing the period when it benefited from the global commodity boom |

On the other hand, Duc Giang Chemical (HOSE: DGC) took a different path with a slight decrease in net profit, reaching VND 842 billion. Nevertheless, DGC still had a stable quarter by significantly improving its gross profit margin from 11% to nearly 17%. In addition, this profit level was the highest in the industry and was only surpassed during the peak profit period in 2021-2022.

The cumulative results for the first half of the year of the leading companies did not change much. DCM, DPM, and BFC all achieved significant profit increases, reaching VND 915 billion (+69%), VND 495 billion (+37%), and VND 232 billion (7.5 times higher than the same period last year), respectively. In contrast, DGC experienced a 7% decline, earning a net profit of over VND 1,500 billion.

Mostly brilliant performance

Not only the leading companies but also the majority of enterprises in the fertilizer and chemical industry could summarize their second-quarter performance in two words: “thriving.”

Notably, the group of enterprises belonging to Vinachem stood out. For instance, LAS witnessed a 30% drop in revenue, reaching only VND 605 billion, but its net profit soared to VND 67 billion, twice as much as the same period last year, and the highest in the past eight years.

| Business performance of LAS from 2022 to the present |

LAS stated that product consumption in the second quarter decreased due to fluctuations in the domestic and global fertilizer markets. However, thanks to their accurate prediction of raw material prices and the purchase of reasonable lots for products such as sulfur and potassium, the proportion of cost of goods sold to revenue decreased significantly, leading to a substantial increase in gross profit. Moreover, the Company successfully auctioned off the production line of acid, bringing in an additional profit of VND 6.5 billion. As a result, the second-quarter performance witnessed exceptional growth.

Meanwhile, CSV benefited from increased sales volume of its main products (NaOH, HCl, liquid chlorine, and H2SO4), despite a decrease in selling prices. Consequently, CSV‘s revenue increased by 34%, reaching VND 481 billion. The enterprise concluded the second quarter with a net profit of VND 69 billion, up by 38% compared to the same period last year.

Notably, DDV, the unit in charge of DAP business under Vinachem, had an impressive quarter with a net profit of VND 64 billion, 72 times higher than the same period last year, and the fifth-highest quarterly profit since its listing on the UPCoM in 2015. The enterprise explained that both selling prices and sales volume of DAP in this period were higher than the previous year, while raw material prices decreased. Furthermore, the enterprise generated additional revenue from the sale of acid and NH3, contributing to the second-quarter profit.

| Compared to the same period’s extremely low base, DDV entered a strong recovery phase starting in Q4/2023 |

Another Vinachem member, Ninh Binh Phosphorus Fertilizer (HNX: NFC), also set a record for quarterly profit, surpassing VND 16 billion, up by 11%, thanks to increased sales revenue.

However, some Vinachem members went against this positive trend. Viet Tri Chemical (HNX: HVT) experienced a slight decline with a net profit of VND 17 billion. Meanwhile, Ha Bac Nitrogen Fertilizer (UPCoM: DHB) returned to gloomy days with a loss of more than VND 137 billion after two consecutive profitable quarters due to the restructuring of its massive debt.

In essence, this loss could be considered unfortunate for DHB as the reason for the loss was due to… nature. According to the explanation, the unpredictable weather in the first six months, especially lightning strikes that repeatedly damaged the company’s power transmission lines, caused the production lines to stop abnormally, significantly affecting the equipment. After restoring the power grid, the enterprise detected some equipment with electrical leakage and had to shut down the machines for an extended period, combined with major overhauls. As a result, the machine running time decreased by 45 days compared to the plan, and no products were produced.

Overall, the second-quarter performance significantly impacted the semi-annual picture. Enterprises that thrived in the second quarter continued their growth in the first half, such as BFC, which earned a profit of VND 232 billion, six times higher than the same period last year; LAS, which made a profit of VND 120 billion, up by 83%; and DDV, which earned a profit of VND 90 billion, 90 times higher. Conversely, the loss in the second quarter caused DHB to incur a loss of VND 99 billion (compared to a loss of VND 380 billion in the same period last year).

|

Semi-annual results of fertilizer and chemical enterprises

|

Fertilizer industry to experience a low point in Q3 and a rise in Q4

In a recent interview, CEO Van Tien Thanh of Ca Mau Fertilizer shared some insights about the fertilizer market and the factors affecting supply and selling prices in the coming time.

According to Mr. Van Tien Thanh, fertilizers and energy are greatly influenced by economic and political developments, as these commodities closely follow oil and gas prices. The Ukraine war, conflicts in the Middle East, and the division of the Red Sea have had significant impacts.

In addition, policies from major markets, firstly from China, play a crucial role. “Previously, China had 200 urea plants, producing 60 million tons (out of 190 million tons globally), while domestic consumption was 56-57 million tons/year, leaving a surplus of 4-5 million tons for export. In previous years, during the low season, they reduced export taxes for factories, which affected global markets, especially Southeast Asia” – quoted from the CEO of Ca Mau Nitrogen.

“China buys a lot of grains in Canada and the US for its agriculture. After the US-China trade war, they shifted to self-sufficiency. Every year, China produces 650 million tons of grains, and they aim to increase this to 450 million tons by 2030. Therefore, fertilizers have become a strategic commodity, including urea, DAP, NPK, etc., and they prioritize the domestic market. From 2022-2023, China’s policies have focused on the domestic market”.

Secondly, policies from Russia have a significant impact on supply. According to Mr. Thanh, the sanctions imposed due to the Russia-Ukraine conflict have affected the supply of fertilizers. “In 2023, Russia imposed a special tax on exported fertilizers with prices exceeding $450/ton. In 2024, they introduced a law that gas used for fertilizer production will be taxed at 23%, higher than other industries. These policies have pushed up regional supply and price levels”.

Thirdly, Egypt, which has six fertilizer plants supplying both sides of the Suez Canal, is facing a shortage of gas from Iran (due to the war) and Qatar. “At one point, Egypt’s energy minister called for a halt to fertilizer production in favor of electricity”.

On the other hand, India commissioned six urea plants in 2020, producing nearly 10 million tons annually, enhancing its self-sufficiency in fertilizer consumption (using 30 million tons of various fertilizers annually).

“Every year, when India issues a tender to purchase urea, the market experiences a sudden increase in prices. Now, this is no longer the case, as price changes may cause India not to purchase the full amount of the tender. Moreover, they can benefit from low-cost gas (due to the Russia-Ukraine conflict), reducing their dependence on external sources” – added Mr. Thanh.

Based on these influencing factors, Mr. Thanh provided his outlook on fertilizer prices in the coming months.

“Urea prices have been declining since their peak in 2022 and continued to drop in 2023. In 2024, urea prices went against the usual trend, rising before the Tet holiday and then decreasing, followed by a sideways movement in the summer-fall season. Urea prices are currently stable at $360-370/ton. Given this context, I predict that fertilizer prices may drop slightly in the low season of Q3, fluctuating between $330-350/ton. But in the spring season (Q4), prices will increase, and I expect them to reach $370-400/ton”.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.