VIS Ratings has released an analytical report on the banking sector, noting that smaller banks face challenges with non-performing loans and liquidity.

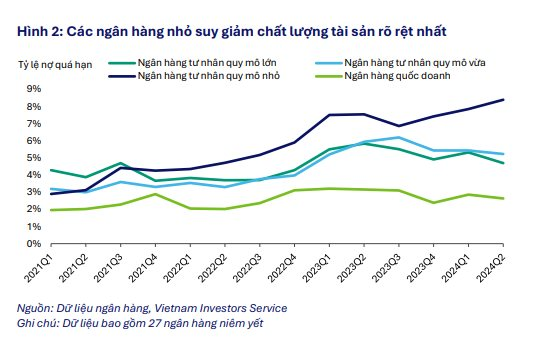

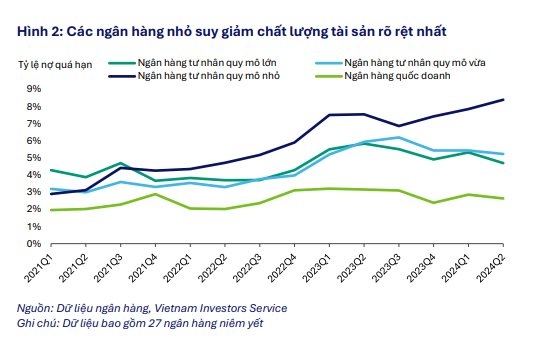

According to the analysis, in the first half of 2024, the industry’s problematic debt ratio remained stable at 2.2% compared to the previous quarter, with the most significant asset quality deterioration observed in smaller banks. The average return on total assets (ROAA) for banks slightly increased to 1.6% in the first half of the year from 1.5% in 2023, driven by stronger corporate credit growth and higher net interest margins (NIMs).

Some smaller banks may be more vulnerable to liquidity risks due to increased short-term market funding amid low deposit growth.

VIS Ratings expects asset quality and profitability of banks to stabilize in the second half of 2024, supported by improving business conditions.

The deterioration in asset quality was most evident in smaller banks. Institutions such as NCB, BacABank, Saigonbank, and VietBank reported higher new non-performing loan (NPL) formation rates than their peers, primarily from the retail and SME segments.

Among the state-owned banks (SOBs), VietinBank and BIDV experienced an increase in problematic debt ratios due to exposures in the construction and real estate sectors.

In contrast, some larger banks reduced their non-performing loans by utilizing provisions to deal with VAMC bonds, such as VPBank, or by reducing problematic debt from large customers, like MB.

Another bank with a low new NPL formation rate is TPBank, attributable to tighter lending conditions for new consumer loans.

VIS Ratings believes that the low-interest-rate environment and policy measures to support businesses across various sectors will contribute to improved debt servicing ability and a reduction in overdue loans in the coming periods.