Mr. Tran Khanh Quang, an experienced real estate investor, shared his insights on the market.

According to Mr. Quang, the market has shown significant recovery in the first half of 2024 compared to 2022-2023, but the improvement varies across segments. Most transactions involve projects with completed infrastructure and legal frameworks, developed by reputable investors.

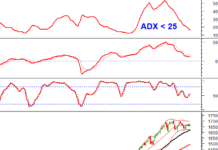

The real estate market, including land plots, has witnessed a gentle boost, creating a psychological effect and expectations with the new law tightening land subdivision sales. However, the land plot market’s recovery will take at least 6-12 months. Thus, from August 1, 2024, to the end of Q2 2025, the land plot market will not see much change, and prices will mostly stagnate.

“It’s likely that land prices will rise, and liquidity will improve only by Q3 2025,” said Mr. Quang. He added that the market would flourish only in areas near city centers or urban outskirts. Land plots in remote areas will struggle to recover or create a fever like in previous years.

Mr. Quang also warned investors against hoarding land plots in anticipation of price increases due to expected supply scarcity. Land prices are unlikely to rise due to low liquidity, and land plot inventories in many provinces remain high.

Recently, the Ministry of Construction reported a significant increase in successful land plot transactions in Q2 2024. Data from 60/63 provincial Departments of Construction showed that land plot transactions remained the highest compared to apartment and detached house sales.

Specifically, there were nearly 25,900 successful transactions for apartments and detached houses in Q2 2024, a 28% decrease from Q1 2024. In contrast, land plot transactions in Q2 2024 showed an upward trend, with nearly 125,000 successful transactions, a 28% increase from Q1 2024 and an over 85% increase compared to the same period in 2023.

Investors’ concerns about scarce land plot supplies due to the new Real Estate Business Law, which tightly controls land subdivision sales, led to a rush to hoard land, resulting in a surge in successful transactions.

However, when asked about the possibility of a land fever in the southern region by the end of this year, most industry experts believe that the land plot market is unlikely to experience a sudden short-term surge in prices or demand. Several reasons contribute to this outlook:

Firstly, real estate continues to be impacted by macroeconomic factors and the global geopolitical crisis.

Secondly, the market remains polarized, with one group of investors struggling to pay bank interest on their property purchases, while another group opts for low-interest savings instead of investing in real estate.

Additionally, while the new laws have come into effect early, there is a need for implementing guidelines and decrees, which takes time.

The early implementation of the new laws is expected to boost market recovery by addressing existing obstacles and bottlenecks. However, there are still issues to be resolved through drafting and issuing guiding documents for the laws.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…

Real Estate Expert Forecasts Booming Market for Land in 2024

Currently, land plots are still highly valued by experts as they bring high profits and minimize risks, even in a slow-paced and low liquidity market.