The stock market has seen a robust recovery with vibrant trading activities since hitting a short-term bottom earlier in August. This favorable context has created numerous attractive opportunities for investors to increase their stock holdings and achieve desirable returns. It is forecasted that this will drive up the demand for Margin leverage in the coming time.

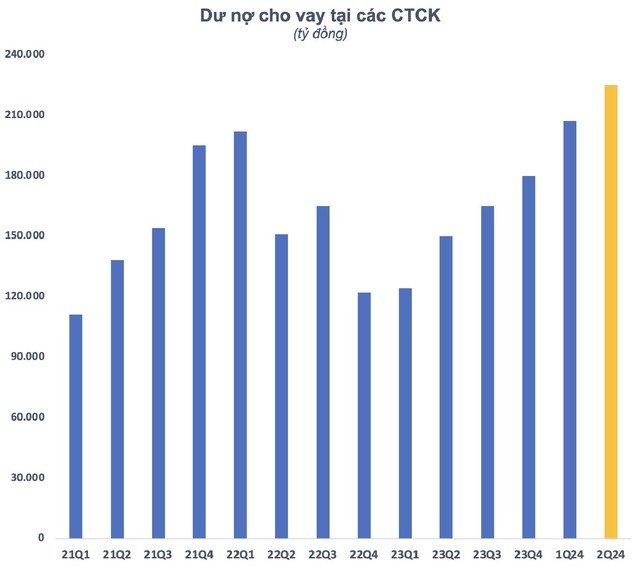

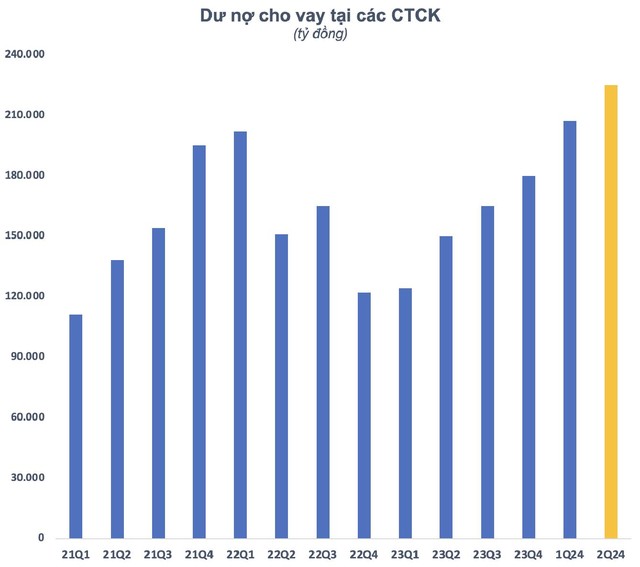

Previously, Margin debt recorded at the end of the second quarter also reached an all-time high. According to statistics, the estimated total debt for the market at the end of the quarter was 225 trillion VND (9 billion USD). Of this, Margin debt amounted to about 218 trillion VND, an increase of 23 trillion VND compared to the end of the first quarter and a record high. Since the beginning of 2023, Margin debt has been consistently increasing each quarter.

The increase in demand for leverage is partly due to a series of interest rate incentive packages offered by securities companies in a context where the market in the past two quarters has not seen many breakthroughs. Typically, Yuanta has several packages with interest rates at 8-9%; Mirae Asset offers a low-interest rate package of 7.99%, and recently, ACBS also launched a 7% margin lending package…

Dynamic with abundant financial resources, DNSE is naturally also in the game. This securities company offers its customers many attractive margin lending packages with interest rates as low as 5.99% or 9.99%. The special feature is that the product packages are very diverse, suitable for the risk appetite of the majority of investors in the stock market.

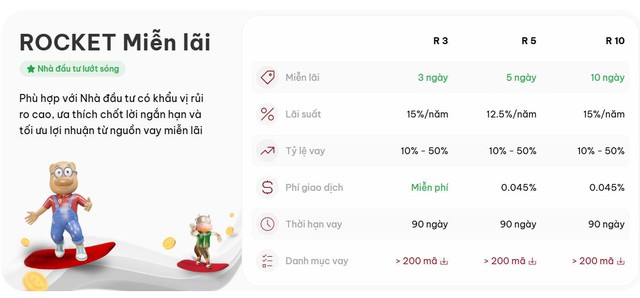

With the Rocket Free Interest package – a short-term lending product with the cheapest cost in the market, DNSE brings to investors with a high-risk appetite and a preference for short-term profit-taking, the opportunity to optimize profits from interest-free loans. With the 3-day Rocket Free Interest package, investors are also exempt from transaction fees.

DNSE’s Rocket Free Interest package offers investment optimization opportunities, especially for short-term traders.

The stock market in the third quarter is experiencing many strong fluctuations, creating short-term “trading” opportunities for investors. This is a suitable time for the Rocket Free Interest package to maximize its effect, helping investors surf without worrying about interest and fees. One notable point is that this product is applied to more than 200 stock codes, almost meeting all the needs of investors.

Meanwhile, long-term investors can use the Rocket package with an interest rate of only 5.99% to take advantage of the opportunity to accumulate many stocks that are currently at a low valuation.

However, investors still need to pay attention to allocating a reasonable Margin ratio in the context of an ever-volatile market. Risk management is not easy for both professional and non-professional investors. Therefore, DNSE is currently applying a system of lending, managing debt, and profits according to each transaction called Margin Deal.

With this system, Margin lending and management are governed by each buy/sell order and transaction, helping investors avoid “selling across” their portfolios, replacing the traditional method of managing and lending Margin on the total account. Currently, all DNSE loan packages are managed through the Margin Deal system. After 1.5 years of launching in the market, the product has received a positive response from investors, as evidenced by DNSE’s continuously growing Margin debt, reflecting the effectiveness of this form in helping investors manage risks.

At this stage, the stock market is showing positive signs of consolidating its medium-term recovery trend, following the explosive trading session on August 16. With a stable macro environment, the growth potential of listed companies is highly valued, and valuations are quite attractive compared to other regional markets. Vietnam’s stock market has many opportunities for long-term development. Especially, if upgraded to an emerging market, the stock market can attract billions of dollars from foreign investors, serving as a driving force for its long-term growth.

For detailed information about DNSE’s Margin lending packages, please visit: https://s.dnse.vn/marginmienlai-cafef

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.