The market witnessed a significant influx of shares from the explosive session on August 16, as large volumes landed in accounts this afternoon. Turnover on the two exchanges surged by 68% compared to the morning session, but stock prices rose even more sharply, indicating enhanced liquidity alongside proactive buying.

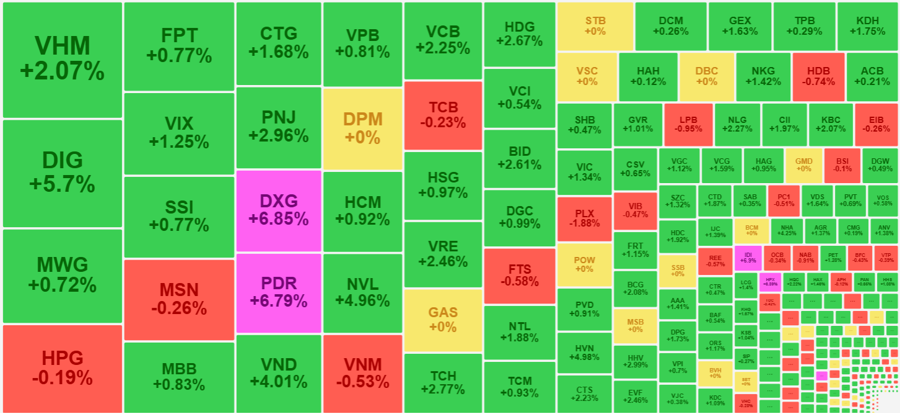

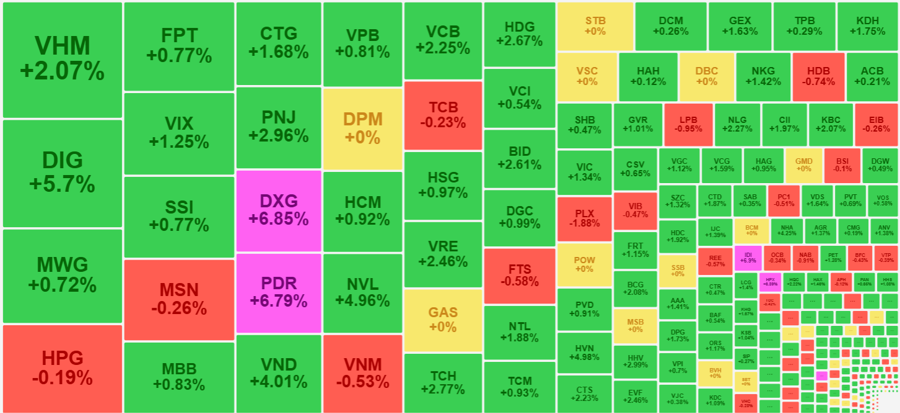

The VN-Index closed up 0.87% (+10.93 points), with 264 gainers and 136 losers. This was a much better performance compared to the morning session’s gain of 4.78 points, with only 152 gainers and 207 losers. The trading atmosphere became notably more vibrant in the afternoon as investors embraced higher risk, boldly “facing off” against the large volume of new shares.

The shift in market breadth, as mentioned earlier, clearly illustrates the proactive nature of buyers. The successful reversal of hundreds of stocks resulted in widespread price increases. Additionally, 117 stocks witnessed gains of over 1%, a significant improvement from the morning session’s 38. Only 36 stocks experienced losses of more than 1%, half the number from the morning session. Thus, not only did prices recover, but the magnitude of the increases was also considerable.

Real estate and securities stocks witnessed the most dynamic developments this afternoon, whether in terms of liquidity, price movements, or both. VHM rose 2.07% with a turnover of 689.9 billion VND, leading the market in liquidity. DIG surged 5.7% with a turnover of 641.7 billion VND, ranking second. VIX increased by 1.25% with a turnover of 454.3 billion VND, taking seventh place, while SSI climbed 0.77% with a turnover of 450.4 billion VND, securing eighth place. Among the high-liquidity stocks in this group, 11 witnessed gains of over 1% at the close, including VHM, DIG, DXG, PDR, NVL, VRE, and TCH, all with liquidity exceeding 200 billion VND. The VNREAL index on the HoSE closed up 2.33%, the strongest performance among sectoral indices. Real estate also contributed VHM, VIC, and NVL to the top 10 stocks boosting the index today.

In the securities group, only HBS hit the ceiling price, while many other stocks witnessed strong gains. However, it is a bit disappointing that smaller companies performed better, with notable representatives being CSI, EVS, CTS, and DSE. Among the larger companies, VND stood out with a gain of 4.01%, while VCI rose 0.54%, SSI increased by 0.77%, and HCM climbed 0.92%… Nonetheless, only six stocks in this group were in the red, with the majority witnessing gains.

Alongside real estate stocks, a few banking pillars accelerated the VN-Index today, notably VCB, which rose 2.25%, BID climbing 2.61%, and CTG increasing by 1.68%. However, the banking group was not particularly robust, with only 12 out of 27 stocks in the group witnessing gains, and only five of those gaining more than 1%. In addition to the aforementioned blue chips, two smaller banks, BVB and ABB, increased by 1.74% and 1.3%, respectively.

Liquidity on the HoSE in the afternoon session rose by 63% compared to the morning, reaching 11,120 billion VND. However, only 36.2% of this came from the VN30 basket. Capital appeared to flow more broadly, reaching mid-cap and small-cap stocks. From accounting for 50.3% of the entire HoSE in the morning session, the VN30 basket’s share decreased to 41.6% by the end of the afternoon session. Mid-cap trading also increased by 26% compared to the previous day, reaching 7,978.9 billion VND, while small-cap trading rose by 28% to 2,120.9 billion VND. Many of the stocks with the largest trading volumes today were mid-caps, including DIG, VIX, PNJ, DXG, PDR, VND, DPM, HCM, and NVL, all with turnovers between 300 and 600 billion VND.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.