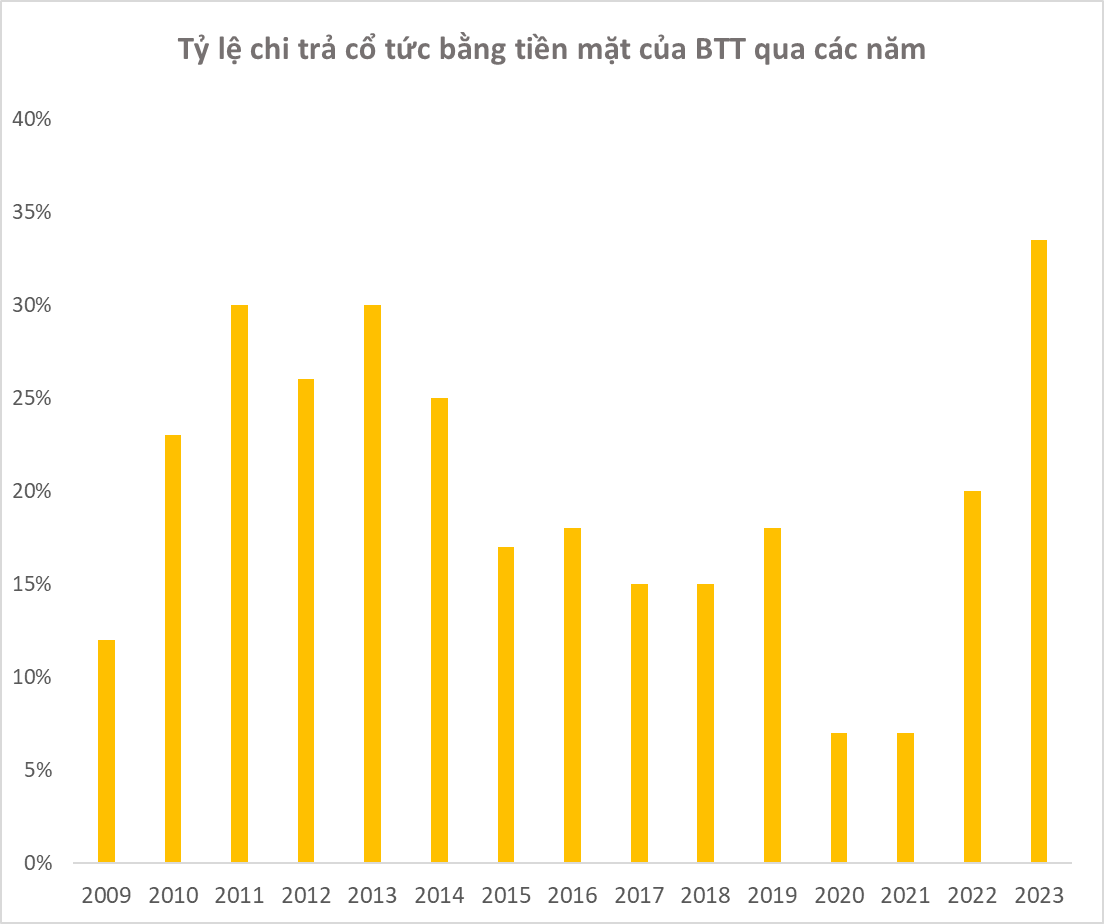

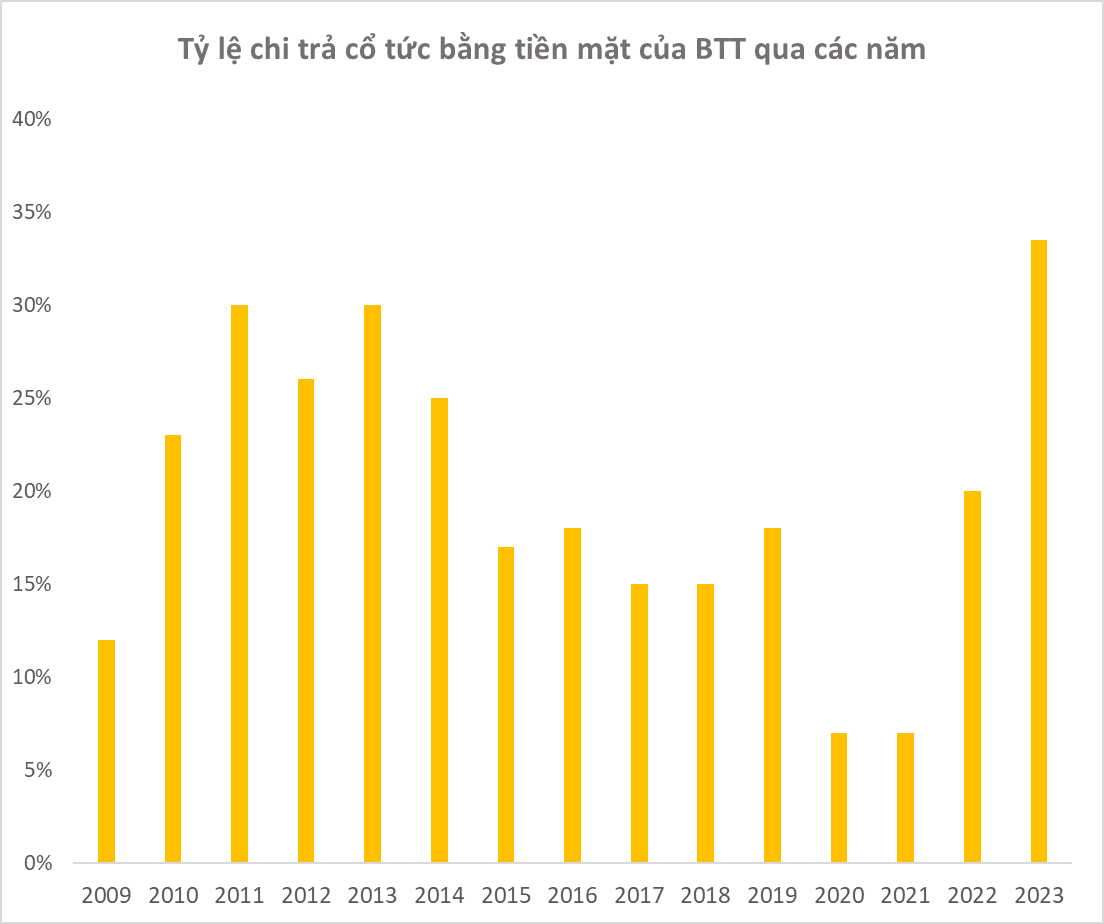

On September 5, Ben Thanh Trading – Service Joint Stock Company (Ben Thanh TSC, code: BTT) will finalize its list of shareholders to distribute a 33.5% dividend for 2023, corresponding to a payout of VND 3,350 per share.

BTT plans to disburse dividends in two phases, with the first phase commencing on September 17, 2024, at a rate of 20% (VND 2,000 per share) and the second phase on November 6, 2024, at a rate of 13.5% (VND 1,350 per share).

With 13.5 million shares outstanding, the company is expected to distribute a total of over VND 45 billion to shareholders, thereby fulfilling the plan approved at the 2024 Annual General Meeting of Shareholders. This is also the highest cash dividend rate since BTT’s listing on the stock exchange.

Reacting to this positive news, BTT’s stock price surged to the maximum daily limit on August 19 after nearly 20 stagnant trading sessions. The market price rose to VND 36,500 per share, reflecting a roughly 17% increase since the beginning of 2024.

Ben Thanh TSC primarily operates in the fields of commercial and real estate services and financial investment. The company’s key areas of expertise include retail services at Ben Thanh Market and Dan Sinh Market, wholesale import of various product categories, and construction and operation of hotels and office spaces for lease.

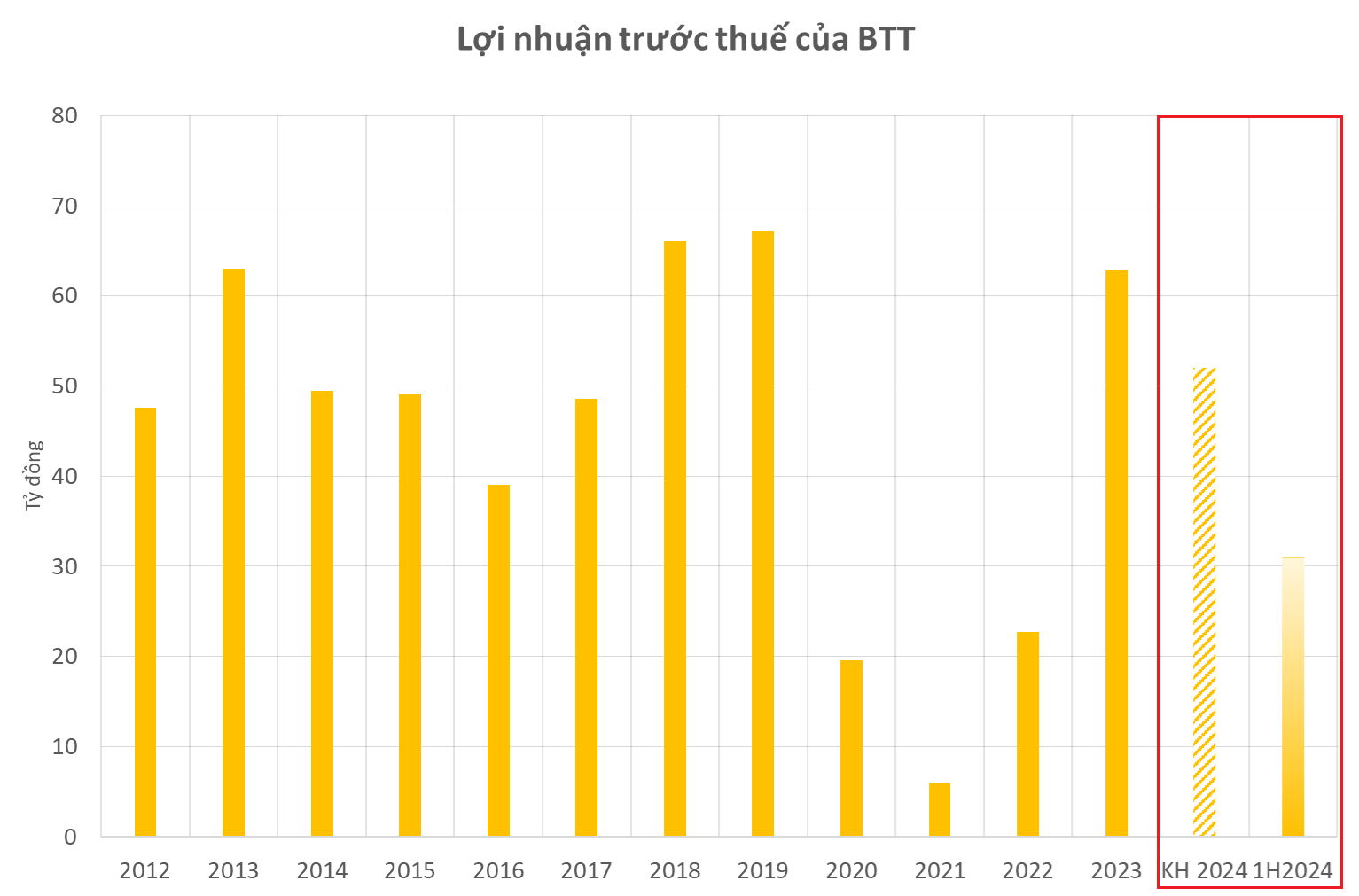

At the 2024 Annual General Meeting of Shareholders, BTT approved a consolidated revenue plan of nearly VND 249 billion and a consolidated pre-tax profit plan of over VND 52 billion, representing a 2% increase and a 17% decrease, respectively, compared to the previous year. The targeted net profit for the parent company was set at over VND 46 billion. The company’s management anticipated that 2024 would continue to present challenges, including the impact of inflation on both consumer spending and input costs. While the real estate and financial investment sectors were forecasted to remain difficult, the retail sector was expected to show improvement.

BTT intends to distribute the entire net profit of the parent company for 2024 as dividends to shareholders. Therefore, if the company achieves its stated goals, shareholders can anticipate a cash dividend rate of approximately 34%.

For the first half of the year, BTT reported consolidated net revenue of over VND 136 billion, a 24% increase compared to the same period last year. After deducting expenses, the company’s consolidated pre-tax profit decreased by 14% to below VND 31 billion, fulfilling approximately 60% of the full-year profit plan.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.