In a recent share, Giang Huynh, Director of Research and Consultancy at Savills Vietnam, opined that land-attached housing prices in Ho Chi Minh City have tripled in the primary market and doubled in the secondary market over the past five years. The high selling prices have pushed buyers with actual housing needs to the neighboring provinces for more suitable options.

In the past quarter, most of the new townhouses and villas in Ho Chi Minh City were priced above VND 30 billion per unit (accounting for nearly 80% of the total supply). According to Ms. Giang, this has resulted in a meager absorption rate of just 6% in the city.

“In a city of over ten million people, we only had 668 units of land-attached primary housing, with ten new launches and 72 transactions in Q2 2024. The high prices in the primary market, competition from the secondary market, and affordable options in the neighboring provinces have posed challenges for Ho Chi Minh City’s real estate sector,” shared Ms. Giang.

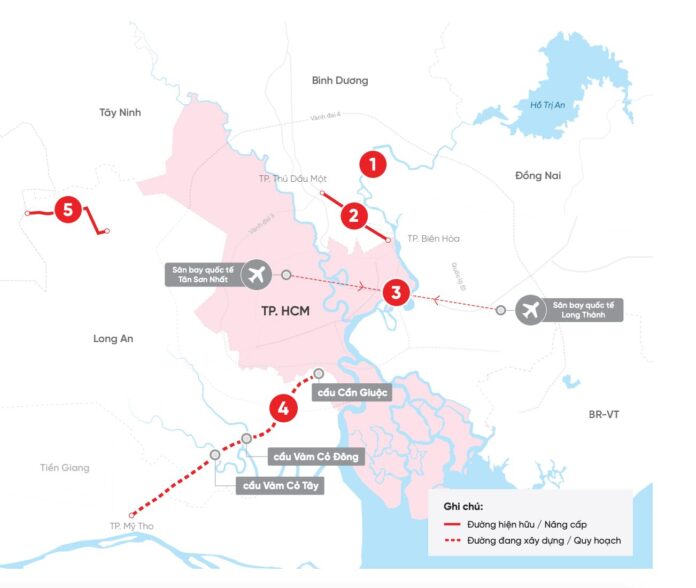

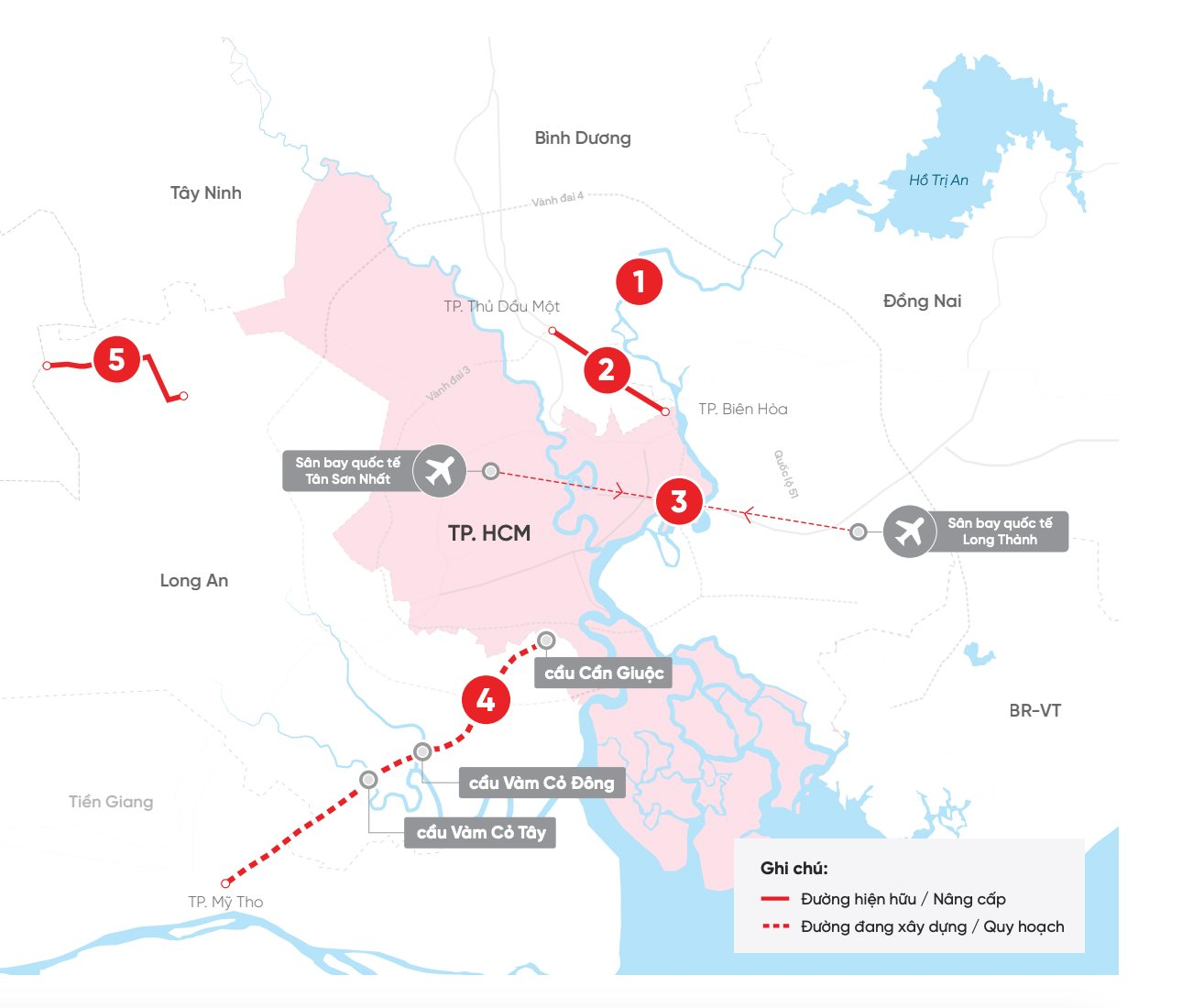

Improved infrastructure connectivity in areas neighboring Ho Chi Minh City.

According to the Savills expert, the ongoing development of key infrastructure projects will benefit areas with future supply along the main infrastructure routes. As a result, adjacent urban areas like Dong Nai, Binh Duong, and Long An will continue to reap the benefits of enhanced infrastructure.

Moreover, with prices 79% lower and a primary supply 31% higher, land-attached real estate in the peripheral areas has become a direct competitor to Ho Chi Minh City. In the past, products priced at VND 6-8 billion per unit for townhouses and VND 10-12 billion per unit for villas and villas in adjacent urban areas recorded strong actual demand. Meanwhile, these price ranges are becoming increasingly scarce in Ho Chi Minh City.

According to Savills, by 2026, Ho Chi Minh City is expected to have no low-rise products priced below VND 5 billion, and only 10% of the primary supply will be below VND 10 billion. In contrast, products in this price range account for 80-90% of the supply in adjacent areas.

In the second half of 2024 alone, Ho Chi Minh City is anticipated to supply 883 low-rise units to the market, mainly from subsequent phases of existing projects. Properties priced above VND 20 billion will account for 80% of future supply.

High prices and limited supply cause Ho Chi Minh City’s townhouse and villa segment to compete with demand for adjacent urban projects. Illustrative image.

The Power of Lizen: Consistently Winning Massive Bids

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.