Global steel prices have taken a surprising turn, surging back up after hitting their lowest point since 2016. Steel rebar futures recently saw a jump of over 6%, pushing back above the 3,000 CNY/ton mark. This sudden shift can be attributed primarily to temporary declines in output, which have overshadowed the growing concerns about weak demand.

Chinese crude steel output fell by 9.5% in July as plummeting demand erased mills’ profit margins. This provided support for steel rebar futures, while a wave of electric arc furnace closures threatened output in August. However, compared to the beginning of the year, prices for this commodity have dropped by 23%.

China’s economic downturn has led to a significant decline in demand for new housing in recent years, highlighted by the fastest annual drop in home prices since 2015 in July. Widespread oversupply in the housing market has prompted the Chinese government to curb support for major real estate developers, significantly impacting steel consumption prospects.

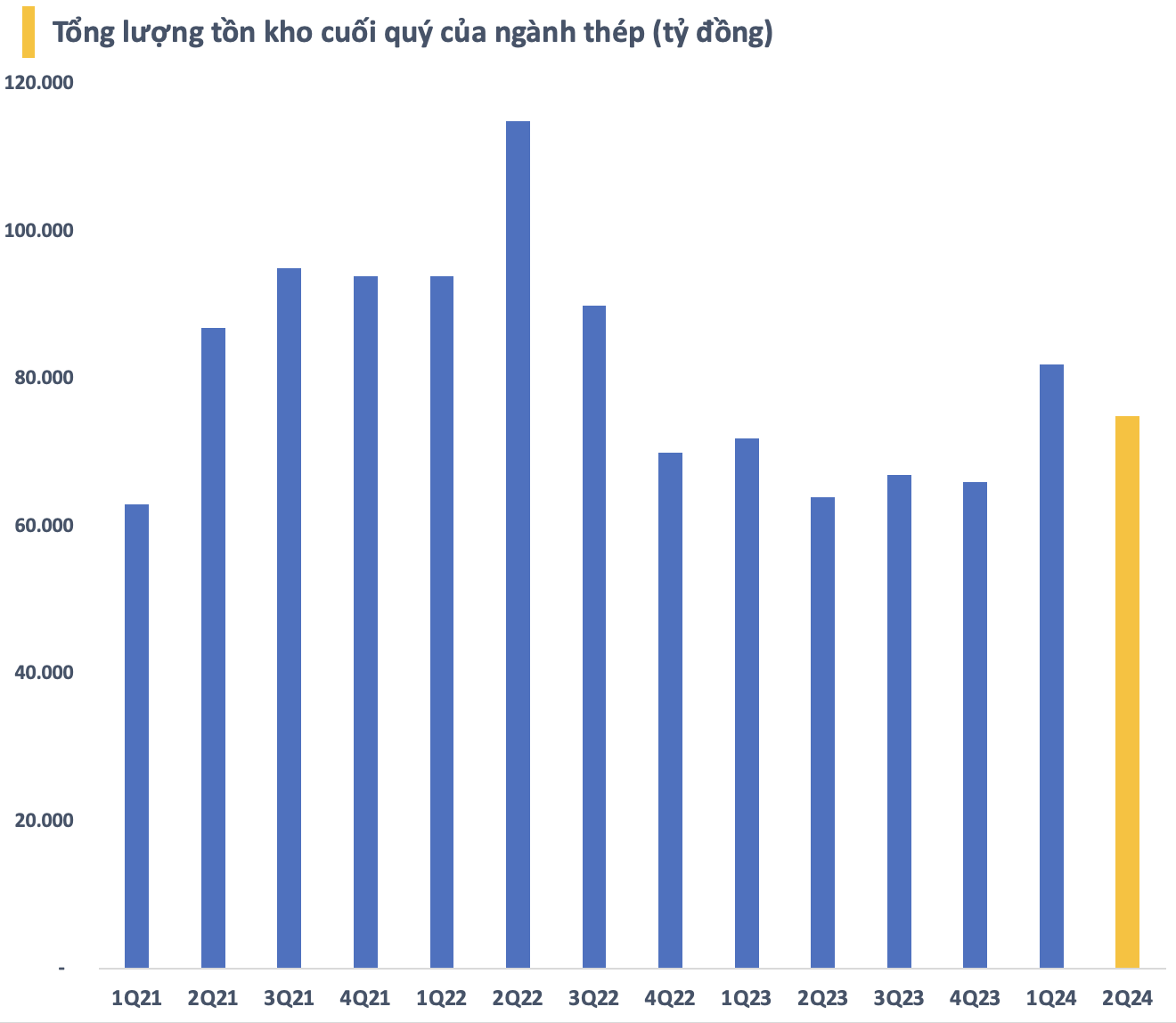

The recovery in steel prices will provide some relief to domestic steel producers, as inventory levels at the end of the second quarter remained high. As of June 30, the total inventory value of the steel industry on the stock exchange was estimated at approximately 75 trillion VND, a decrease of about 7 trillion VND from the previous quarter but the second-highest level in the past seven quarters.

Steel stocks on the Vietnamese stock exchange have shown sensitivity to the rebound in steel prices. HPG, HSG, NKG, TVN, and GDA, among others, have seen strong gains, with SMC even hitting the ceiling with no sellers. Prior to this, many steel stocks had signaled a bottom after falling by double-digit percentages from their recent highs. If steel prices continue their recovery trend, steel industry shareholders can anticipate a short-term upward move despite lingering headwinds.

Anti-dumping Investigations: A Headache for the Industry

On August 14, India’s Directorate General of Trade Remedies (DGTR) initiated an anti-dumping investigation into hot-rolled steel coils originating from or exported from Vietnam. This move was prompted by a petition filed by two major steel companies, JSW Steel and ArcelorMittal Nippon Steel India.

The products under investigation include hot-rolled steel coils, alloy or non-alloy, not clad, plated, or coated, with a thickness of up to 25mm and a maximum width of 2,100 mm. The period of investigation for dumping is from January 1, 2023, to March 31, 2024 (15 months), and the period for investigating injury is from April 1, 2020, to March 31, 2023. DGTR has requested that interested parties submit their comments on the product scope and product control number (PCN) within 15 days of the initiation.

Prior to this, on August 8, the Vietnamese steel industry received some unfavorable news when the European Commission (EC) issued a notice initiating an anti-dumping investigation into certain hot-rolled steel products originating in Egypt, India, Japan, and Vietnam, and imported into the European Union (EU).

These developments come as domestic steel companies anxiously await the Vietnamese Ministry of Industry and Trade’s decision on anti-dumping investigations into hot-rolled coil (HRC) imports from China and India and galvanized coil imports from China and South Korea. However, Vietcap believes that the likelihood of anti-dumping duties being imposed on HRC is relatively low due to insufficient domestic supply to meet HRC demand.

According to Vietcap, the risk to galvanized coil manufacturers is significant, and the possibility of anti-dumping duties being applied to these products is higher. If sufficient evidence of dumping is found, Vietcap expects provisional anti-dumping measures to be implemented as early as mid-September 2024. Hoa Phat would be the biggest beneficiary if anti-dumping duties are applied to both HRC and galvanized coil. Galvanized coil manufacturers, including Hoa Sen and Nam Kim, would only benefit from duties on galvanized coil.

April 18 Market: Oil slumps 3%, Iron ore at 5-week high, Robusta coffee hits record high

Oil prices fell 3% to settle at $100.18 a barrel on April 17, 2024, amid concerns that demand worries would outweigh supply risks from the Middle East. Gold prices dipped but held near record highs. Iron ore rose to its highest in more than five weeks on improving steel demand and restocking ahead of a holiday.