Strong buying interest in large-cap stocks helped the VN-Index maintain its upward momentum on August 20. The index closed the session with a gain of over 10.93 points, ending at 1,272.55. Liquidity was sustained with a trading value of over 19,000 billion VND on the HOSE. Foreign investors’ net buying was a positive factor, with a net purchase value of nearly 313 billion VND in the market.

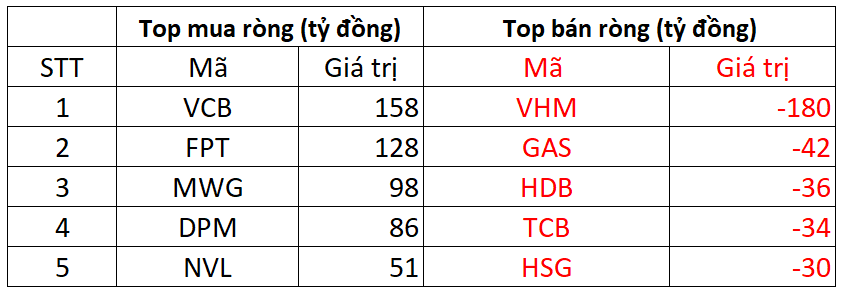

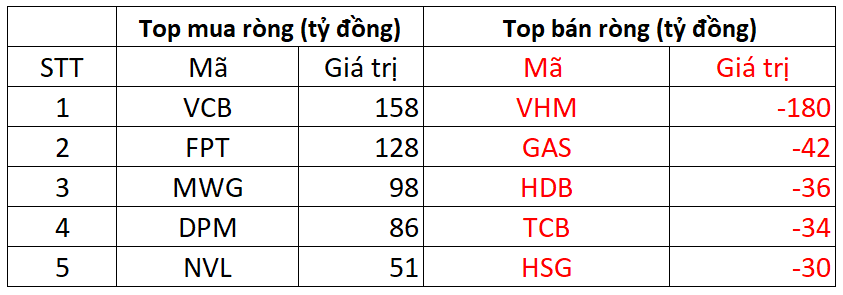

On the HOSE, foreign investors net bought 327 billion VND.

In terms of buying, VCB was the most net bought stock by foreign investors, with a value of 158 billion VND. FPT and MWG followed closely, with net purchases of 128 billion VND and 98 billion VND, respectively. Additionally, DPM and NVL also saw net buying of 86 billion VND and 51 billion VND.

On the other hand, VHM faced the strongest selling pressure from foreign investors, with net sales of nearly 180 billion VND. GAS and HDB also witnessed net selling of 42 billion VND and 36 billion VND, respectively.

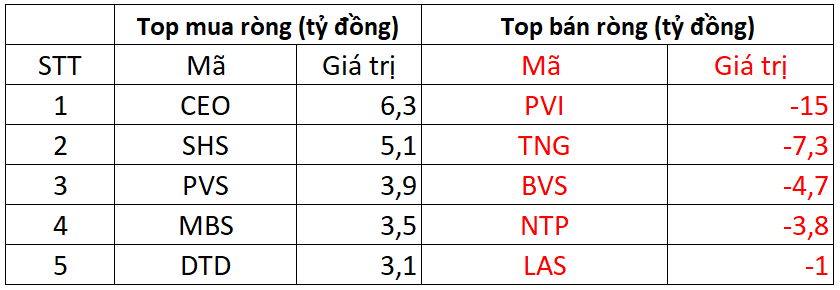

On the HNX, foreign investors net sold 7 billion VND

In terms of net buying on the HNX, CEO topped the list with a net purchase value of 6 billion VND. SHS followed closely, with net buying of 5 billion VND. Foreign investors also spent a few billion VND each to net buy PVS, MBS, and DTD.

On the opposite side, PVI faced the highest net selling pressure from foreign investors, with a value of nearly 15 billion VND. TNG, BVS, and NTP also experienced net selling of a few billion VND each.

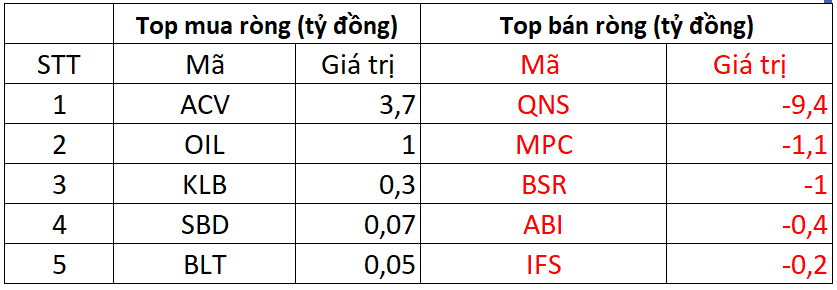

On the UPCOM, foreign investors net sold 7 billion VND

Conversely, QNS faced net selling pressure of nearly 10 billion VND from foreign investors. Additionally, they net sold MPC, BSR, and a few other stocks…

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.