The stock market struggled to break through the 1,300-point threshold and experienced significant volatility since the beginning of Q2, causing many stock groups to lose their upward momentum from earlier in the year. Numerous stocks underperformed the VN-Index’s nearly 13% gain, and some even declined compared to their levels at the start of 2024. Against this backdrop, retail stocks emerged as a bright spot, attracting investment capital.

Abundant capital inflows propelled the duo of The Gioi Di Dong (MWG) and FPT Retail (FRT) to surge by approximately 60-70% year-to-date. Consequently, MWG reached a nearly 2-year high, while FRT also approached its historical peak achieved in early July. The more modestly performing PNJ stock still managed to climb nearly 30% since the beginning of the year and is currently trading at its all-time high price (adjusted for dividends).

Although slower to join the rally, the consumer goods group is showing signs of catching up, led by Bluechip stocks such as Vinamilk (VNM), Masan (MSN), and Sabeco (SAB). VNM surged nearly 16% in less than a month and is currently trading at its highest level in almost a year. Both MSN and SAB have recorded double-digit percentage gains since the beginning of August.

This is a positive signal for a stock group that had been largely “silent” for an extended period. While price movements have not been particularly impressive, trading activity in VNM, MSN, and SAB has been significantly more vibrant this year compared to the previous period. All three stocks have set new records for matched volume in the first eight months.

In the first half of 2024, Vietnam’s retail and consumer goods sectors witnessed several notable investments by foreign investors, including Bain Capital’s investment in MSN and CDH Investments’ investment in BHX (a subsidiary of MWG). Additionally, several prominent global retail brands, such as UNIQLO, MUJI, and Starbucks, expanded their presence in Vietnam by opening new stores.

Benefiting from Stimulus Measures and the Economy’s Recovery

The retail and consumer goods sectors share many similarities in terms of their response to macroeconomic factors. Since the beginning of 2024, the government, ministries, and local authorities have implemented various measures to stimulate domestic consumption, including salary reforms and VAT reductions.

As a result, the total retail sales of goods and revenue from consumer services at current prices in the first six months increased by 8.6% compared to the same period in 2023, reaching nearly VND 3.1 quadrillion. The growth trend, which has been increasing month-over-month, indicates a positive recovery in consumer spending power, albeit at a modest pace.

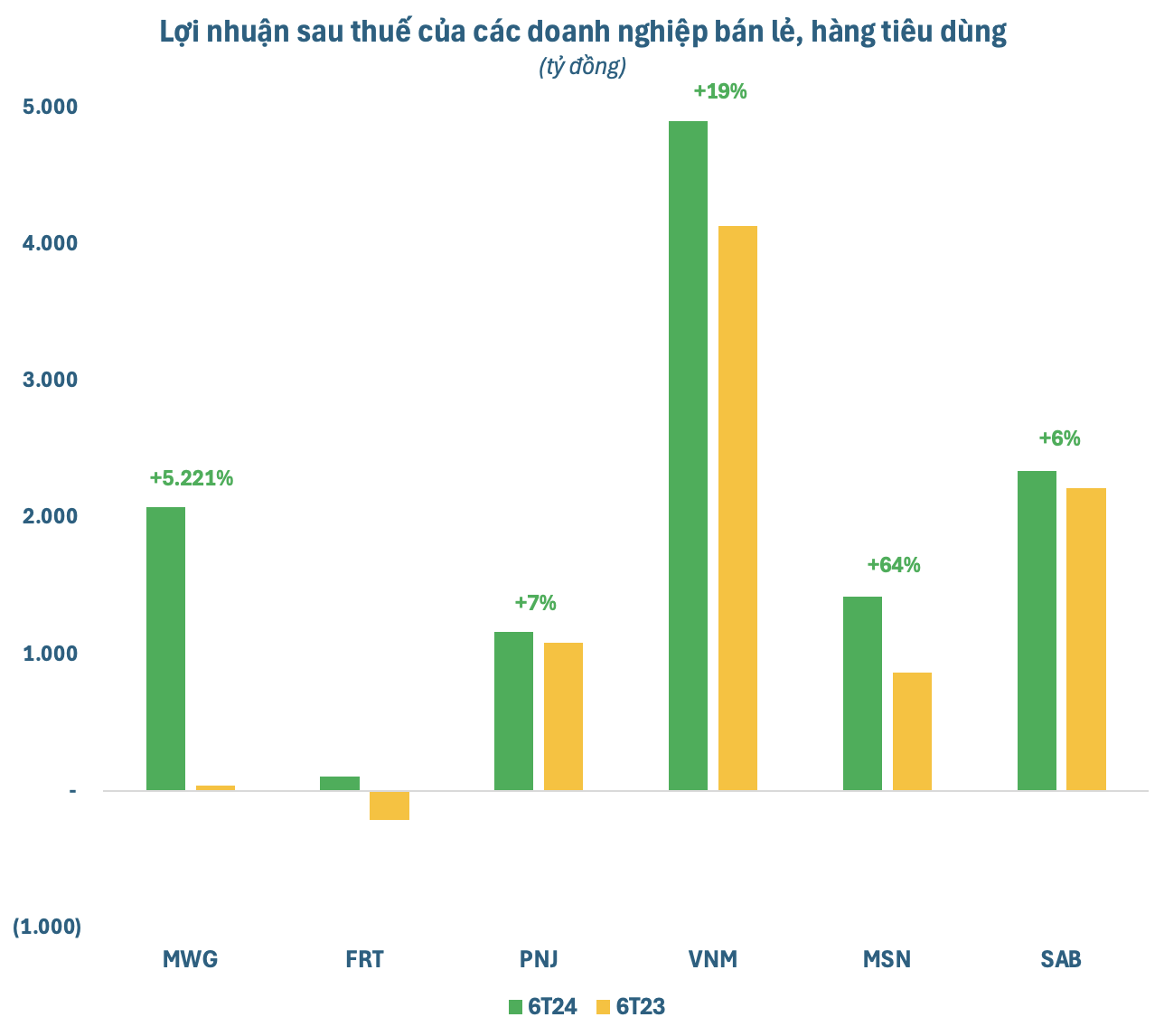

Numerous favorable factors have facilitated the recovery of business performance for retail and consumer goods companies following a challenging period. Bach Hoa Xanh (BHX) officially turned profitable, and the growth of the electronics chain contributed to MWG’s second consecutive quarter of exceptional growth compared to the previous year. The company’s net profit for the first half of the year increased by 5,200% and is close to fulfilling its full-year plan. Similarly, FRT, driven by the Long Chau pharmacy chain, reported profits for the second consecutive quarter, with a net profit of VND 109 billion in the first six months, a significant improvement compared to the loss of VND 213 billion in the same period last year. PNJ also achieved record-high profits in the first half.

In the consumer goods sector, MSN recorded an impressive 64% year-over-year growth in net profit for the first six months of the year. Vinamilk also had a remarkable quarter, achieving record-high revenue and the highest profit in 11 quarters, representing a 21% increase compared to the same period. SAB persevered through the “blow” of the alcohol concentration issue and posted a nearly 6% growth in net profit for the first half of the year compared to the previous year.

While some companies have yet to regain their peak performance from the past, the improvements in the first half of the year have brought optimistic signals to shareholders. Moreover, the outlook for the retail and consumer goods sectors remains positive in the coming period.

Optimistic Prospects for the Future

In the second half of the year, the retail sector is expected to continue its recovery, supported by positive signals from the macroeconomy and a low base from the previous year. As the Fed moves closer to a potential rate cut, it is hoped that this will ease pressure on exchange rates, providing room for the SBV to maintain its accommodative monetary policy. This, in turn, is expected to stimulate consumption and revive domestic purchasing power.

Additionally, the government’s supportive policies, such as the increase in the basic wage and the continued 2% VAT reduction until the end of 2024, will continue to have a positive impact. The economic recovery is anticipated to positively influence consumer sentiment, and an optimistic consumer mindset will encourage spending in a low-interest-rate environment.

For essential goods and pharmaceuticals, there remains significant room for growth. According to KBSV, retail grocery chains benefit from the shift in shopping habits from traditional to modern channels, leveraging their advantages in quality and service. Similarly, retail pharmacy chains are expected to outperform small, independent stores in the future due to their scale, service, and product quality advantages.

In the ICT retail sector, KBSV anticipates several factors that could drive growth in the second half of 2024, including (1) the replacement cycle for phones and laptops, and (2) the discontinuation of 2G and 3G networks. However, this sector is already quite saturated and highly competitive, leading many retail chains to aim for single-digit growth this year.

Given these optimistic prospects, KBSV believes that Vietnam’s retail sector has numerous opportunities to attract significant capital inflows in the future. In the long term, the market also anticipates significant IPOs from prominent domestic retail companies, such as MSN’s IPO of The CrownX, FRT’s IPO of Long Chau, and MWG’s potential IPO of BHX and EraBlue.