FPT Retail aims for 100 vaccine centers by the end of 2024 (Illustrative image)

Long Châu began opening vaccine centers in Q4 2023 and this segment is still recording losses due to initial costs. However, FPT Digital Retail Joint Stock Company (FPT Retail, code: FRT) believes that the demand for vaccinations may continue to increase in the long term, so it has decided to replicate this model starting in 2024.

FPT Retail targets to have 100 vaccine centers by the end of 2024, followed by opening 100-150 vaccine centers each year in 2025-2026. Long Châu’s vaccine centers are expected to be located next to its pharmacies to attract existing customers.

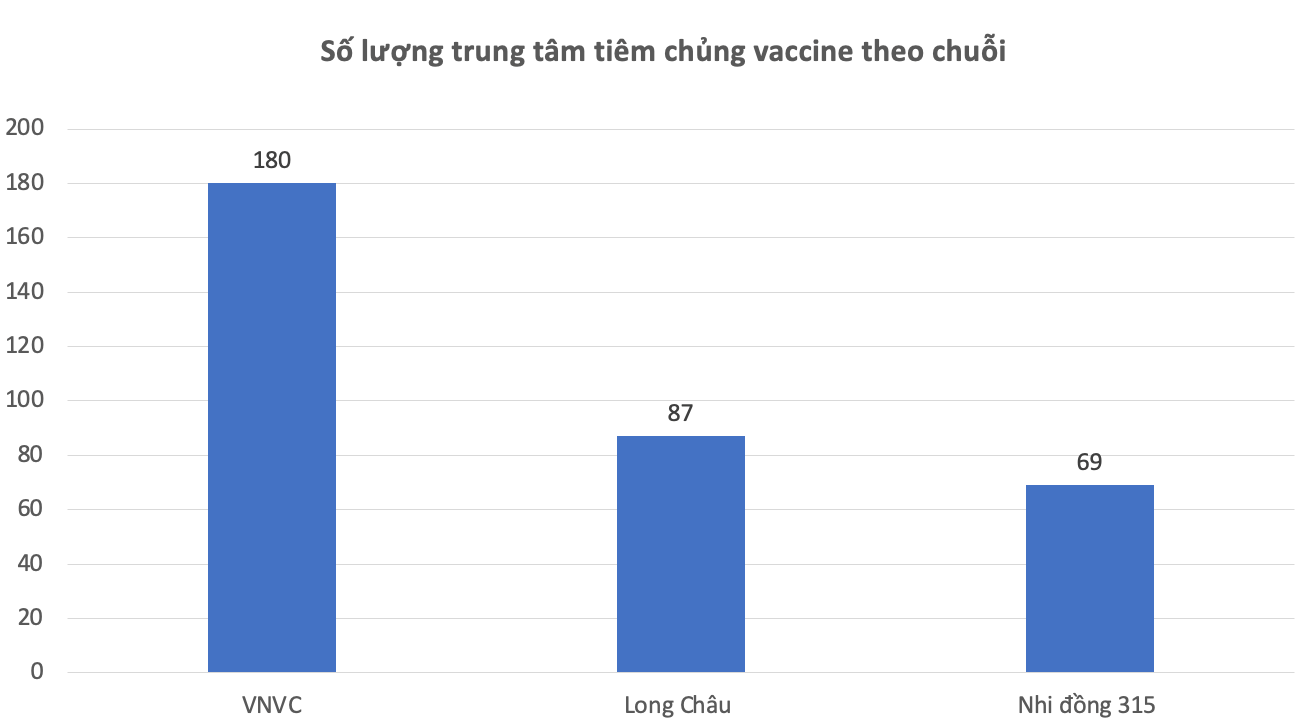

Currently, among private vaccination clinics, Long Châu has 87 vaccination centers in 40 provinces/cities, while VNVC (Vietnam Vaccine Joint Stock Company), the largest company, has more than 180 vaccination centers, and Nhi Đồng 315 has 69 vaccination centers.

With the current pace of expansion and the planned strategy, it will probably take just about a year for Long Châu’s number of vaccination centers to surpass that of VNVC.

Having just been established in late 2023 and expanding at a rapid pace, Long Châu may need some time to build expertise and gain the trust of customers, as well as demonstrate its financial capacity and the safety and quality of its services.

However, Long Châu has some strengths, such as leveraging its 16 million customers and a network of thousands of pharmacies nationwide to cross-sell vaccine services. Long Châu’s current customers are adults with chronic illnesses and compromised immune systems. Therefore, these customers are encouraged to get vaccinated against preventable diseases, such as pneumonia and influenza, to prevent further weakening of their immune systems.

The application of technology in customer care and FRT’s incentive policies can also be considered superior when compared to VNVC. In addition to offering discounts on vaccination services depending on the type of vaccine, through the Long Châu (pharmacy) app, customers can earn points when using vaccination services and redeem them for products sold at Long Châu pharmacies, something that private vaccination centers currently cannot do.

However, operating vaccine centers also entails certain risks. For example, managing anaphylaxis after vaccination is complex and requires expertise and facilities capable of handling potential incidents that may arise post-vaccination. In this case, hospitals are better equipped to handle anaphylaxis, while most public and private vaccination centers and clinics may struggle to do so.

Vaccine storage conditions are stringent to ensure quality, while Vietnam frequently faces power outages, which can impact vaccine quality. The continuous large-scale expansion also poses challenges in terms of process control.

According to SSI Research’s forecast, vaccine revenue is expected to account for 4% and 9% of Long Châu’s revenue in 2024 and 2025, respectively, equivalent to VND 1,031 billion and VND 2,610 billion.

According to statistics, the vaccine market size in Vietnam in 2023 reached VND 16,000 billion, a 14% increase compared to the same period. The Expanded Immunization Program (EIP), a free vaccination program provided by the government, contributed VND 900 billion, according to SSI Research’s estimate based on the budget allocated by the Ministry of Health for the 2021-2025 period.

While the vaccination rate for diseases included in the EIP reached 93-97% in 2017 (WHO data), the vaccination rate for diseases not yet included in the program remains low (below 5%).

According to SSI Research’s experts, in a report on vaccine business activities in Vietnam, vaccine demand is expected to maintain stable growth in the coming years due to the increasing demand for key vaccine types such as HPV, pneumococcal, and influenza vaccines (accounting for 33%, 22%, and 10% of the total vaccine market in Vietnam, respectively) due to the low vaccination rate in Vietnam (according to management, below 5%) as these vaccines are not yet included in the EIP.

In May 2024, the Ministry of Health licensed three new vaccines in Vietnam: a dengue fever vaccine (Qdenga), a shingles vaccine (Shingrix), and a pneumococcal vaccine (Pneumovax 23). While Pneumovax 23 is an improved version of the pneumococcal vaccine currently available in the Vietnamese market, Qdenga and Shingrix are new types of vaccines introduced in the country.

The overcrowding in public hospitals has changed people’s behavior towards disease prevention rather than cure. For some diseases (such as influenza, dengue fever, and rotavirus), vaccination can help reduce hospitalization rates. These vaccines will be recommended for people living in rural areas with limited healthcare access. Reducing hospitalization rates not only helps alleviate overcrowding in public hospitals but also reduces financial burdens on patients.

In the context of increasing vaccine demand, SSI Research’s experts believe that private vaccine centers will be better positioned for growth due to offering more vaccine options and advanced cold storage facilities. Parents tend to choose private vaccination clinics for three reasons.

First, they prioritize imported vaccines over domestically produced ones, despite the higher cost. Second, they face overcrowding at public vaccination facilities and vaccine shortages. Third, the EIP does not provide sufficient coverage, excluding some vaccines for adults, such as pneumococcal, HPV, and dengue fever, and some vaccines for children, such as influenza and rotavirus.