Mirae Asset Securities’ recent update report states that the Q2 2024 earnings picture showed overall improvement and differentiation across sectors. While the number of sectors with positive net income growth was lower than in Q1 2024, the market’s net income growth rate was higher.

According to FiinPro data, Q2 2024 net income grew by 26% year-on-year, higher than the growth rate in Q1 2024 (+21.5%) but significantly lower than Q4 2023 (+56.6%). Non-financial sectors saw a stronger increase in net income in Q2 2024, with a rise of 32.9% compared to the financial sector’s growth of 20.6% over the same period last year.

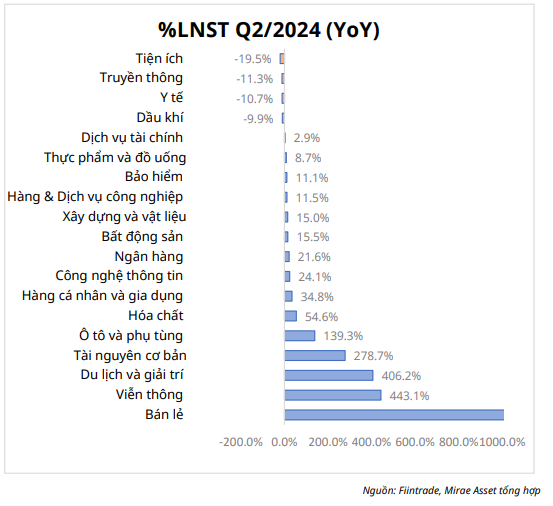

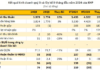

The following sectors recorded growth: Retail (+1,403.3%), Telecommunications (+443.1%), Travel & Entertainment (+406.2%), Basic Resources (+278.7%), Automotive & Components (+139.3%), Chemicals (+54.6%), Personal & Household Goods (+34.8%), Information Technology (+24.1%), Banking (+21.6%), Real Estate (+15.5%), Construction & Materials (+15.0%), Industrial Goods & Services (+11.5%), Insurance (+11.1%), Food & Beverage (+8.7%), and Financial Services (+2.9%).

The sectors that experienced declines were: Oil & Gas (-9.9%), Healthcare (-10.7%), Media (-11.3%), and Utilities (-19.5%).

Additionally, MASVN assessed that the Vietnamese stock market did not perform overly optimistically in Q2 2024, experiencing a downward trend in April, a recovery in May, and a sideways movement in June. On the last trading day of June, the VN-Index reached 1,245.32 points, a 1.3% decrease from May but still maintaining a 10.21% increase from the end of 2023.

As of June 30, 2024, the market capitalization of stocks on HOSE exceeded VND 5,080 trillion, equivalent to 50.26% of GDP in 2023 (at current prices), a 1.11% decrease from May 2024 but an 11.58% increase from the end of 2023, accounting for over 93.46% of the total market capitalization of listed stocks in the market.

Filtering “Super Stocks”

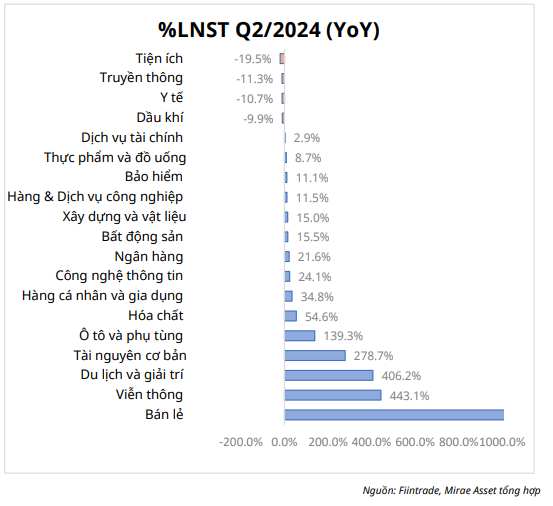

Based on Q2 2024 business results, the analysis team filtered stocks with stable performance, maintaining good growth, and having their own unique stories.

Stocks from stable sectors such as food and insurance are relatively safe choices. Additionally, prospective sectors with recovery stories, such as apparel, retail, technology, and construction materials, are also suitable options when they enter attractive price regions.

Furthermore, MASVN evaluates and selects stocks by comparing gross profit margins between the last two quarters and the previous year to identify stocks with potential that have experienced revenue and profit growth. These stocks also meet the criteria for transaction value, meaning they have liquidity.

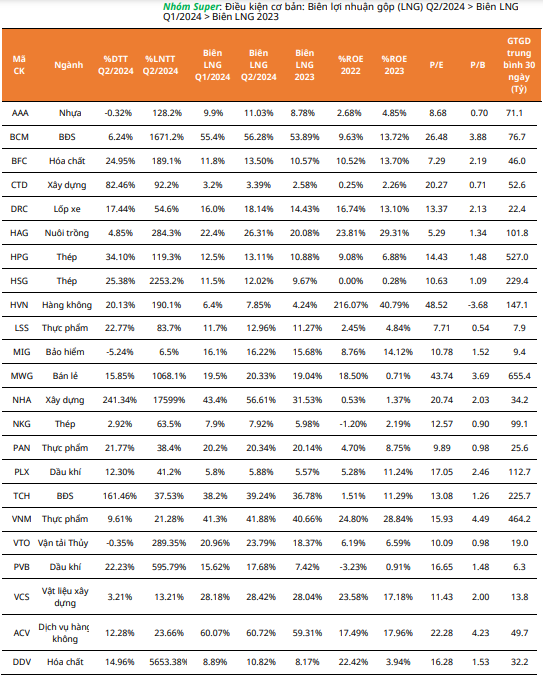

Mirae Asset recommends 28 “Super” stocks with the basic condition that the gross profit margin for Q2 2024 is higher than that of Q1 2024 and higher than that of 2023. These include companies from the food sector like PAN and VNM; retail like MWG; technology like VGI and FOX; and steel like NKG, HPG, and HSG, among others.

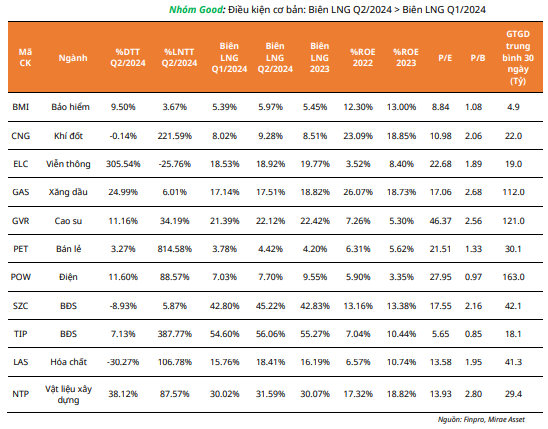

At the same time, the analysis team also provided a list of 11 “Good” stocks with the basic condition that the gross profit margin for Q2 2024 is higher than that of Q1 2024. These include stocks from the real estate sector like SZC and TIP; oil and gas like GAS; retail like PET; electricity like POW; and construction materials like NTP, among others.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.

Once a formidable competitor in the stock market, the total market capitalization of the entire real estate industry is now less than the combined market capitalization of three banks.

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).