In the latest announcement from Vietnam National Gas Corporation – Joint Stock Company (PVGas, code: GAS), the company will finalize the list of shareholders on September 16 to pay a 2023 cash dividend of 60%, equivalent to VND 6,000 per share. This ratio is triple the amount proposed at the 2023 Annual General Meeting of Shareholders and was approved at the 2024 Annual General Meeting.

With nearly 2.3 billion shares outstanding, the total amount of money the company plans to allocate is VND 13,780 billion. This is not only PVGas’s record-high dividend ratio but also the largest amount ever paid out by a listed company on the stock exchange to its shareholders.

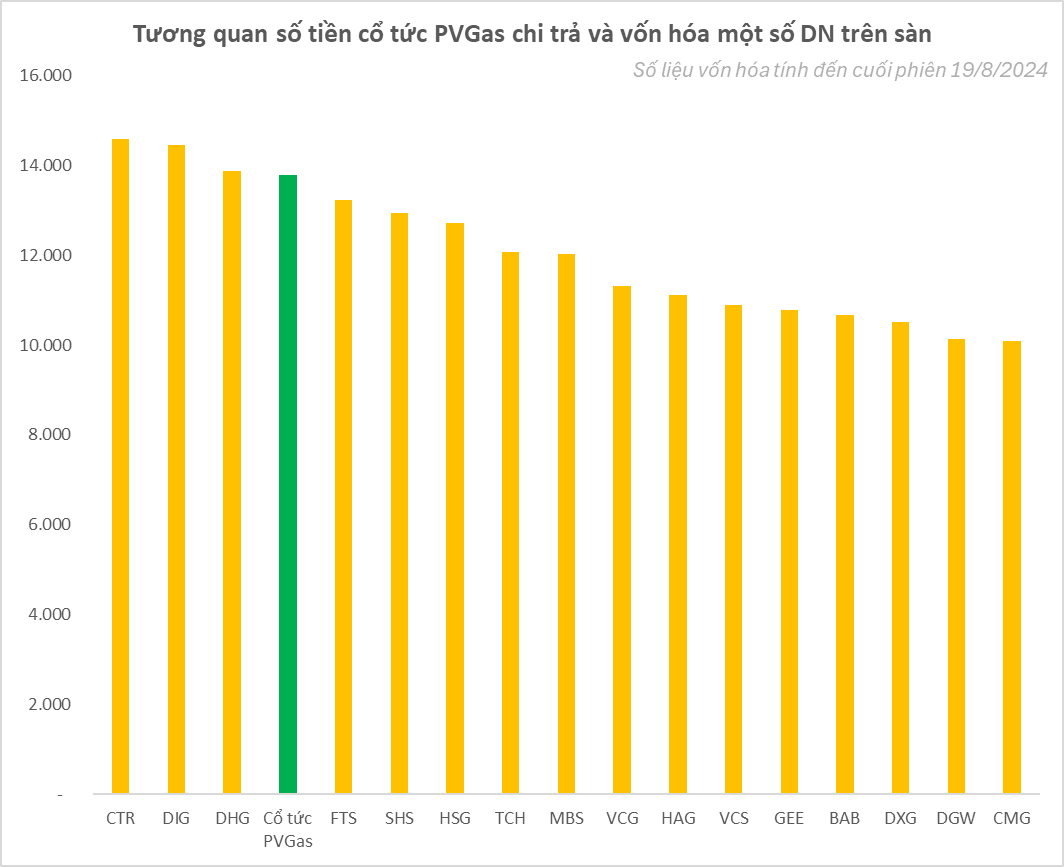

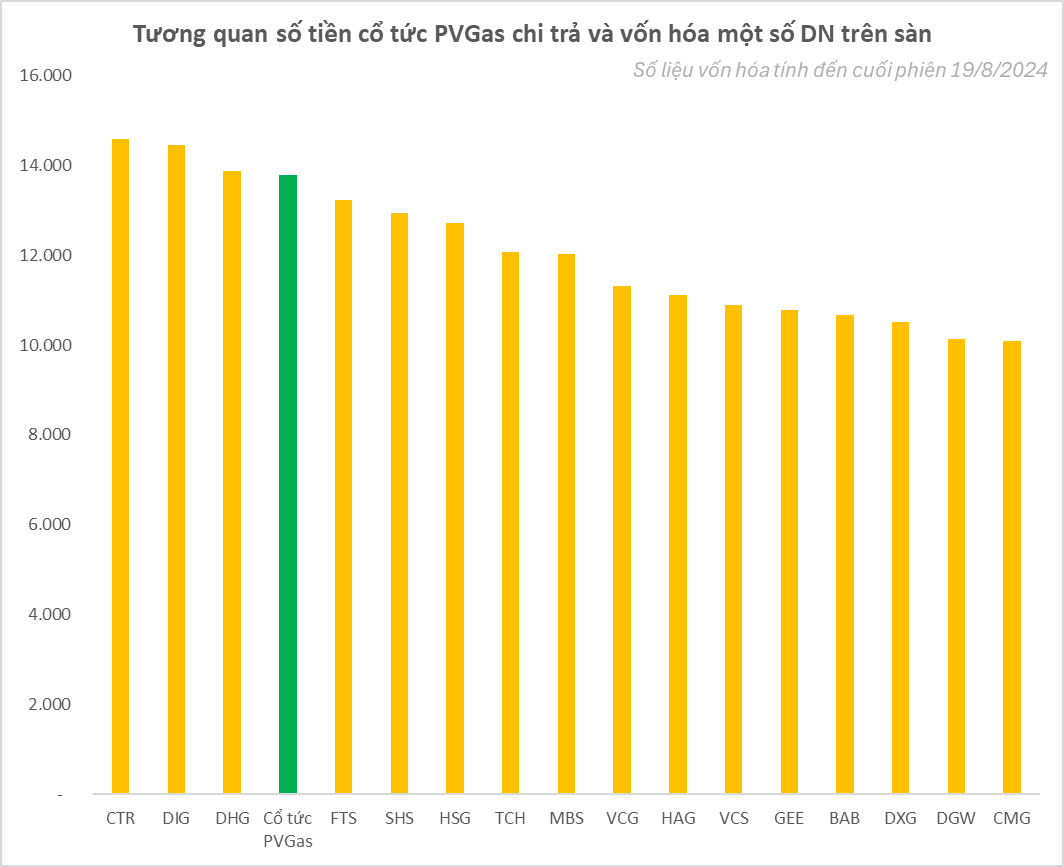

To put the scale of the nearly VND 14,000 billion dividend into perspective, this figure is equivalent to or even surpasses the market capitalization of several banks on the exchange, such as the Northern Asia Commercial Joint Stock Bank, An Binh Joint Stock Commercial Bank, and a host of other listed companies, including Phat Dat Real Estate Development Corporation, the Corporation for Finance and Promoting Technology (FPT), Hoa Sen Group, and Viettel Construction.

It is worth noting that most of the money (over VND 13,200 billion) will go to the Vietnam Oil and Gas Group (PVN), the parent company of GAS, which currently owns 95.76% of the Enterprise’s charter capital. The payment will commence on November 28, 2024.

In tandem with the massive dividend payout plan, PVGas will also issue shares to increase its charter capital from its own equity source. The issuance ratio is 50:1, meaning that for every 50 shares held, shareholders will receive one bonus share, resulting in the issuance of nearly 46 million new shares and increasing the charter capital to approximately VND 23,420 billion.

PVGas’s substantial cash reserves enable it to distribute high dividends to its shareholders. As of the end of the second quarter of 2024, the company boasted VND 43,900 billion in cash and cash equivalents, a VND 3,000 billion increase from the beginning of the year. This is the largest amount of cash PVGas has ever held at the end of a quarter since its inception.

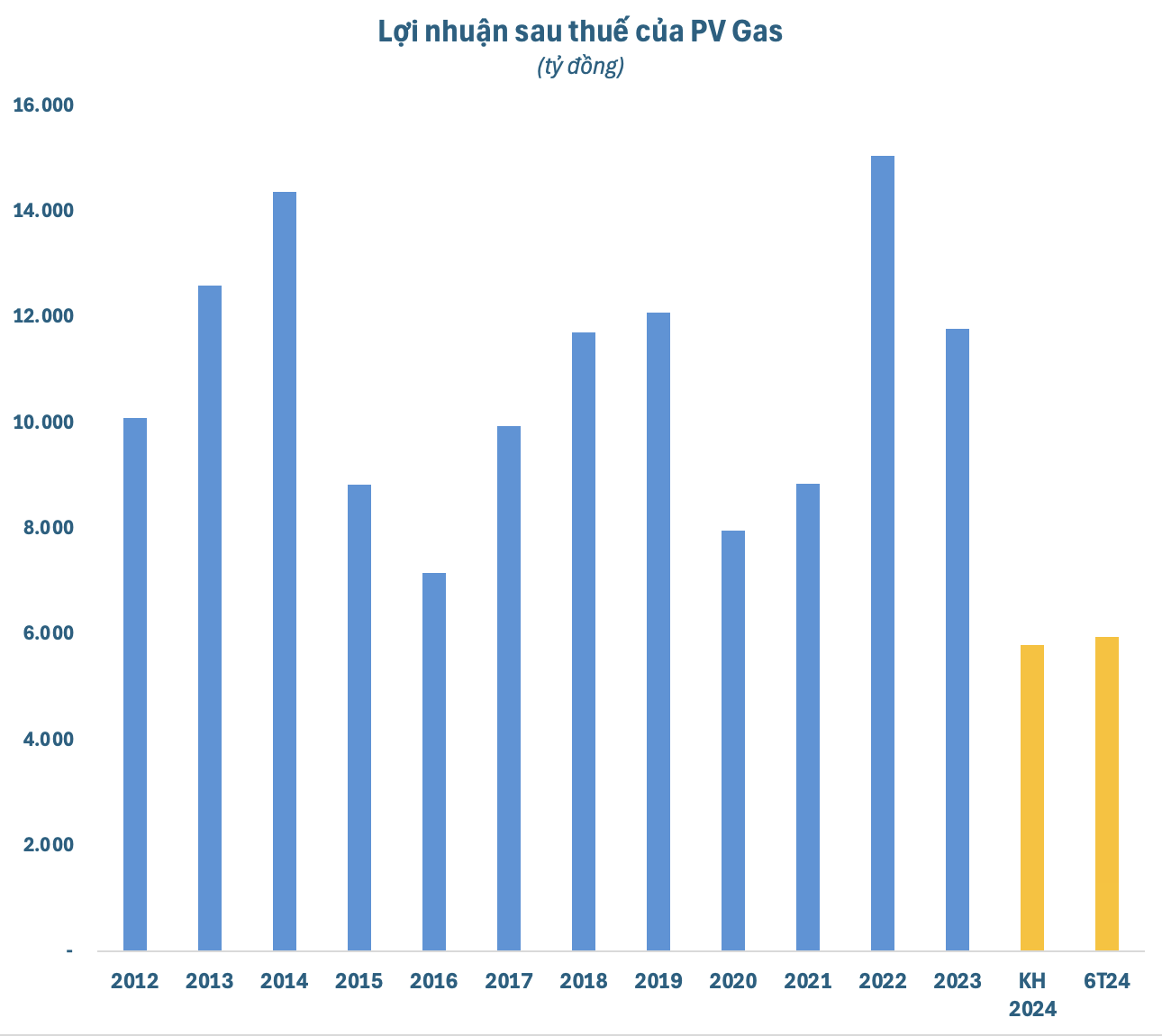

In terms of business performance, for the first six months of 2024, PV Gas recorded VND 53,367 billion in net revenue and VND 5,960 billion in after-tax profit, an 18% increase and a 10% decrease, respectively, compared to the same period last year. With these results, the Vietnamese giant has achieved 75% of its revenue target and surpassed its full-year profit goal.

On the market, GAS closed at VND 84,500 per share on August 19, a 12% increase since the beginning of the year, with a market capitalization of over VND 195,200 billion.