The stock market closed on August 20 with a surprise for investors as it did not drop but continued to rise, gaining 10.93 points and pushing the VN-Index past the 1,270 mark. The HNX Index closed at 237.31 points, a 1.29-point increase from the previous session.

While liquidity was lower than the previous day, it remained significantly higher than previous sessions, with trading value on the HOSE exceeding VND 19,000 billion. Another positive sign was the net buying by foreign investors of VND 326.7 billion on the HOSE, focusing on stocks such as VCB, FPT, and MWG.

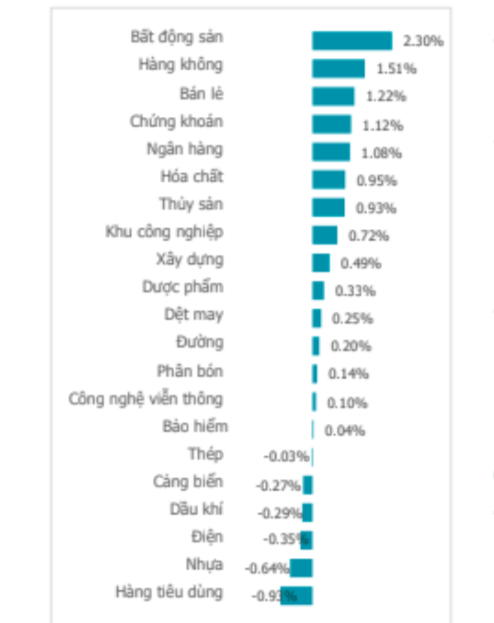

In today’s session, real estate stocks continued their strong performance, with many stocks closing in the purple after hitting the daily limit-up, such as IDI, DXG, and PDR, while others saw significant gains, including CEO, DIG, NVL, and SCR. This three-session winning streak has helped the VN-Index recover nearly 50 points from the previous downward correction.

Many real estate stocks surged or hit the daily limit-up during today’s session

Mr. Vo Kim Phung, Head of Analysis at BETA Securities Company, attributed the upbeat investor sentiment to the strong performance of large-cap stocks in the real estate and securities sectors. Many stocks in these sectors not only maintained their gains but also hit the daily limit-up, contributing to the market’s overall positive momentum. This indicates that optimism is spreading and investors are willing to invest in stocks with growth potential.

According to Nguoi Lao Dong reporters, real estate stocks surged amid the buzz surrounding an overnight land auction in Hanoi, capturing investors’ attention.

Batdongsan.com.vn reported that the winning bids for 19 land plots in the LK03 and LK03 areas of Tien Yen, Hoai Duc, Hanoi, on the night of August 19 to the early morning of August 20, were two to three times higher than the average market price. According to the information disclosed by the organizing unit, after nine rounds of bidding, the highest price reached VND 133.3 million/sqm, more than 18 times the starting price.

Real estate sector stocks witnessed the most positive performance on August 20. Source: CSI

In addition to the land auction in Hanoi, there has also been news of an upcoming land auction in Ho Chi Minh City. The city’s People’s Committee has announced the conclusion of the Party Committee of the City’s People’s Committee on the plan to organize an auction for land plots in the new urban area of Thu Thiem.

Specifically, the Party Committee of the Ho Chi Minh City People’s Committee agreed to organize an auction for land plots in the new urban area of Thu Thiem, Thu Duc City, as reported by the City People’s Committee in Report No. 3116/2024.

The Department of Natural Resources and Environment will take the lead, in coordination with relevant departments and units, to promptly finalize the plan for organizing the auction of land plots in the new urban area of Thu Thiem, and advise and submit it to the City People’s Committee for issuance and implementation…

Returning to the stock market, some securities companies predicted that after three consecutive gaining sessions, the VN-Index is likely to face short-term corrections and downward adjustments on August 21.

However, this could be a good opportunity for those with high cash ratios to accumulate stocks. Investors should focus on stocks with growth potential that have not yet fully reflected their value in the current prices.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.