Banks Proactively Build Multi-Layer Authentication Systems

In reality, with the rise of cybercrime, banks have also continuously updated and implemented multiple functions to ensure the safety of their customers in the digital world.

For instance, ACB (Asia Commercial Bank) has proactively eliminated virtual accounts from the account opening process by utilizing eKYC technologies, Video Call Face Identity, and IDCheck data cross-referencing with the Ministry of Public Security’s CCCD data. They have also introduced a feature that automatically detects and warns customers about suspicious applications that have been granted accessibility permissions on their phones, which could potentially take over their devices and steal funds from their bank accounts.

According to Decision No. 2345/QD-NHNN, in July, ACB simultaneously deployed a combo of facial recognition and ACB Safekey – an online transaction authentication method that generates OTP codes directly within the app, enhancing their multi-layer authentication system. ACB customers can rest assured that not only their accounts but also their transactions are secure, even in cases of identity theft. As of now, over 1 million ACB customers have successfully registered for facial biometric authentication. Additionally, according to the State Bank’s Circulars 17 and 18/2024/TT-NHNN, all online transactions will be interrupted if customers do not complete the process of matching their ID cards and biometric information with the bank. Therefore, ACB recommends that all customers complete facial recognition registration using their CCCD chip cards/ID cards before January 1, 2025, to avoid any disruptions to their online transactions.

Multi-Layer Authentication Can’t Prevent “Con Artists” – Scammers Who Trick People Into Voluntarily Transferring Money

To counter this, ACB has launched a specialized security page to guide customers through safe transaction principles, update them on scam tactics, and provide instructions for emergency situations. Customers can proactively refer to 24 common scam methods to protect themselves and their loved ones at Safe Transaction Principles (acb.com.vn).

Scams such as romance scams involving financial investments, impersonation of police or prosecutors demanding money transfers, or pretending to be teachers or medical staff asking for emergency funds, are all classified as “con artists” – scammers who build trust to exploit their victims. These scammers often manipulate their victims’ psychology, leading them to willingly give up their assets, most commonly by transferring money to specified accounts. In these cases, even the most robust multi-layer authentication or tight security system can be bypassed by the account holder themselves. The most common targets for these scams include retirees, small business owners, and homemakers.

Recognizing this potential risk, ACB periodically screens for possible information leaks (account, card, etc.) and contacts customers to provide timely warnings and guidance. Older customers or those frequently targeted by scammers are regularly informed through ACB’s communication channels to raise awareness about information security and prevent potential risks. Additionally, the bank continuously updates a list of suspicious accounts to block transactions to these accounts and prevent further losses. Parallelly, ACB also focuses on awareness campaigns, providing warnings and guidance, and cooperating with law enforcement to protect customer interests.

However, alongside technological safeguards, ACB also encourages users to educate themselves about safe transaction principles to protect themselves and ensure secure transactions.

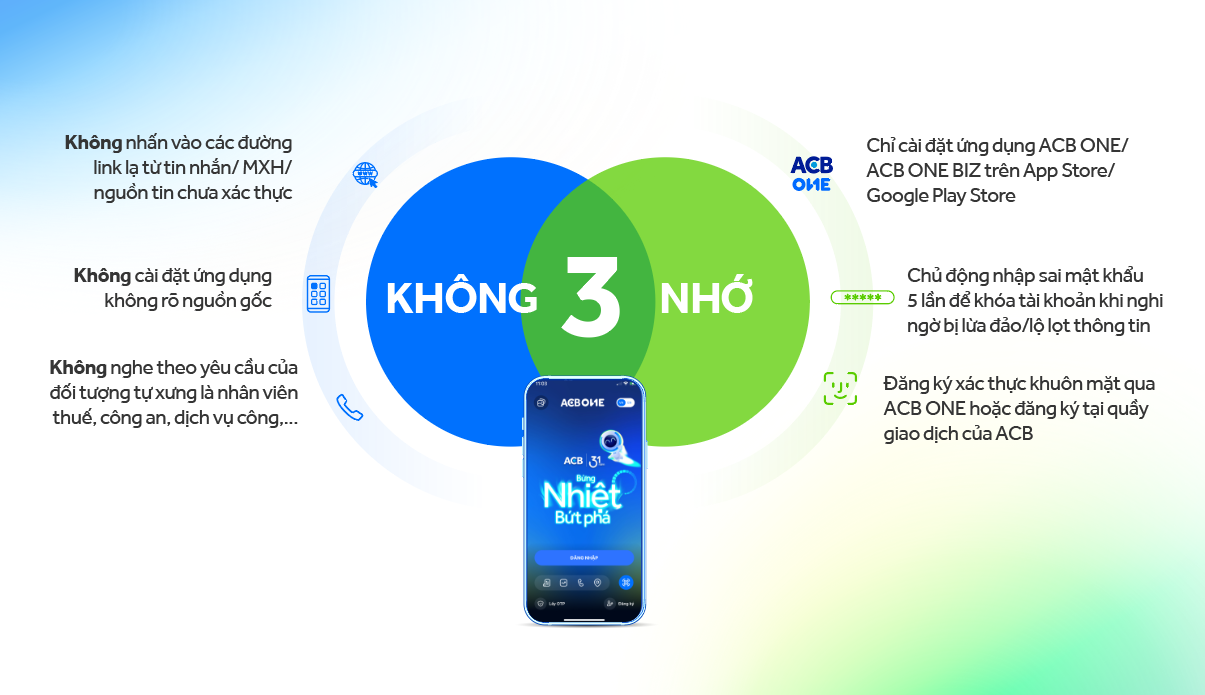

ACB recommends the “3 Remember & 3 Don’t” secret to its customers

ACB affirms that digital banking remains a safe and convenient channel for banking transactions, provided that customers follow basic safety principles to avoid potential risks.

For assistance with facial recognition registration on ACB ONE, customers can contact ACB’s Contact Center at 028 38 247 247 or (028) 35 14 54 86, or visit their nearest ACB branch or transaction office.

Combating Criminal Activity: The Dangers of Facilitating Bank Account Transactions

In recent days, Hanoi City Police have released information that there have been cases of subjects renting and purchasing bank accounts on forums and groups for the price of 500 thousand to 1 million VND. These accounts are then used for fraudulent purposes such as asset appropriation, and money laundering through a variety of different methods.

Beware of Scams This Holiday Season: A Bank’s Warning

“Cybercriminals are constantly devising new ways to scam unsuspecting individuals, and banks are now warning their customers about the latest schemes targeting their accounts. The fraudsters’ tactics are evolving, and it’s crucial for account holders to stay vigilant and informed to protect their hard-earned money.”