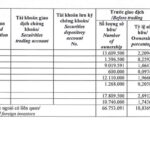

Dragon Capital recently announced that it sold 3.17 million HSG shares of Hoa Sen Group during the trading session on August 16th.

Specifically, DC Developing Markets Strategies Public Limited Company, a member fund, sold over 2.34 million shares, while Norges Bank sold 300,000 shares. Amersham Industries Limited and Vietnam Enterprise Investments Limited each sold 250,000 shares, and Samsung Vietnam Securities Master Investment Trust sold 30,000 shares.

Following this transaction, the total holdings of this group of foreign shareholders in Hoa Sen decreased from nearly 50.7 million shares (corresponding to 8.22% of capital) to 47.5 million shares (corresponding to 7.71% of capital). Calculated based on the closing price of HSG shares on August 16th at VND 20,350/share, Dragon Capital would have earned approximately VND 64.5 billion from this transaction.

Thus, in nearly two months (from June 19th to August 16th), Dragon Capital has net sold nearly 15 million HSG shares, reducing its ownership from over 62.47 million shares (10.14%) to 47.5 million shares (7.71%).

The context of the HSG share price has decreased by more than 22% in nearly two months (from June 19th to August 15th) before showing signs of recovery in the last few trading sessions. At the end of the August 21st session, the HSG price stood at VND 21,050/share and recorded four consecutive gaining sessions. However, August 21st was also the tenth consecutive session in which HSG shares were net sold by foreign investors, with a total net selling value of VND 264 billion (12.8 million units).

The situation of HSG shares is similar to that of HPG shares of Hoa Phat Group, a giant in the steel industry. In the August 21st session, HPG was the stock that foreign investors net sold the most in terms of both volume and value, with more than VND 157.4 billion, equivalent to about 6 million units, marking the 13th consecutive session that this steel code has been net sold by foreign investors, with a total value of up to VND 1,419 billion (54.9 million units).

The steel industry still faces many difficulties

Steel stocks have been continuously sold off by foreign investors amid a series of unfavorable information about the industry, such as the continued decline in HRC prices to a three-year low and trade defense movements from the European Union (EU) and India.

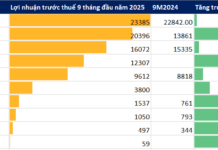

In its Q3 steel industry update report, Vietcombank Securities (VCBS) stated that although the Q2 business results of leading companies such as HPG, NKG, and HSG grew impressively thanks to comparisons with the low base from the same period last year, market share advantages, and agility in seizing export opportunities, as well as stable input material prices in Q1 reflected in the cost of goods sold in Q2, the current advantages and bright spots are only temporary and not really sustainable.

The steel industry will still face many difficulties in the near term. These include new policies from the EU (on July 30, 2024, the EU initiated an anti-dumping investigation into Vietnamese HRC steel due to a surge in export volume, which could hinder export activities) and a possible decline in raw material prices at the end of Q2, which could put pressure on inventory devaluation in Q3.

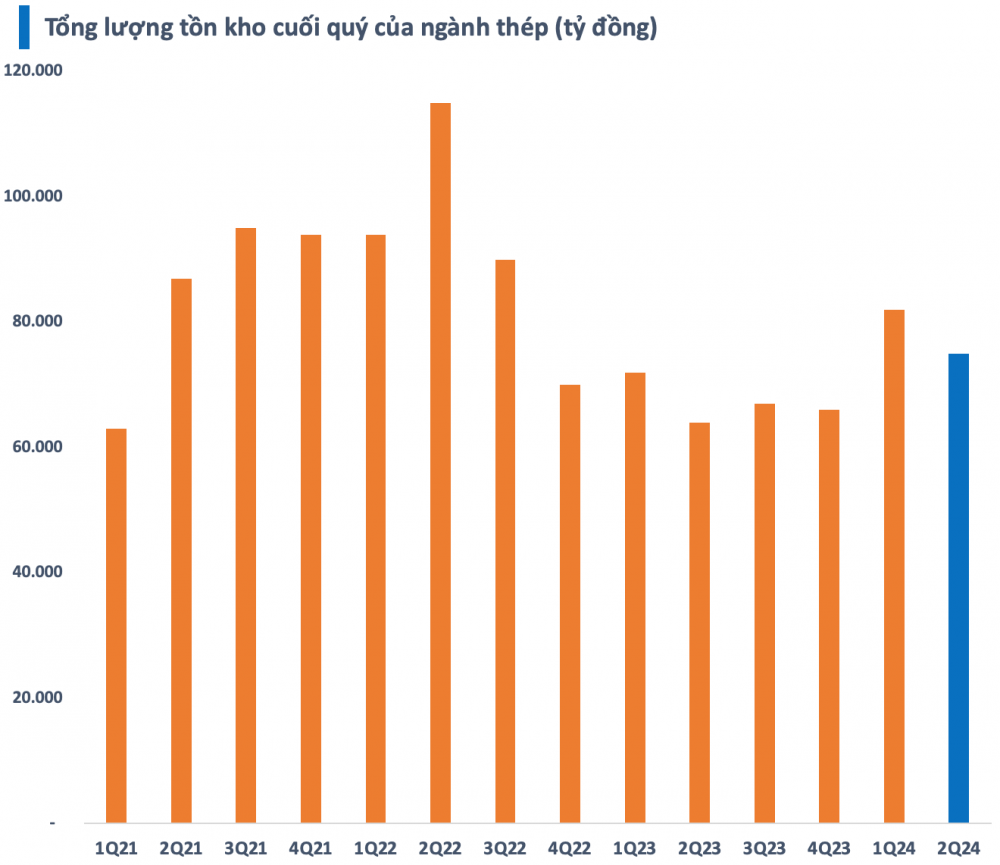

As of the end of Q2, the total inventory value of the steel industry on the stock market was estimated at VND 75,000 billion, a decrease of about VND 7,000 billion compared to the end of Q1. However, this is still the second-largest inventory volume in the past seven quarters.

While exports may decline, VCBS expects domestic consumption to continue its strong recovery momentum towards the end of the year as the real estate market in Vietnam recovers well, with the number of projects maintaining a high level in both the North and the South; and public investment is promoted.

In addition, the application of temporary anti-dumping measures on HRC and coated steel products from China, India, and South Korea is expected to be issued as early as October or November 2024. VCBS assessed that the impact of this policy is feasible and would significantly affect HRC products as after HPG increases its HRC capacity, the domestic market will be the main consumption market, and the imposition of anti-dumping duties will have a significant impact when 60-70% of the industry’s consumption comes from imports.

Regarding coated steel products, VCBS opined that the impact of this policy would not be as significant as in the 2016-2017 period because the proportion of coated steel imports from China and South Korea accounts for only 30% (a low rate compared to 100-110% in the 2016-2017 period) of domestic consumption; China can also easily circumvent the tax by transshipping through neighboring countries.

Steel stocks are not as optimistic as expected

Regarding steel stocks, VCBS assessed that their prospects are not as optimistic as some investors expected. Steel stocks currently show low investment profit margins and high differentiation. Accordingly, the stocks of medium and small-cap companies such as VGS, TVN, and TIS have recorded impressive increases thanks to their unique stories (involving real estate, sudden profits from fixed asset liquidation, etc.), replacing the stocks of leading companies in the industry, which have experienced unfavorable price movements, such as HPG, HSG, and NKG.

For HPG stock, VCBS stated that the profit margin may face adjustment pressure in Q3/2024, although the input cost decreases due to increased provision expenses for inventory and the expected difficulty in HRC consumption amid export market protection policies.

In the long term, the opportunity arising from the mega Dung Quat 2 project, which is expected to come into operation in 2025, can help HPG increase its HRC output significantly. However, the ability to consume this output will largely depend on the anti-dumping policies against Chinese HRC.

VCBS opined that with the view that steel prices will remain low, the projected profit for 2024 has been reflected in the stock price. With an estimated ROE of 13% for 2024, the current P/B of 1.53 times is not attractive compared to the historical level.

Performance of HPG, HSG, and NKG stocks since the beginning of the year

Similarly, for HSG, VCBS stated that the company’s profit margin may be affected as the industry’s profit margin in Q3 and Q4/2024 is expected to narrow due to the adjustment in export steel prices. A significant risk comes from the large inventory that HSG accumulated in Q1/2024, which may require provision for devaluation.

According to VCBS, the expectations for a recovery have been largely reflected in HSG’s stock price, while profits have not recovered proportionally.

As for NKG, as the company focuses on exports to the European market, with revenue from this market accounting for up to 50%, VCBS stated that risks may arise if the domestic production industry in this market recovers rapidly and trade protection measures are implemented. In addition, SMC – one of NKG’s large domestic distributors – is going through a challenging period, which could significantly affect the recovery of NKG’s domestic consumption channel in 2024.

However, NKG maintains a cautious view on market demand, so inventory volume does not fluctuate much. Therefore, the risk of inventory devaluation provision for NKG will be lower than that of HSG.