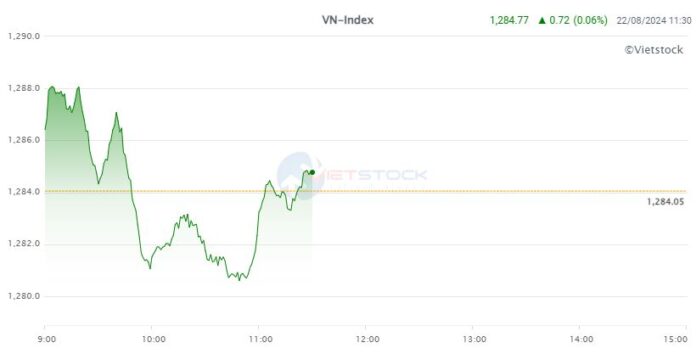

The morning session ended with the VN-Index gaining 0.72 points to 1,284.77, while the other two markets showed less positive performance, with HNX down 0.28 points to 238.13 and UPCoM down 0.04 points to 94.44. The total trading value of the 3 markets reached 7,998.47 billion VND, quite similar to the previous session.

Source: VietstockFinance

|

VN-Index regained its positive momentum, driven by the recovery of banking stocks and a surge in real estate shares.

In the banking sector, TCB led the gains with a 2.5% increase, followed by CTG (+0.88%), SHB (+0.47%), VIB (+1.37%), and SSB (+3.46%). Meanwhile, in the real estate sector, several stocks witnessed strong upward movements, notably VRE (+5.29%), NVL (+2.38%), DIG (+1.02%), PDR (+2.14%), and CEO (+1.8%).

The best-performing sector in the morning session was food and essential retail, which rose by 4.92%. This was followed by household and personal goods, which increased by 1.46%, supported by gains in LIX (+1.07%) and NET (+2.16%).

The only sector that declined by more than 1% was the automotive and components industry, dragged down by tire stocks, including SRC (-3.23%), CSM (-1.49%), and DRC (-0.87%).

Foreign trading activity was not particularly active, with a net sell position of over 460 billion VND. Foreign investors net sold mainly HPG, HSG, VHM, and VPB, while their net buy focus was on FPT.

10:40 am: Market turns red, bank stocks show mixed performance

The market faced significant pressure from 9:40 am onwards and continued to decline. As of 10:30 am, the VN-Index had lost 2.71 points to 1,281.34, with HNX and UPCoM also in negative territory.

The number of declining stocks increased considerably compared to the start of the morning session, with 348 stocks in the red and 2 at the floor price, while 253 stocks were in the green and 15 hit the ceiling price.

The market turned red as many bank stocks failed to maintain their earlier gains, including MBB, HDB, STB, and VCB… Additionally, several securities stocks faced selling pressure, such as VIX, SHS, VCI, and SSI…

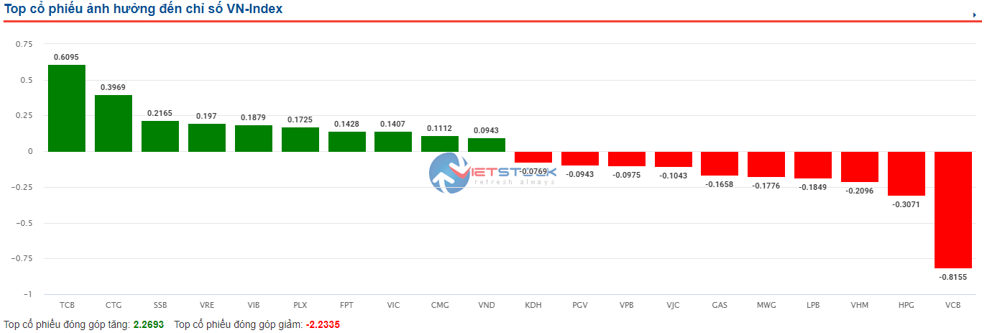

In terms of market influence, the banking sector had the most significant impact, featuring in both the positive and negative contributors.

Specifically, several bank stocks, including TCB, CTG, SSB, and VIB, were among the top 10 positive contributors to the VN-Index. On the other hand, VCB, LPB, and VPB were among the top 10 negative contributors, with VCB alone accounting for a loss of more than 0.8 points for the index.

Source: VietstockFinance

|

In terms of sector performance, the automotive and components industry witnessed the sharpest decline, falling by over 1%, led by tire stocks DRC, CSM, and SRC.

Opening: Continuing the recovery trend

The VN-Index started the session on August 22nd with a positive tone, briefly experiencing a correction soon after but managing to stay in the green, gaining 1.87 points to 1,285.92 as of 9:25 am.

Market performance as of 9:25 am. Source: VietstockFinance

|

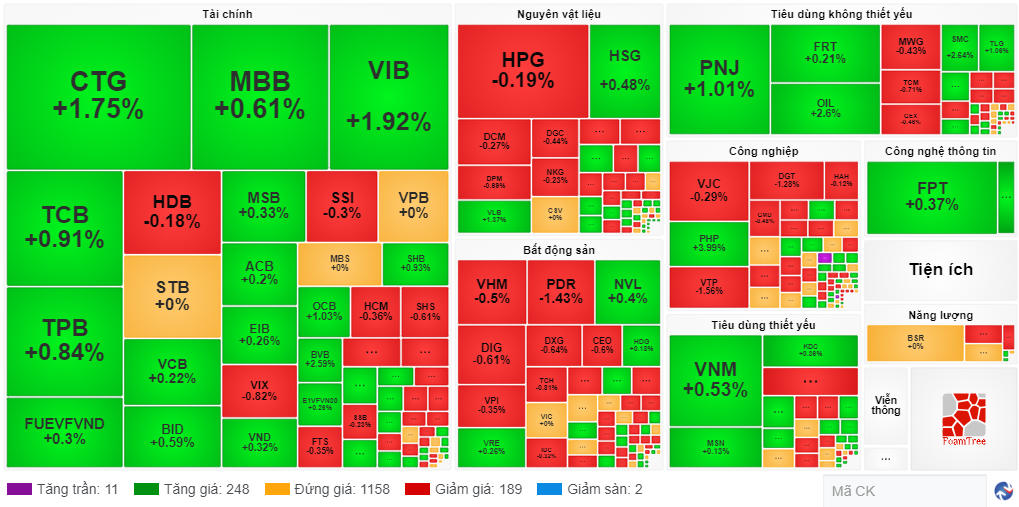

The positive sentiment was widespread, with 259 stocks advancing, including 11 at the ceiling price, while only 191 stocks declined. Trading volume also improved compared to the previous session.

The banking sector continued to be a key driver, with notable gains in CTG (+1.75%), VIB (+1.92%), TCB (+0.91%), TPB (+0.84%), and MBB (+0.61%).

Most sectors posted gains, with food and essential retail leading the advances. On the other hand, only a few sectors declined, and the declines were relatively modest, all below 1%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.