|

Source: VietstockFinance

|

The total trading value of the three exchanges reached nearly VND 17,427 billion, slightly lower than the previous session and the 5-day average.

Banking, securities, and insurance stocks continued to attract the most cash flow, especially large-cap stocks such as TCB, CTG, SSI, HCM, and VRE…

In terms of gains, healthcare stocks stood out with TNH hitting the upper limit, along with BBT surging 11.25% and AMV climbing 3.33%.

The household goods and personal items sector also saw gains of over 1%, with NET up 2.16%, LIX rising 0.27%, and DMX soaring 12.94%.

The number of declining sectors outnumbered the advancing ones, with four sectors falling more than 1%: specialized services and commerce; food and essential retail; consumer services; and vehicles and components.

Foreign investors significantly increased their net selling towards the latter half of the afternoon session, with net sell orders reaching nearly VND 618 billion. The selling pressure was mainly on HPG, with a net sell value of over VND 237 billion, and HSG, with a net sell value of over VND 119 billion. On the buying side, FPT led with a value of over VND 138 billion.

| Foreign Trading Activity |

14:00: Market recovery efforts fall short

In the first half of the afternoon session, the VN-Index displayed a tug-of-war between bulls and bears, quickly dipping into negative territory before attempting a rebound. However, the index once again turned south. As of 14:00, the VN-Index was down 2.61 points, hovering around 1,281.44.

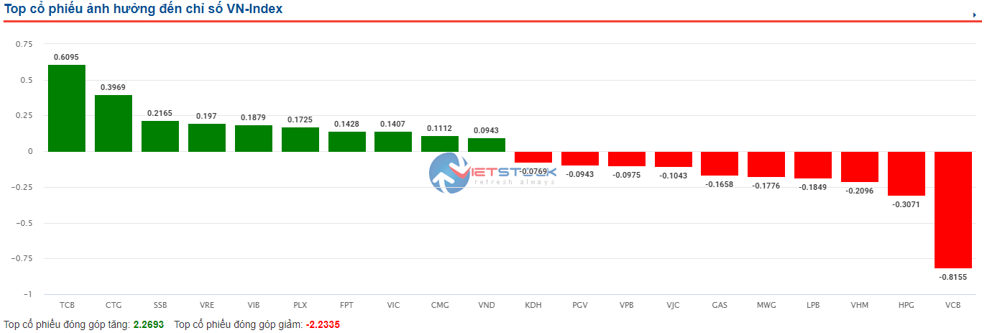

The market breadth was skewed towards decliners, while heavyweights such as BID, HPG, VNM, and VCB exerted significant downward pressure, collectively dragging the index down by more than 4 points. In contrast, the top 10 gainers could only contribute around 2.7 points to the index.

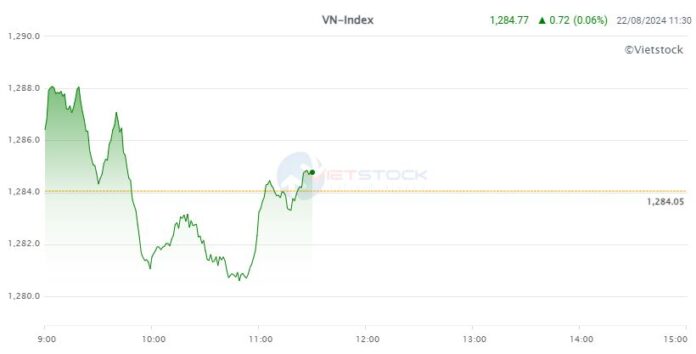

Morning Session: Banks and Real Estate Stocks Drive the VN-Index Back into Positive Territory

After facing multiple headwinds in the middle of the morning session, the VN-Index swiftly regained its footing, propelled by a resurgence in banking stocks and a rally in the real estate sector.

At the morning close, the VN-Index edged up 0.72 points to 1,284.77. Meanwhile, the HNX and UPCoM indexes painted a less optimistic picture, slipping 0.28 points and 0.04 points, respectively, to finish at 238.13 and 94.44. Combined trading volume across the three exchanges stood at VND 7,998.47 billion, roughly on par with the previous session.

Source: VietstockFinance

|

The VN-Index reclaimed positive territory, propelled by a resurgence in banking stocks and a rally in the real estate sector.

Within the banking sector, TCB took the lead, climbing 2.5%, followed by CTG (+0.88%), SHB (+0.47%), VIB (+1.37%), and SSB (+3.46%). Turning to real estate stocks, several names posted robust gains, including VRE (+5.29%), NVL (+2.38%), DIG (+1.02%), PDR (+2.14%), and CEO (+1.8%).

The best-performing sector in the morning session was food and essential retail, advancing 4.92%. This was closely followed by household goods and personal items, which rose 1.46%, bolstered by gains in LIX (+1.07%) and NET (+2.16%).

The only sector to decline by more than 1% was vehicles and components, dragged down by tire stocks, including SRC (-3.23%), CSM (-1.49%), and DRC (-0.87%).

Foreign trading activity was relatively subdued, with buy and sell orders totaling over VND 461 billion and VND 921 billion, respectively, resulting in a net sell value of over VND 460 billion.

Foreign investors offloaded shares of HPG, HSG, VHM, and VPB, with net sell values of over VND 95 billion, VND 71 billion, VND 50 billion, and VND 45 billion, respectively. Conversely, they scooped up FPT shares, accumulating a net buy value of nearly VND 72 billion.

10:40: Market Turns Red as Banking Stocks Exhibit Mixed Fortunes

The market encountered headwinds from 9:40 am onwards, slipping into negative territory and extending losses thereafter. As of 10:30 am, the VN-Index had shed 2.71 points to 1,281.34, with the HNX and UPCoM indexes also in the red.

The number of declining stocks increased significantly compared to the start of the morning session, with 348 tickers in the red and 2 hitting the daily lower limit, while 253 tickers advanced and 15 touched the upper limit.

The market’s downturn was largely attributed to a loss of momentum in banking stocks, as several names failed to sustain their upward trajectory, including MBB, HDB, STB, and VCB… Additionally, multiple securities firms witnessed selling pressure, such as VIX, SHS, VCI, and SSI…

In terms of sector influence, banking stood out, featuring prominently among both the top advancers and decliners.

Specifically, a host of banking stocks, including TCB, CTG, SSB, and VIB, made their way into the top 10 contributors to the VN-Index‘s advance. Conversely, VCB, LPB, and VPB were among the top 10 detractors, with VCB alone responsible for erasing over 0.8 points from the index.

Source: VietstockFinance

|

Examining the decliners, the vehicles and components sector posted the steepest loss, dipping over 1% as tire stocks DRC, CSM, and SRC faced selling pressure.

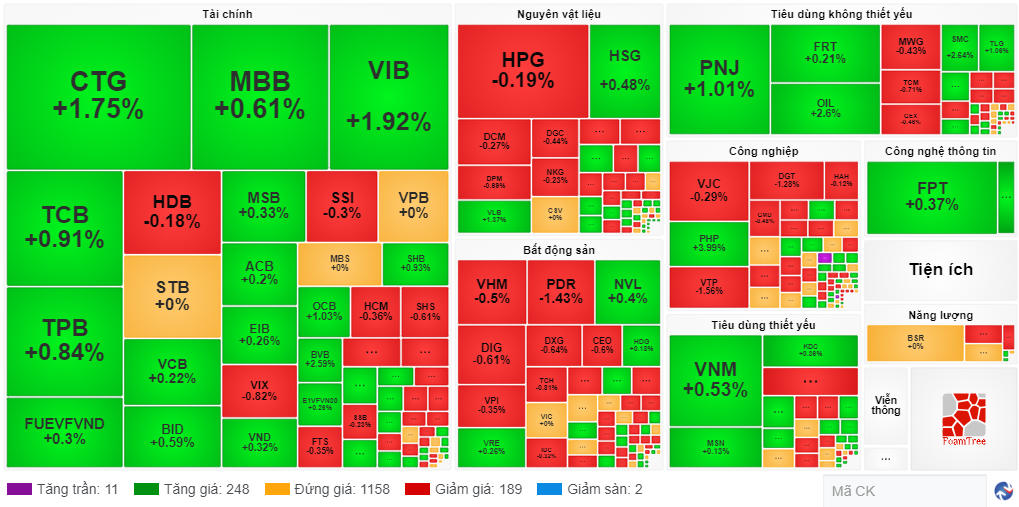

Opening: Market Extends Rebound

The VN-Index commenced the August 22 session on a positive note, sporting a green hue despite a brief pullback shortly after the opening bell. As of 9:25 am, the index had climbed 1.87 points to 1,285.92.

Market Performance as of 9:25 am. Source: VietstockFinance

|

Bullish sentiment prevailed, with 259 tickers in the green, including 11 at the upper limit, versus 191 decliners. Trading volume also witnessed an improvement compared to the previous session.

Banking stocks continued to shine, with notable gainers including CTG (+1.75%), VIB (+1.92%), TCB (+0.91%), TPB (+0.84%), and MBB (+0.61%).

The vast majority of sectors traded in positive territory, led by food and essential retail. Conversely, only a handful of sectors posted modest losses, all of which were below 1%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.