Nam Long Group’s Headquarters

Photo: Nam Long Group’s Headquarters

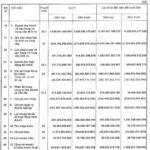

According to the consolidated financial statements for the second quarter of 2024, as of June 30, 2024, the inventory of Nam Long Investment Joint Stock Company (Nam Long; HoSE: NLG) was VND 19,232 billion, an increase of nearly VND 2,000 billion compared to the beginning of the year, or 11.08%.

The Izumi project in Bien Hoa City, Dong Nai Province, had the largest inventory value of VND 8,655 billion, accounting for more than 45% of Nam Long’s total inventory value.

Following are the Waterpoint Phase 1 project with an inventory value of VND 3,837 billion, the Hoang Nam (Akari) project with an inventory value of VND 2,425 billion, the Waterpoint Phase 2 project with an inventory value of VND 2,036 billion, and the Can Tho project with an inventory value of VND 1,492 billion.

Thus, the total value of the above five projects with inventory has exceeded VND 18,447 billion, accounting for 96.26% of Nam Long’s total inventory value.

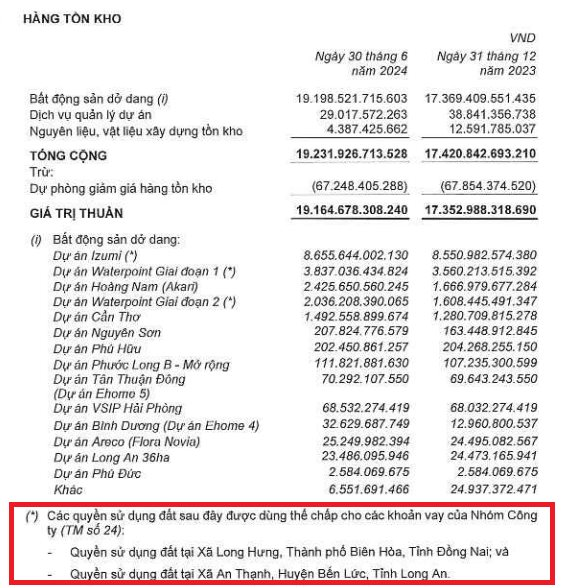

Land use rights of 3/4 of the projects with the largest inventory value of Nam Long are being mortgaged for the Company’s loans.

Out of the 15 projects listed in Nam Long’s inventory, only the Phu Huu and Long An 36ha projects saw a slight decrease in inventory value, while the Phu Duc project remained unchanged. The remaining 12 projects all experienced an increase in inventory value.

The project with the strongest growth in inventory value in the first six months of 2024 for Nam Long was the Hoang Nam (Akari) project, with a value increase of nearly VND 800 billion to VND 2,425 billion.

Notably, according to the financial statement notes from Nam Long, the land use rights of 3/4 of the projects with the largest inventory value, namely the Izumi Project (Long Hung Commune, Bien Hoa City, Dong Nai Province), Waterpoint Phase 1 Project, and Waterpoint Phase 2 Project (An Thanh Commune, Ben Luc District, Long An Province), are currently being mortgaged for the Company’s loans.

In terms of business performance, in the first six months of 2024, Nam Long recorded net revenue from sales of VND 457 billion, a decrease of VND 732 billion compared to the same period last year, or a 62% decline.

According to the company’s explanations in the financial statements, Nam Long’s revenue mainly comes from the sale of houses and apartments (accounting for about 81% of total revenue) and amounted to VND 372 billion from key projects such as Southgate and Izumi.

As a result, Nam Long’s after-tax profit for the first six months was VND 153 billion, a 62% decrease compared to the same period in 2023.

As of June 30, 2024, Nam Long’s total assets were VND 29,731 billion, an increase of 3.91% from the beginning of the year. Of this, short-term assets were VND 26,773 billion (an increase of 5.77%).

Thus, the company’s inventory (VND 19,165 billion) accounts for 71.58% of its short-term assets.

In addition, as of the end of June 2024, Nam Long’s total liabilities were VND 16,425 billion, an increase of 8.93% from the beginning of the year. Thus, the company’s liabilities account for more than half of its total capital.

Loans and financial debts amounted to VND 6,532 billion, an increase of 6.95%. Of this, the company’s bond debt was VND 3,631 billion (including VND 2,0227 billion in long-term bond debt and VND 1,603 billion in short-term bond debt due).

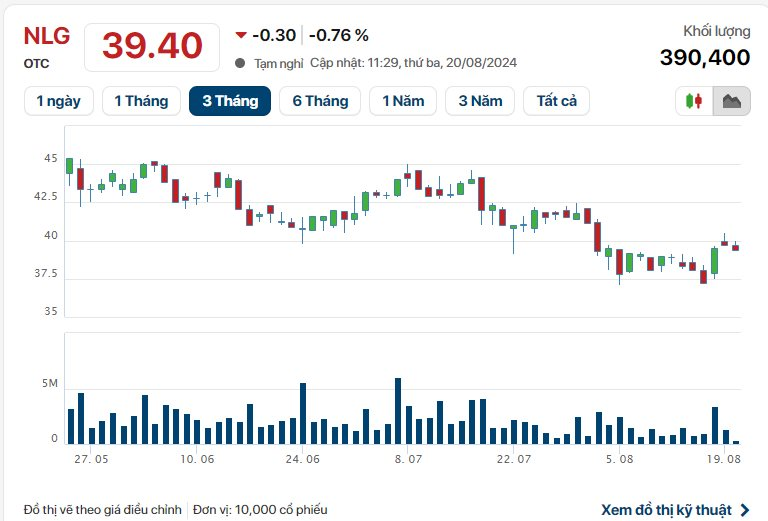

NLG share price has adjusted strongly in the past 3 months. (Source: Cafef)

In the stock market, as of the morning session of August 20, the NLG share price stood at VND 39,400 per share, down 0.76% from the previous session, with a matched volume of over 390,000 units.

BIG: 2023 Profit Soars Over 10x, Expands Nationwide Hotel Chain

Thanks to optimizing real estate business operations and boldly expanding into the service real estate sector (BIG HOTEL), Big Invest Group JSC (UPCoM: BIG) has achieved impressive business results in 2023. BIG has announced its focus on accelerating the plan to open a chain of BIG HOTEL hotels in 2024.