VHM shares of Vinhomes ended the morning session on August 22nd in the green for the seventh consecutive session, pushing the stock price above the 40,000 VND mark for the first time in three months. Trading volume exceeded 4 million units. However, foreign investors sold a net of more than 1 million VHM shares, equivalent to a value of over 52 billion VND.

VHM shares have been on an upward trajectory since Vinhomes announced its plan to repurchase 370 million treasury shares, equivalent to 8.5% of the circulating shares. The expected timeline for the buyback is after obtaining approval from the State Securities Commission, and the company will disclose information about the share repurchase in accordance with regulations. The transaction method will be either order matching or negotiation.

To repurchase the entire amount of shares, Vinhomes is expected to spend tens of thousands of billions of VND. The repurchase of 370 million shares will result in a corresponding reduction of 3,700 billion VND in charter capital. The decrease in the number of circulating shares will lead to an increase in earnings per share (EPS).

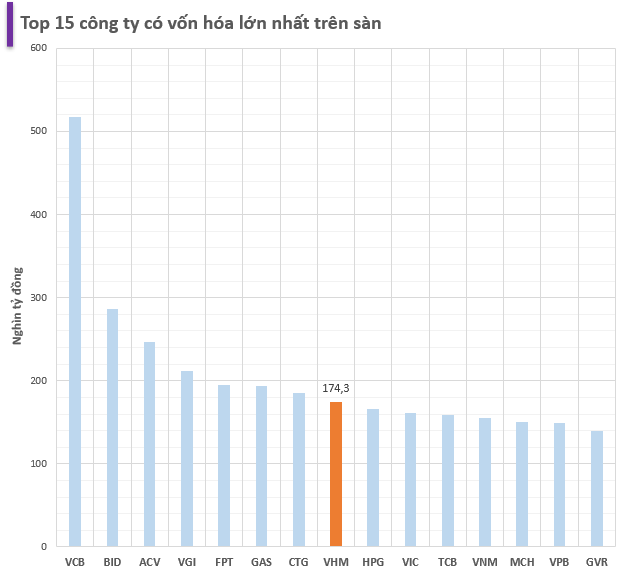

Since the announcement of the share buyback plan, Vinhomes’ market capitalization has increased by approximately 22,800 billion VND, reaching 174,392 billion VND. Its current market value surpasses that of Hoa Phat, Vinamilk, and even its parent company, Vingroup.

According to a report by An Binh Securities (ABS) at the end of July 2024, Vinhomes’ growth prospects remain positive for the second half of the year. Firstly, the company’s “Unrecognized Cumulative Sales” are high, ensuring profits. With a value of 118,700 billion VND in unrecognized cumulative sales at the end of Q2 2024, this serves as a guarantee for future revenue and profits, helping the company achieve its business targets for 2024.

Secondly, Vinhomes’ sales are expected to continue rising with the upcoming launch of major projects. The company also mentioned being in the final stages of completing two bulk sale transactions with a total value of approximately 40,000 billion VND.

ABS stated that the prospects for the second half of 2024 include the focus on delivering projects such as Vinhomes Ocean Park 3, Sky Park, Golden Avenue, and Royal Island, as well as recognizing revenue from bulk sales. Additionally, in the coming years, large projects like Vinhomes Co Loa (Dong Anh, Hanoi) and Vinhomes Wonder Park (Dan Phuong, Hanoi) will contribute to sustaining the company’s sales.

Furthermore, Vinhomes has been approved for numerous projects in various provinces, including Hai Phong, Da Nang, Khanh Hoa, Ha Tinh, Tuyen Quang, Hung Yen, and Long An, ensuring a robust land fund and a pipeline of projects for the long term.

Lastly, the securities firm believes that the trio of laws related to the real estate industry that came into effect on August 1, 2024 (the 2023 Real Estate Business Law, the 2023 Housing Law, and the 2024 Land Law) will positively impact the real estate market. Vinhomes, as a leading real estate developer in Vietnam with a vast and clean land fund and strong financial capabilities, is well-positioned to benefit significantly from these new regulations.

Healing Lives in Ocean City: A Foreign Expert’s Perspective

In a fragmented healing industry, Ocean City has made a major breakthrough by integrating a comprehensive healing ecosystem into residential complexes, nurturing sustainable health and happiness woven into everyday life, Technode Global reports.