Credit growth in the first half of 2024 reached 6.1%, equivalent to 41% of the government’s target of 15%. In the second half of 2024, to achieve the goal, the economy needs to push an additional 8.73%, equivalent to 1,184,995 billion. Banks with high credit growth in the first half were wholesale banks such as LPB and TCB, and retail banks with strengths in the southern region such as ACB and HDB.

In the updated report on the banking industry outlook, VPBankS believes that credit growth of 14-15% per year is a significant challenge due to Vietnam’s credit/GDP ratio being too high. Moreover, when credit growth is considered a criterion for evaluating banks as a basis for assigning credit room for the following year, it will also indirectly cause banks to try to push the credit limit.

When growth has to be compromised by asset quality, that growth is unsustainable and can lead to economic instability, high inflationary pressures, and problematic bad debt issues. Vietnam is approaching the level of developed countries such as Australia, China, and Thailand, and is still much higher than countries with similar economies such as Indonesia and the Philippines.

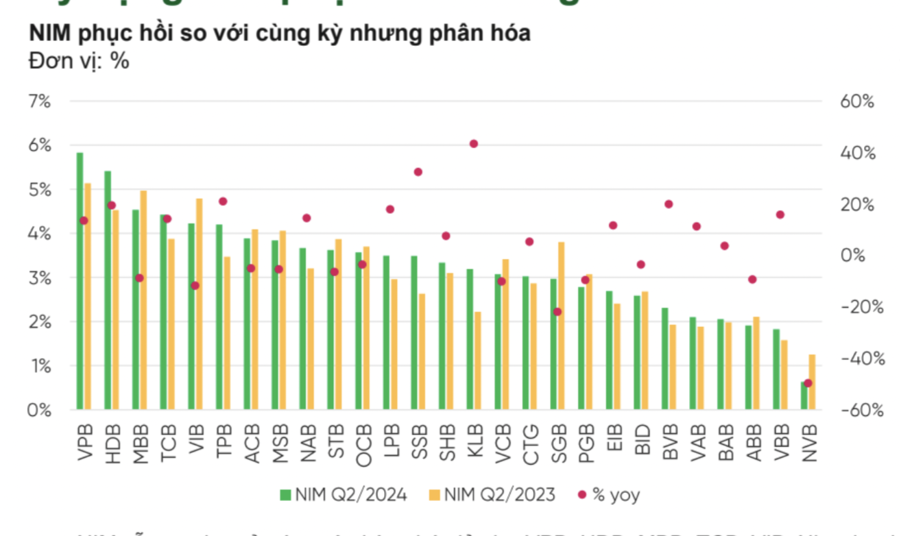

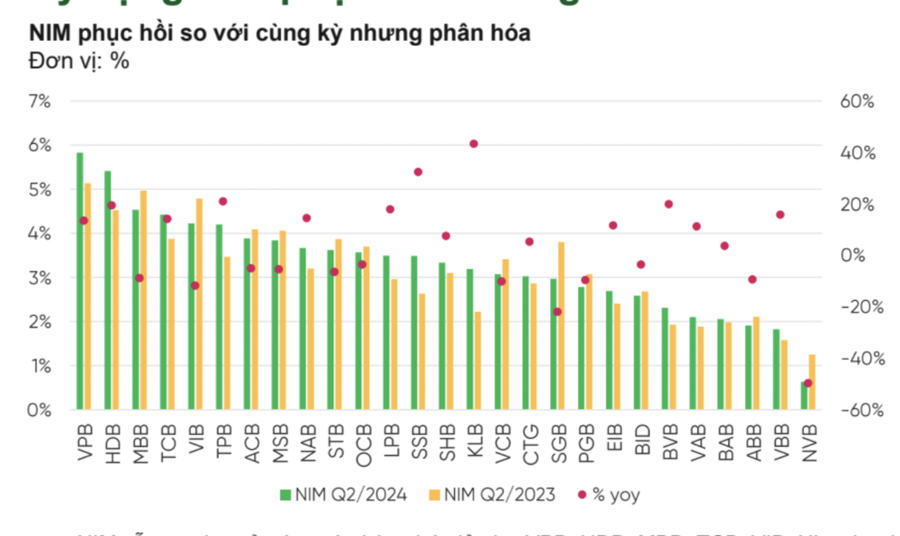

In terms of NIM, VPBankS expects NIM to recover but not reach the peak of 2022. With the cost of capital already reduced to the COVID period due to low deposit interest rates and CASA growing again. CASA still belongs to banks with a large advantage in corporate customers such as MBB, TCB, and VCB. Banks are racing to payment products to gain the main payment account position of customers, for example, VPB has VPPay and Tap2Phone products; MBB has Miniapp and Biz MBBank products; TCB has CD Bao Loc product.

NIM is supported by this trend, and the projected NIM for the entire industry in 2024 will reach 3.75%, higher than the current 24 bps, but it is also not expected that NIM will recover to the peak of 2022 due to fierce competition among banks. about prices to gain market share and expand the customer base, expand the credit institution.

NIM is still higher at retail banks such as VPB, HDB, MBB, TCB, and VIB. When the market recovers, the NIM growth rate of these banks also grows faster than the industry, except for MBB and VIB due to diversification into the corporate segment.

However, bad debt remains the biggest risk. Provisioning costs are expected to increase compared to 2023 due to the industry’s bad debt still on the rise. This will affect the overall business results as the bad debt recovery situation has not seen much positive improvement, especially the bad debt originating from SCB.

By the end of Q2/2024, the industry’s NPL ratio was at 4.56%, up 8.6% from the beginning of the year, but if the bad debt of the 5 credit institutions under special control is peeled off, the on-balance sheet bad debt ratio is still below 3%. The NPL ratio of listed banks is at 2.2%, up 29 percentage points from the beginning of the year.

The bright spot is that in Q2, 20/27 banks saw a decrease in Group 2 debt compared to the previous quarter. Most banks also chose to proactively provision early, so the peak of bad debt in 2024 is expected to fall in Q3. Although still under control, it is a big challenge when the Law on Credit Institutions 2024 has limited the right to seize assets secured for bad debts of credit institutions.

In terms of dividends, banks with strong financial potential this year have been able to pay dividends and have plans to pay dividends more regularly, for example, ACB, MBB, HDB, TPB, VIB, and VPB. This year, banks still need capital for growth, so they generally pay dividends in shares, and only VPB pays cash dividends. If we consider the dividend yield, there are currently 2 banks with the highest dividend yield, VIB at 5.9% and VPB at 5.4%, higher than the deposit interest rates of large banks.

Regular cash dividend payments can increase the valuation of banks as regular dividend payments are a signal of financial stability and profitability. This effect also affects the valuation when using the Residual Income (RI) valuation method.

A consistent dividend policy is a sign of a less risky bank and therefore requires a lower average cost of capital than other banks.

Although dividends reduce retained earnings, thereby reducing equity and book value, they also reduce the cost of equity, the required return on equity, increase residual income, and thus increase the valuation per share when discounted to the present value, even though dividend payments can affect the necessary capital for growth.

In the stock market, since the beginning of the year, LPB’s price has doubled due to strong credit growth and outstanding business results in the first half, along with a name change to reflect the divestment from LienVietPost. Along with this is TCB with a dividend story but has been reflected in the price. MBB, HDB, ACB, and CTG saw stable price increases, reflecting the top business results in the market in the first half of the year.

12/27 banks are currently outperforming the VN-Index, and most of these banks are private, with CTG being the only state-owned bank. Currently, the P/B of the banking industry is trading around the 10-year 1 STD of 1.55, equivalent to the decline when the Covid-19 pandemic started, reflecting the SCB – Van Thinh Phat event and the increase in bad debts recently, affecting the health of the entire system.

However, VPBankS believes that with a brighter economic context, the current P/B is trading at a quite attractive level.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.