The Hanoi apartment market has witnessed a shocking surge in prices over the past two months, with a noticeable upward trend. This surge comes after a period of stagnation, where apartment prices in Hanoi remained stagnant for over a month.

In the Thanh Xuan district, for instance, a three-bedroom, two-bathroom apartment at Five Star Kim Giang, spanning 100 square meters, has seen its price jump from 5.8 billion VND to 6.3 billion VND. Similarly, a two-bedroom, two-bathroom apartment with an area of 88 square meters in the same complex has increased in value from 4.8 billion VND to 5.2 billion VND. Most apartments in this area have experienced a rapid increase of 200 to 500 million VND within a short span of just one to two weeks.

Another example is the three-bedroom apartment in the Sudico My Dinh project, which has seen its price rise from 4.4-4.6 billion VND to 4.6-4.8 billion VND. Apartments in the Vinhomes Smart City mega-project have also recorded average increases of 150-250 million VND compared to two months ago.

Across Hanoi, apartments have generally witnessed another round of increases, ranging from 200 to 500 million VND, depending on location, area, and apartment furnishings.

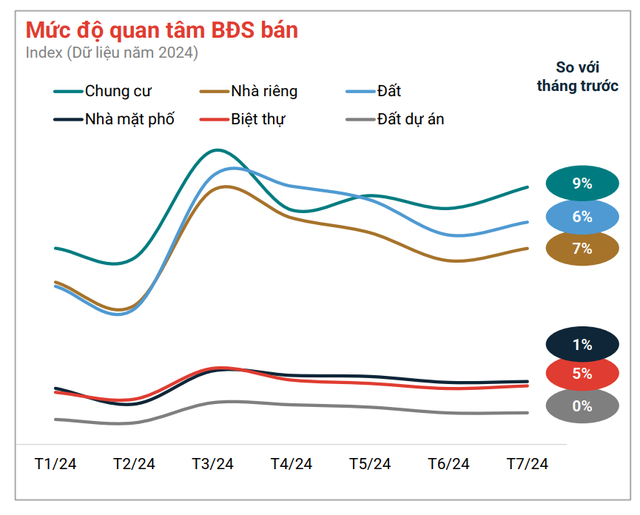

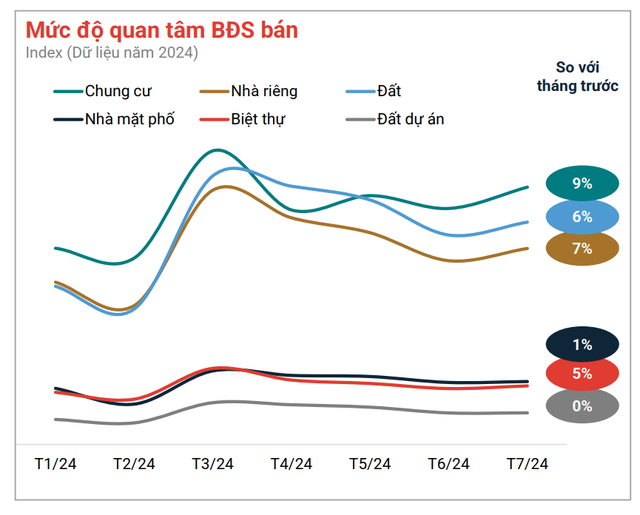

According to market data from Batdongsan.com.vn, the Hanoi real estate market experienced impressive growth in July 2024, with a 2.4% increase in overall interest and a 6% rise in the number of listings. These figures are notable because, in the previous month (June 2024), the market had witnessed a decline, with a 9% drop in overall interest and a 6% decrease in listings.

Within the broader context of Hanoi’s real estate market, apartments continue to lead the way. Specifically, interest in Hanoi apartments rose by 6%, and listings increased by the same percentage. Notably, this growth is not limited to apartments; other segments and property types have also seen increased interest and listings. Compared to the previous month, interest in Hanoi houses for sale rose by 4%, and listings increased by 8%. Similarly, interest in Hanoi land plots increased by 3%, with listings rising by 5%, while interest in villas rose by 2%, and listings by 4%. Hanoi shophouses followed a similar trend, with a 1% increase in interest and a 4% rise in listings.

In the rental market, interest surged across various property types, with apartments and room rentals witnessing the most significant growth in interest, at 15% and 10%, respectively. Interest also increased for other property types, with a 3% rise for rental houses and a 2% increase for shophouses. In terms of listings, apartments led the way with a 7% increase, followed by offices at 13%, rental houses at 5%, and villas at 15%. The most notable areas in terms of interest were Cau Giay, with an 11% increase, Hoai Duc with 20%, and Dong Da with a 13% rise.

Commenting on the apartment price movement, Ms. Nguyen Thi Hong Van, Deputy Director of Valuation and Financial Consulting at Savills Hanoi, shared: “In the short term, residential property prices, especially apartment prices, will continue to rise due to limited new supply in the market. New supply decreased by 34% quarter-on-quarter and 25% year-on-year to around 2,700 units in Q2/2024. 98% of this supply came from existing projects, with almost no new projects.

However, looking at future supply in Hanoi, there are about 100,000 apartments from 2025 onwards, which is ten times the current supply for sale. These products are mainly concentrated in the suburbs. When the supply of apartments in the suburbs improves, it will be challenging to maintain the current rapid price increase in this area.”

Discussing the most significant impact of the 2024 Land Law on the real estate market, Ms. Van attributed it to the government’s decision to abolish the framework on land prices, giving local authorities the power to determine land prices annually instead of every five years, as per the previous law. Additionally, the law stipulates that land can only be revoked after the delivery of resettlement housing. This regulation will facilitate the compensation and site clearance process, expediting project implementation.

However, Ms. Van also noted that as compensation prices move closer to market prices and stricter compensation support is provided, investment costs for projects will increase, leading to higher real estate prices.

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…