(Illustration)

BIDV Securities (BSC) recently released a report on the stock market, stating that in the context of low deposit interest rates, the earnings per share (EPS) growth rate of enterprises will be the main driving force for stock prices, with the VN-Index’s forward E/P for 2024 at 8.6% and 10.6% by the end of 2025, outpacing the current deposit interest rates of around 5.5-6%.

With the trailing PE at 13.4 times and trailing PB at 1.5 times, following the update of business results for the second quarter of 2024 and the strong correction in the first half of the third quarter of 2024, the VN-Index is trading at an attractive valuation compared to history, just about 5-6% higher than the historical lows of the second quarter of 2020 (Covid pandemic), the fourth quarter of 2022 (Van Thinh Phat event), and the third quarter of 2023 (market correction due to lower-than-expected business results).

Given the expectation of continued improvement in market profits in the second half of the year and the relatively discounted market, down 6.5% from its 2024 peak, BSC believes that these corrections present good opportunities for mid- to long-term accumulation, and investors can consider a “dollar-cost averaging” strategy at attractive price levels.

In terms of valuation, BSC noted that the gap between the non-financial sector (excluding banks, real estate, and securities) and the financial sector has narrowed after the sharp correction in July 2024, and the strong profit growth of this sector. The forward PE for 2024 of the non-financial sector in the BSC-Universal model is 15.3 times, approaching the -1 standard deviation level and lower than the 5-year average of 18 times.

Therefore, BSC believes that the downside risk will be limited, and corrections will present more opportunities than risks. However, it is important to be mindful of recession-related risks that could impact profit growth rates and valuation projections.

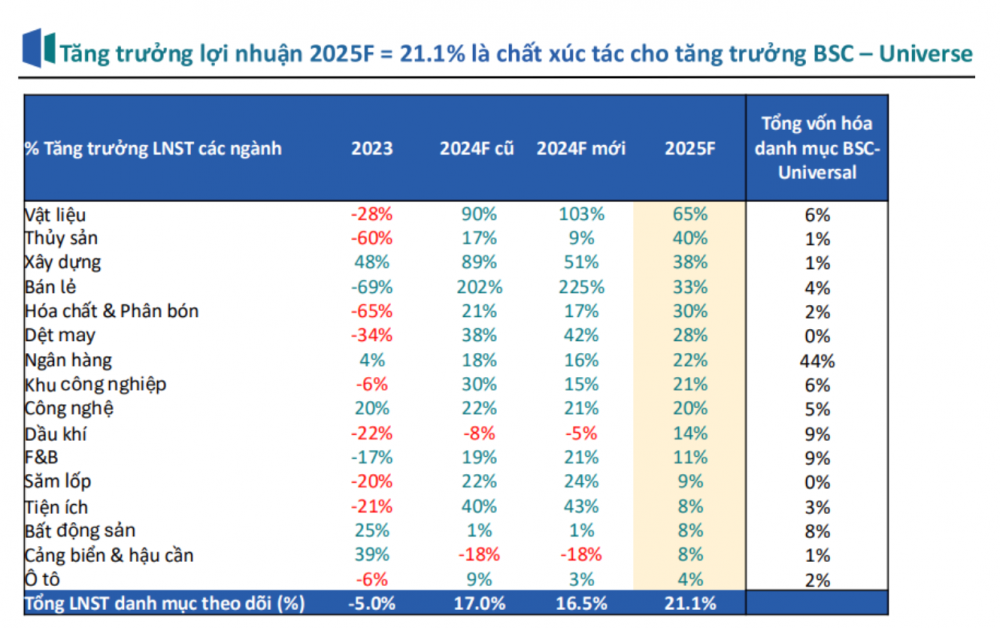

BSC’s experts noted a clear differentiation in sector valuations when comparing the forward PE for 2024 with the 4-year average sector PE, with some sectors still offering attractive discounts, such as banking, industrials, real estate, and port services. Some sectors have seen strong price appreciation and are trading higher than the industry average, including retail, technology, and oil and gas.

Most other sectors do not offer much valuation upside for 2024, so investors should look at profit growth expectations for 2025 to find opportunities. Additionally, in the recovery cycle, profit growth takes precedence, so a valuation approach based on P/E will be more effective than P/B, although P/B will serve as a valuation floor in case of a sharp market correction.

BSC maintains a positive outlook for 2025 for the information technology, industrial park, seafood, F&B retail, construction materials, textiles, utilities, banking, chemicals and fertilizers, oil and gas, and maritime transport sectors, based on an assessment of profit growth in 2025, with the criterion of net profit growth of >15%.

The stock portfolio of interest focuses on key factors: (1) Leading enterprises with strong competitive advantages that benefit from the recovery cycle, (2) Companies with their own growth stories, such as capacity expansion, improved profit margins, and benefits from new policies, (3) Enterprises with strong financial foundations, (4) Attractively valued enterprises in the medium to long term.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.