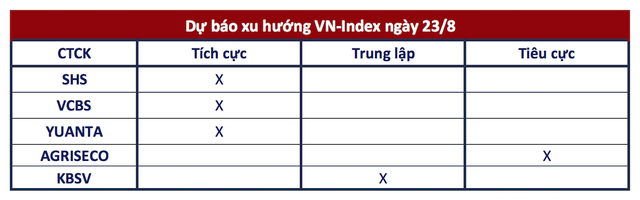

The VN-Index hovered around the reference point before closing on August 22 with a slight loss of 1.27 points, settling at 1,282.78. Total trading volume on the three exchanges reached nearly VND 17,400 billion, a 25% decrease compared to the previous session.

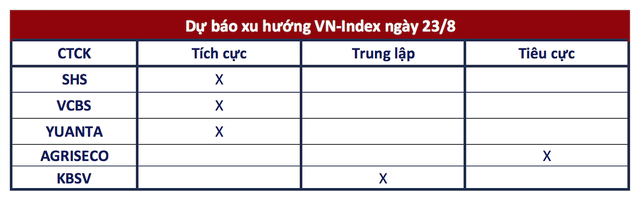

Most securities companies believe that this minor correction will soon end and the VN-Index will advance to conquer the next resistance levels.

Advancing to 1,300 Resistance

SHS Securities

In the short term, the VN-Index is maintaining its position in the 1,280-1,300 range, with the nearest support area around 1,280 and stronger support at 1,255-1,260. This is a very strong resistance zone that, after multiple attempts in March, June, and July 2024, faced significant corrective pressure. The positive aspect is that the market is taking turns recovering in different stock groups, leading to short-term buying positions with potential profitability.

SHS expects the VN-Index to continue towards the strong resistance zone around 1,300 and possibly expand to the 1,320 range, corresponding to the highest price range in June 2022.

Volatility is Necessary for Upward Movement

VCBS Securities

The market is performing well and showing a stable trend. It is normal for volatility and corrective accumulation to occur during an upward trajectory.

Investors are Optimistic

Yuanta Securities

The market is likely to resume its upward trajectory in the next session. Additionally, the market is still in a phase of strong positive fluctuations, so the corrective phase may end quickly, and money flow remains robust even as the market approaches short-term resistance levels.

Furthermore, after large-cap stocks led the growth in previous sessions, mid-cap and small-cap stocks are now attracting money flow. The rising psychological indicator reflects investors’ optimism about market developments, and short-term risks remain low.

Testing Selling Pressure around 1,270-1,290

Agriseco Securities

Agriseco Research believes that a corrective phase and a test of supply and demand at critical levels are necessary after the market’s rapid rise. In terms of index performance, the market may continue to test selling pressure around the 1,270-1,290 range.

Investors can reduce a portion of their trading positions on T+ during early recovery. Consider buying again when the market confirms a balanced zone, prioritizing oil and gas, real estate, securities, and retail sectors.

Short-Term Corrective Signals May Strengthen

KBSV Securities

Profit-taking is more evident in some leading stock groups from the previous phase, but selling pressure has not increased sharply, and demand is still present, indicating a somewhat positive psychological trend. Although short-term corrective signals may strengthen, with the current upward momentum, the VN-Index has a good chance of conquering the 1,300 resistance level.