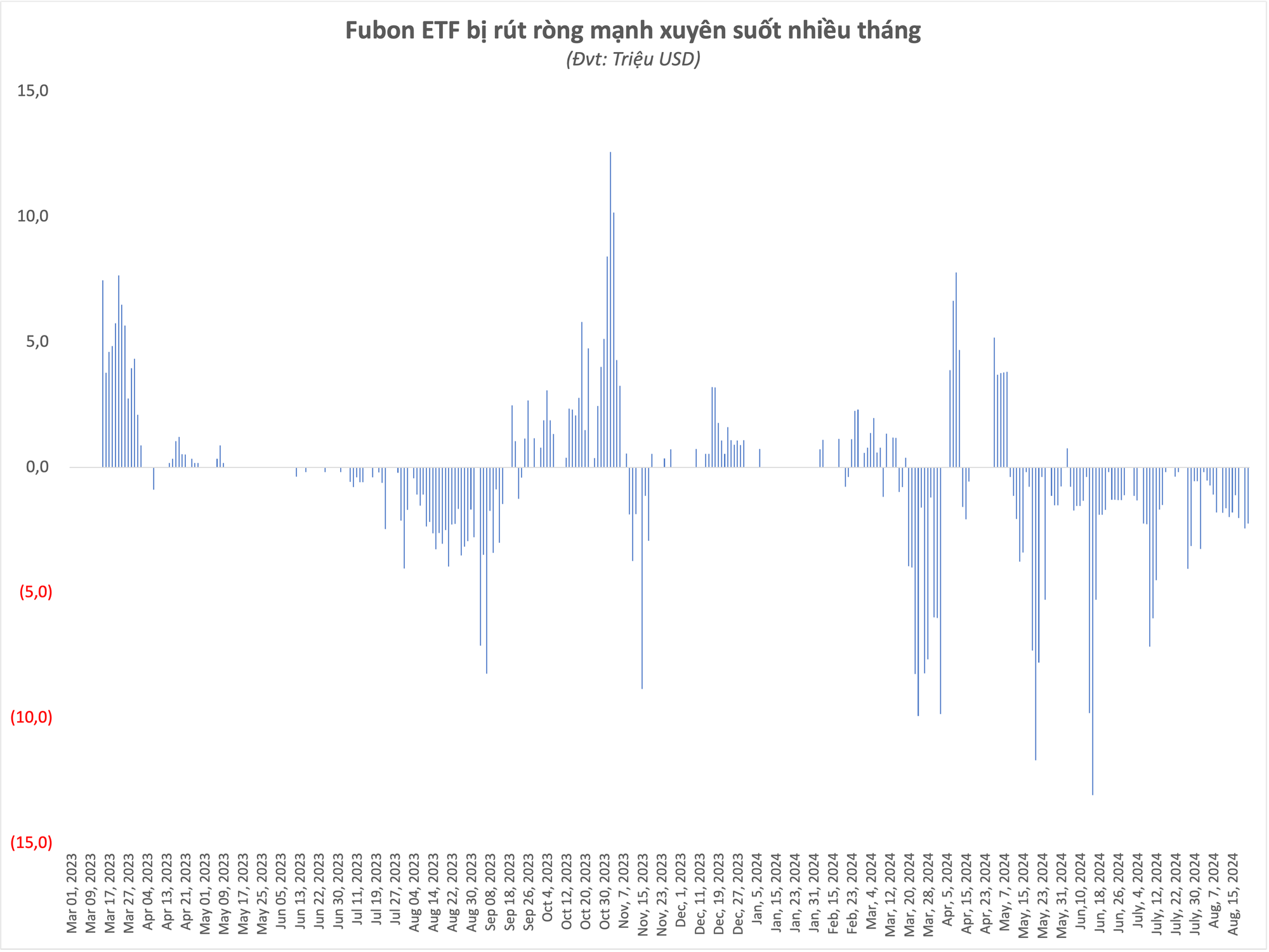

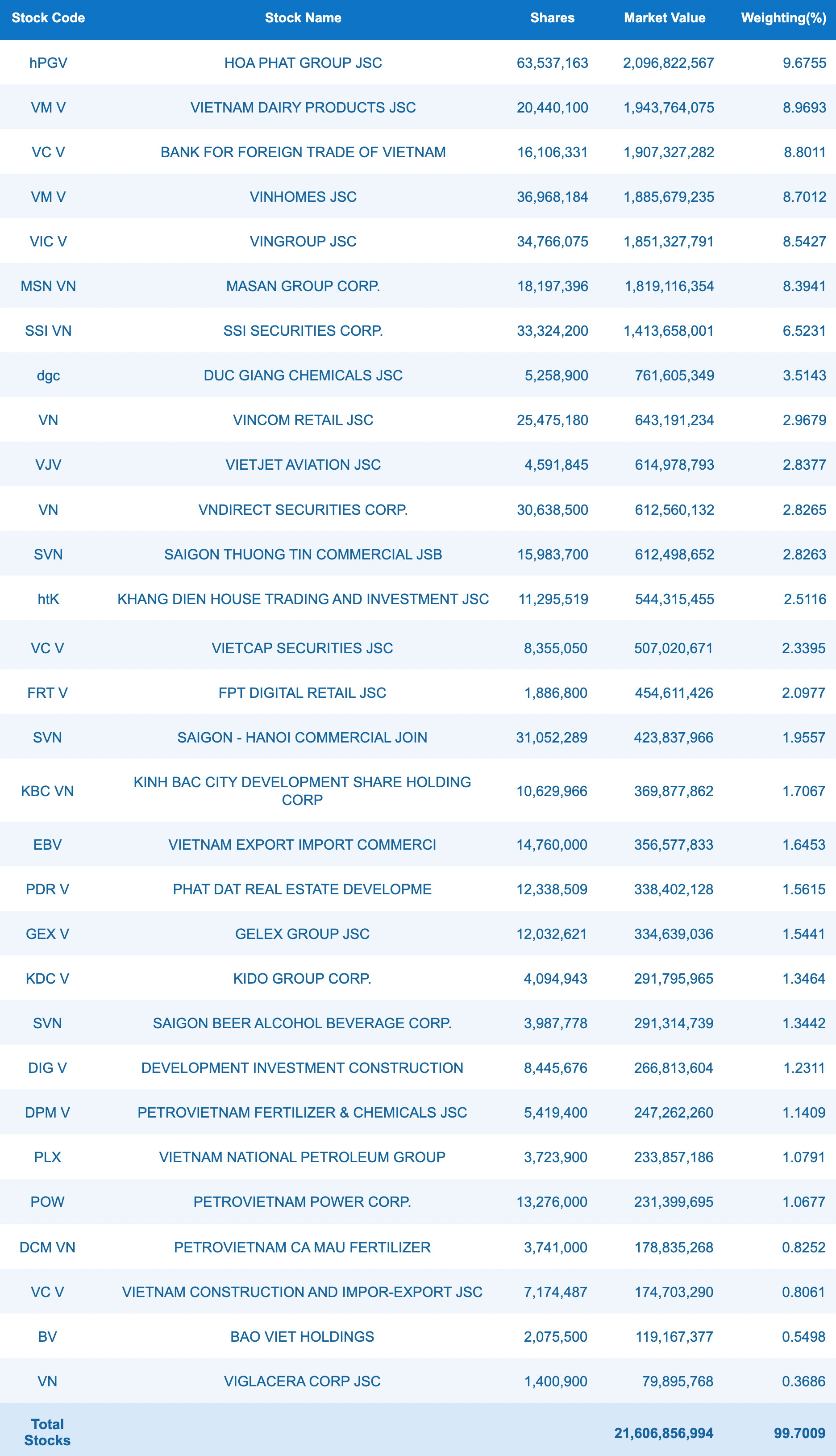

The Fubon FTSE Vietnam ETF has experienced continuous capital outflows for several months. Since June 4th, this Taiwanese fund has not had any net inflows, mainly experiencing outflows. A significant amount of $107 million, equivalent to 2.7 trillion VND of Vietnamese stocks, has been sold within less than three months.

The heavy outflows have significantly reduced the size of this ETF. As of August 22nd, the scale of the Fubon FTSE Vietnam ETF stood at 21.7 billion New Taiwan Dollars (approximately $676 million, equivalent to 16.9 trillion VND), a decrease of more than 3.3 trillion VND compared to the beginning of 2024. However, Fubon remains the largest ETF in the Vietnamese stock market.

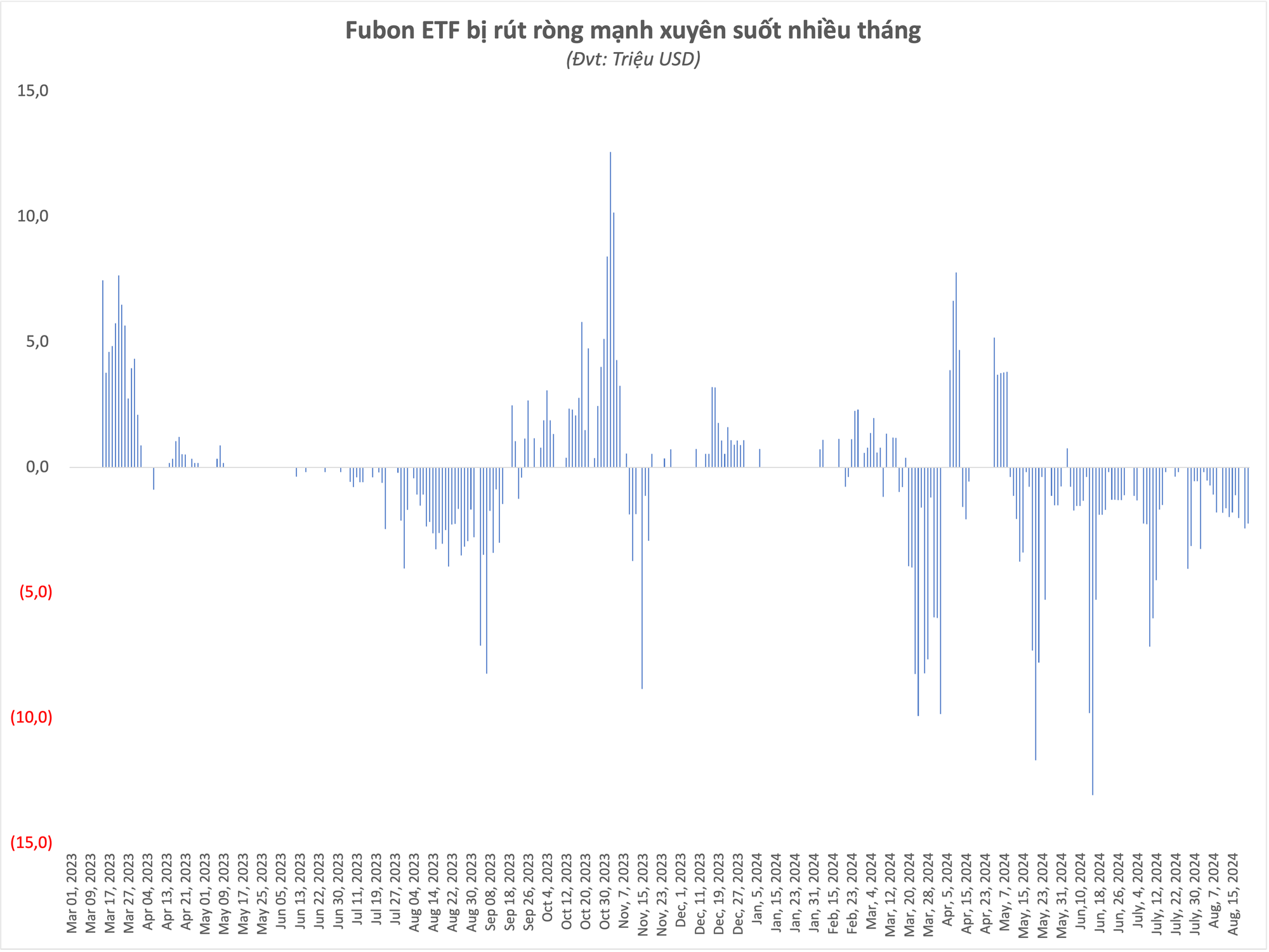

The fund uses the FTSE Vietnam 30 Index as its reference index, with HPG being the stock with the largest weight in the portfolio at 9.7% (63.5 million shares). This is followed by VNM (8.97%), VCB (8.8%), VHM (8.7%), and VIC (8.5%)…

Fubon ETF’s Portfolio as of August 22, 2024

Since the beginning of 2024, net outflows from this ETF have reached $167 million, equivalent to approximately 4.2 trillion VND. Notably, the outflows from Fubon ETF occurred despite the fund raising additional capital in the 6th issuance.

Previously, in June, the Financial Management and Supervision Commission approved the 6th capital raise of Fubon FTSE Vietnam ETF at 5 billion TWD (~$154 million). This means Fubon ETF could potentially inject up to 4 trillion VND to purchase Vietnamese stocks.

The outflows from Fubon ETF are in line with the overall sentiment of foreign investors in the Vietnamese stock market. Foreign investors have not shown signs of returning to net buying, and in the first eight months of the year, they recorded net selling of nearly 68.2 trillion VND on HoSE – setting a record for net selling in a year.

The foreign investors’ sell-off of stocks is likely due to concerns about the impact of economic difficulties on companies’ financial results, the market’s valuation having increased significantly, and the fact that Vietnamese stocks may not align with foreign investors’ preferences. The rising foreign exchange rate also partly affects investment flows, leading to outflows from emerging and frontier markets such as Vietnam.

According to experts, it is challenging to determine if foreign capital will return sustainably as the market will need new catalysts. However, it can be affirmed that the peak of the foreign capital outflow wave has likely passed.