Illustrative image

Positive Signals from the Fed

The minutes of the US Federal Reserve’s (Fed) July meeting, released early this morning, suggest that an interest rate cut in September is almost certain. Accordingly, most meeting participants stated that easing monetary policy would be appropriate if economic data continues to evolve as expected.

“A large portion” of meeting attendees “judged that if the data were consistent with expectations, a policy easing at the next meeting would be appropriate,” according to the minutes.

In the US financial markets, investors are confident that the Fed will cut interest rates in September. Data from the FedWatch Tool on the CME trading floor shows that traders in the futures market continue to bet on a 100% chance of the Fed lowering rates at the September meeting. If expectations are met, this will be the first time the Fed has cut rates since the emergency easing at the start of the COVID-19 pandemic.

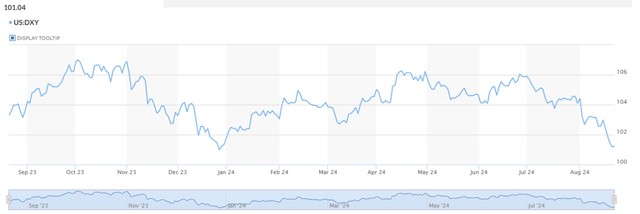

Previously, US monetary policymakers had consistently signaled that the Fed was likely to cut interest rates in September. This was the main reason for the sharp decline in the dollar in recent weeks. According to MarketWatch data, the USD Index (DXY), a measure of the dollar’s strength, has fallen nearly 3% since the beginning of August, to its lowest level in nearly eight months.

USD Index Performance (Source: MarketWatch)

With the dollar weakening in the international market and a more abundant foreign currency supply in the domestic market, as FDI registered and disbursed capital increased compared to the same period and the trade balance remained positive, the USD/VND exchange rate fell sharply in both the official and free markets.

In the interbank market, the USD exchange rate has fallen below 25,000 VND. Since the beginning of August, the interbank USD exchange rate has decreased by more than 1.3%.

Similarly, the listed USD prices at banks also cooled down, with a decrease of up to 300-350 VND compared to the end of July, equivalent to a 1.3% drop. Vietcombank, the bank with the largest foreign exchange transaction volume in the system, is currently listing USD buying and selling prices at 24,750-25,120 VND/USD, much lower than the peak of 25,250-25,480 VND/USD recorded at the end of May. Compared to the end of 2023, the USD/VND exchange rate at banks has only increased by about 2.8%.

The free market exchange rate also continued to fall rapidly and is currently trading at 25,350-25,430 VND/USD. This is the lowest level since March. Compared to the peak of nearly 26,000 VND set at the end of June, the free USD price is now lower by 600 VND, equivalent to a decrease of about 2.3%.

“The weakening of the USD globally, combined with an increase in foreign currency supply in the market, has supported the exchange rate adjustment below the 25,000 VND threshold,” said ACB in a recent market analysis report.

ACB’s analysts also forecast that the exchange rate’s downward trend could continue, with a target range of around 24,800 VND before the Fed meeting on September 18.

SBV Loosens Monetary Policy

The Fed’s expected interest rate cut in September and the cooling exchange rate are believed to create favorable conditions for the State Bank of Vietnam (SBV) to implement a looser monetary policy in the coming time to support liquidity for the banking system and the economy.

Previously, in the context of the continuous rise in the exchange rate due to the Fed’s delay in reducing interest rates and the increasing domestic foreign currency demand, the SBV reopened the issuance of bills from mid-March to absorb excess liquidity in the interbank market. At the same time, the regulator gradually increased the bill interest rate to 4.5% at the end of June, along with raising the OMO interest rate to 4.5%.

This move aimed to reduce pressure on the exchange rate by establishing a higher VND interest rate in the interbank market, narrowing the interest rate gap between USD and VND.

In addition to measures affecting interest rate differentials, the SBV also intervened by selling foreign currencies to increase the USD supply in the market since the end of April. According to informed sources, the amount of foreign currency the SBV sold to commercial banks by the end of June reached $6 billion, equivalent to the amount of foreign currency purchased in 2023.

The simultaneous implementation of these tools demonstrates the regulator’s efforts to curb the rise in the exchange rate when market factors were not supportive.

Reporting to the National Assembly in late May about the hot exchange rate situation, Governor Nguyen Thi Hong stated that the exchange rate increase was a common trend among many currencies globally and in the region, with many regional currencies depreciating significantly. In the SBV’s view, in such a volatile global economic environment, Governor Nguyen Thi Hong considered it normal for the exchange rate to fluctuate, sometimes rising and sometimes falling.

At that time, Governor Nguyen Thi Hong predicted, “foreign currency demand from domestic businesses will decrease in the coming months. At the same time, the Fed may cut interest rates by the end of the year. As a result, the exchange rate is expected to cool down by the end of this year.”

In reality, the USD exchange rate has only increased by about 2.8% compared to the end of 2023, a significant cooldown from the nearly 4.4% rise recorded in late May, indicating that the market situation has likely followed the SBV’s expected scenario.

With the pressure from the exchange rate easing, on August 5, the SBV simultaneously reduced the OMO and bill interest rates by 0.25 percentage points to 4.25%. And as of August 20, the bill interest rate has fallen to 4.2% per annum.

Analysts believe that the SBV’s reduction in OMO and bill interest rates aims to support the banking system’s liquidity and guide interbank interest rates to a lower level in the future. Previously, interbank interest rates had consistently remained at 4-5% per annum since the beginning of the second quarter, which somewhat pressured the capital costs of banks, especially small and medium-sized ones.

Therefore, the regulator’s adjustment is considered necessary as credit growth shows signs of acceleration, and deposit interest rates have been on the rise since the second quarter. According to the SBV’s data, credit growth at the end of June 2024 reached 6%, much higher than the 3.4% recorded at the end of May. Meanwhile, deposit interest rates have increased broadly in the second quarter and the beginning of the third quarter, with dozens of banks adjusting rates every month.

“With the high possibility of a cooldown in the exchange rate and inflation by the end of the year, the State Bank of Vietnam will have more room to loosen monetary policy and maintain interest rates at a reasonable level to support domestic businesses in their recovery,” Shinhan Securities (SSV) stated in a recent macroeconomic report.

USD prices in banks and the free market rise after the Tet holiday

On the first day of trading after the Lunar New Year holiday, the USD price increased both in banks and on the free market.