Fertilizer, being a crucial input for agricultural production, has consistently contributed significantly to Vietnam’s export earnings. As per the General Department of Customs, in the first seven months of 2024, Vietnam exported over 1.03 million tons of fertilizers, raking in nearly $420.32 million. This signifies a 9.7% increase in volume and a 7.5% surge in value compared to the same period in 2023. However, the average price witnessed a slight dip of 2%, standing at $406.6 per ton.

Specifically, in July 2024, the export volume reached 132,215 tons, generating $58.81 million. This reflected a decrease of 23.6% in volume and an 8.5% drop in value compared to the previous month. Nonetheless, compared to July 2023, there was a marginal decline of 6.2% in volume, but a promising increase of 7.6% in value.

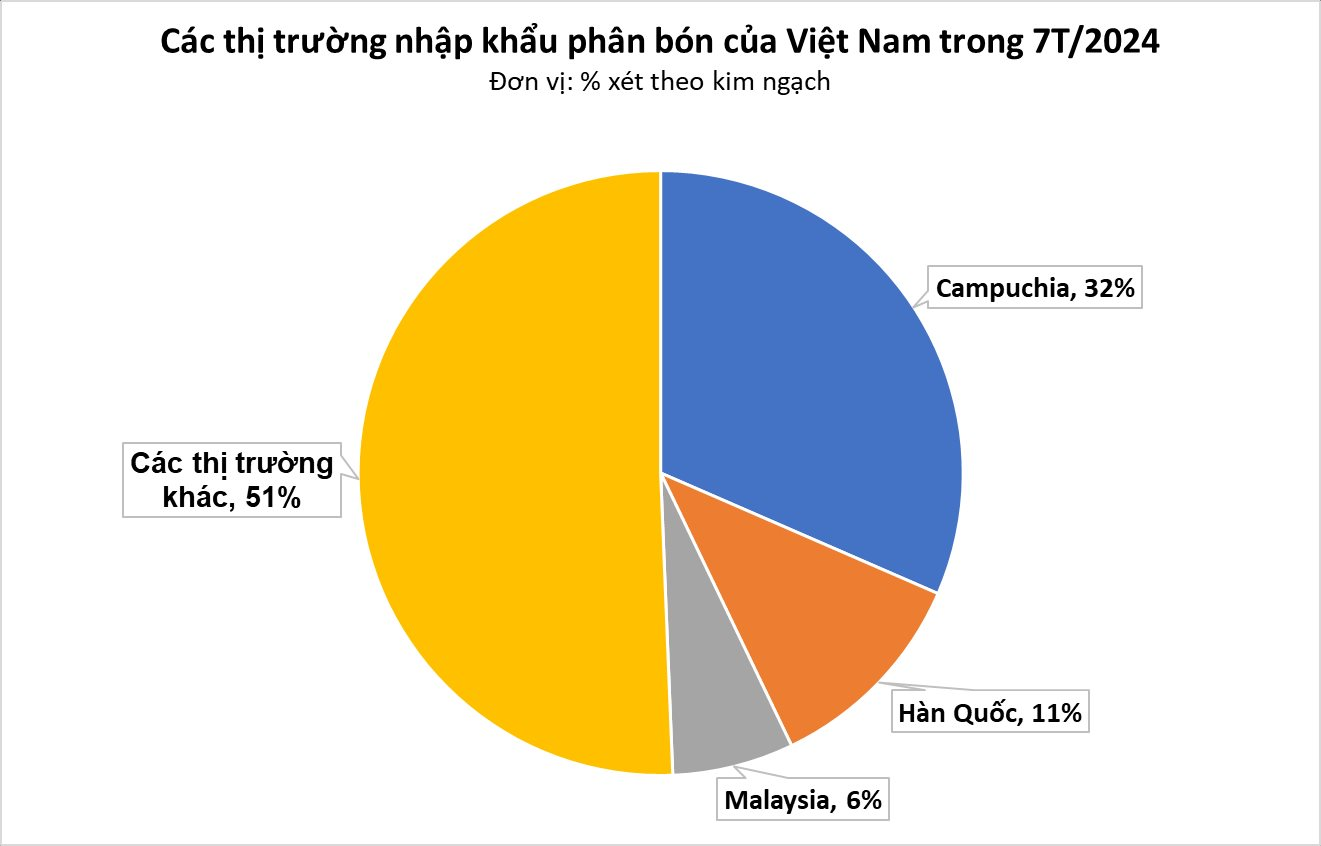

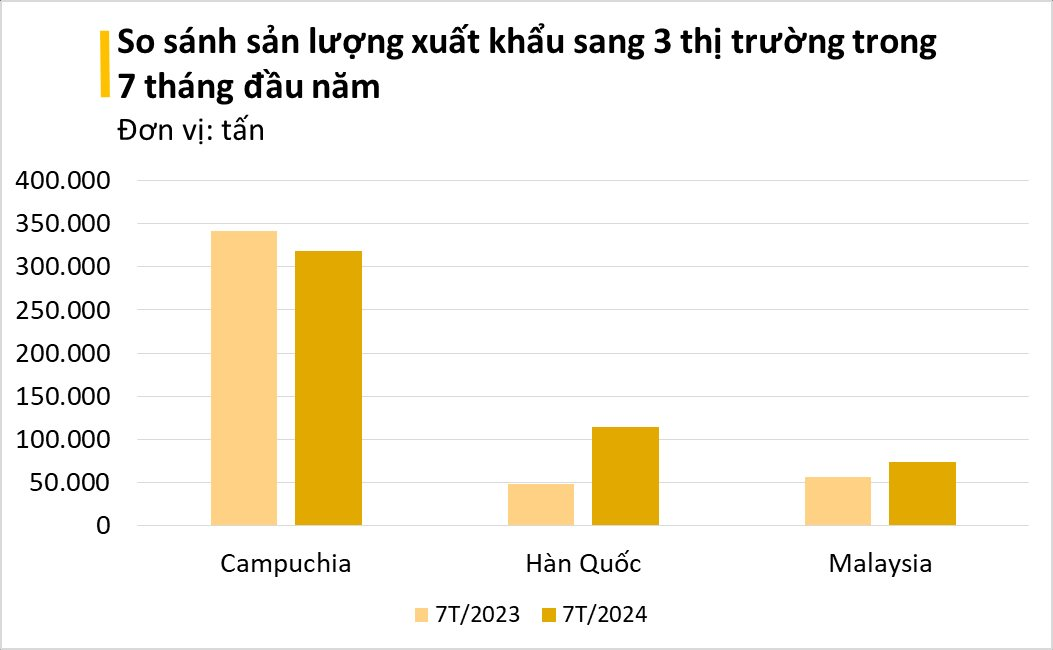

Cambodia stood out as the largest importer of Vietnamese fertilizers during the 7-month period, accounting for nearly 31% of the total volume and value. The export volume to Cambodia reached 318,716 tons, equivalent to $132.51 million, indicating a slight contraction of 6.6% in volume and 7.1% in value year-on-year.

In July 2024, exports to Cambodia witnessed a positive trajectory, amounting to 68,698 tons, with a total value of $30.28 million. The average price climbed by 4.8% to $440.7 per ton, marking a substantial increase of 12.2% in volume and 17.6% in value compared to the previous month.

South Korea followed closely as the second-largest importer, with a volume of 114,697 tons and a value of over $47.68 million. The average price was $415.7 per ton, translating to a significant surge of 136.6% in volume and 165.9% in value, with a 12.4% increase in price. South Korea accounted for over 11% of Vietnam’s total fertilizer export volume and value.

Malaysia, another key importer, imported 73,740 tons of fertilizers from Vietnam, valued at $27.27 million. The average price was $369.8 per ton, reflecting a robust growth of 29.8% in volume, 47.8% in value, and 13.9% in price. Malaysia represented 7.1% of the total export volume and 6.5% of the total value.

Looking ahead, experts predict a tightening fertilizer supply in 2024, which could lead to a slight uptick in prices compared to previous years. Additionally, a stronger demand for urea fertilizer is anticipated from the European and American markets starting in September. Several Asian markets, including Sri Lanka and Pakistan, have already conducted fertilizer tenders, and India is expected to follow suit within the next one to two weeks. However, trading activities in the American market remain subdued.

Notably, major fertilizer consumers worldwide, including China, India, the US, Brazil, and Europe, are actively re-tendering to secure their fertilizer supplies. China and Russia have also extended their fertilizer export restrictions, creating an opportunity for Vietnamese businesses to ramp up exports during this low domestic demand period.

In recent developments, a draft Law on Value-Added Tax proposes a 5% tax on fertilizers, which is expected to be submitted to the National Assembly for approval at the upcoming eighth session in October. Fertilizers, being an essential input for agriculture and a critical commodity for socio-economic development and the livelihood of farmers, have sparked diverse opinions regarding this proposed taxation.

Vu Hong Thanh, Chairman of the Economic Committee, expressed concern that this indirect tax would ultimately burden farmers as they would bear the cost through higher fertilizer prices. Currently, the average production cost for businesses is around 6-8%, which is already higher than the proposed tax rate. This means that fertilizer producers will be subject to VAT but will not be eligible for a refund. Furthermore, imported fertilizers are exempt from this tax, creating an unfair competitive landscape for domestic producers.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)