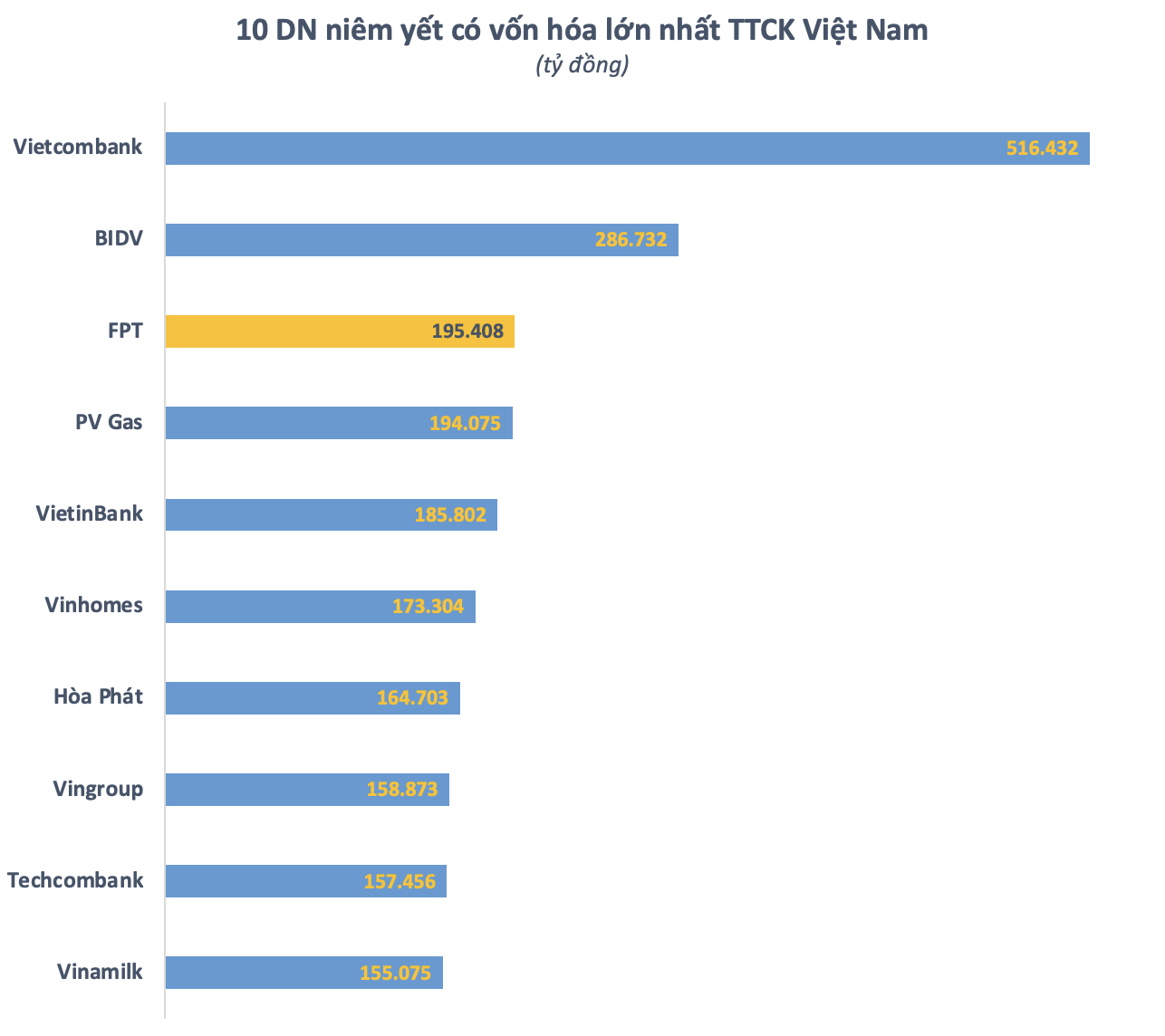

Vietnam’s stock market ended its four-day winning streak, but FPT shares still edged up to 133,800 VND per share. Since the beginning of the year, FPT’s market price has surged by over 61%, just 4% shy of its all-time high reached in early July. Its market capitalization now stands at VND 195.4 trillion (~ USD 7.8 billion), propelling it back into the top 3 listed companies by market value on the stock exchange, following Vietcombank and BIDV.

If we consider the entire market, including unlisted companies trading on UPCoM, only Viettel Global and ACV surpass FPT in terms of market capitalization.

Data as of August 22, 2024

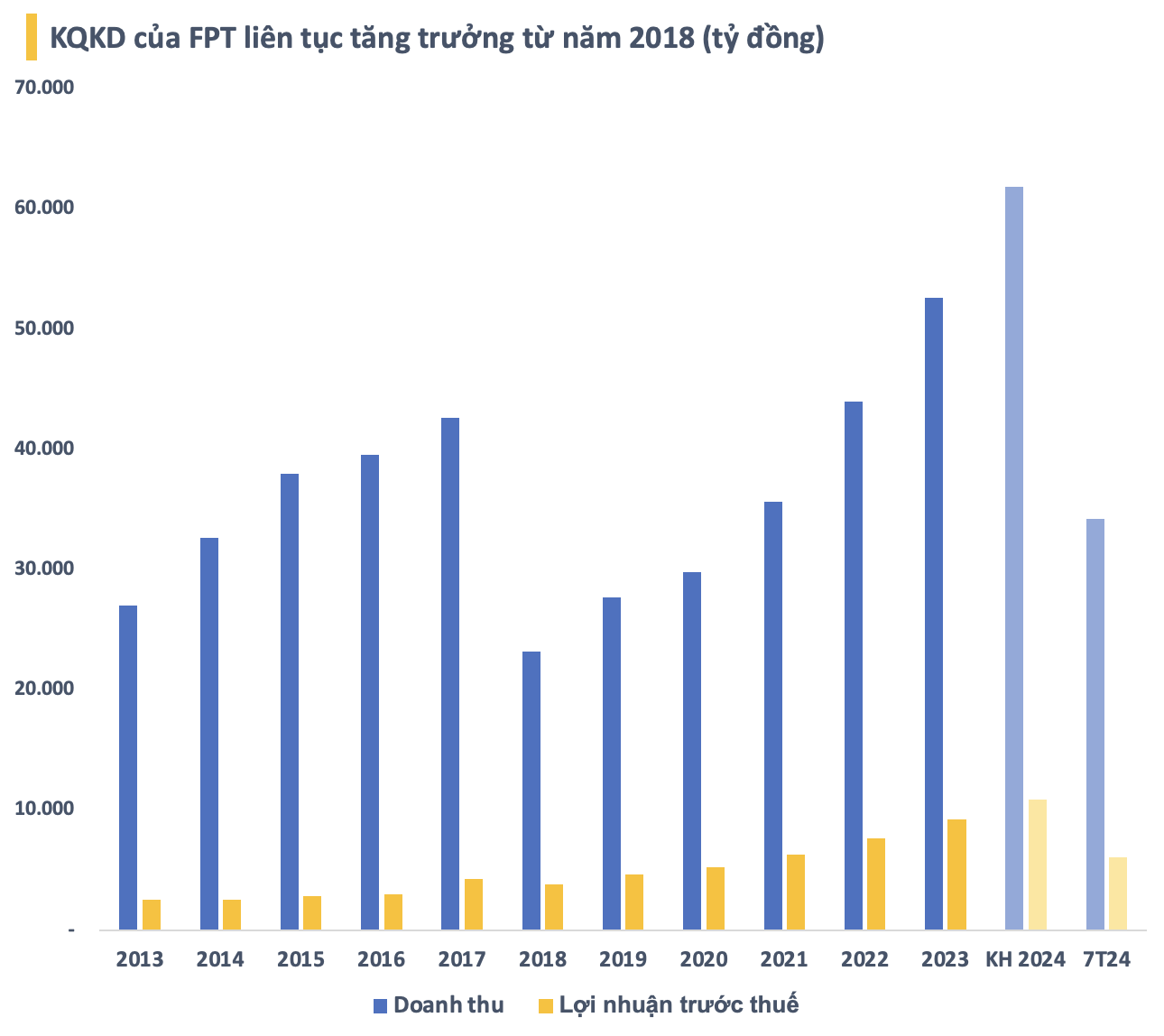

FPT shares have shown a swift recovery from the recent dip, fueled by consistently strong financial results on a monthly, quarterly, and annual basis. In July 2024, the company’s estimated pre-tax profit reached VND 875 billion, a 20% increase compared to the same period last year. Net profit also surged by 25% year-over-year to VND 613 billion.

For the first seven months of 2024, FPT recorded revenue of VND 34,243 billion and pre-tax profit of VND 6,075 billion, representing increases of 20.5% and nearly 20%, respectively, compared to the previous year. Net profit attributable to parent company shareholders also rose by nearly 23% to VND 4,285 billion, corresponding to an EPS of VND 2,934 per share.

FPT has set ambitious business targets for 2024, aiming for a record revenue of VND 61,850 billion (~ USD 2.5 billion) and a pre-tax profit of VND 10,875 billion, reflecting an approximate 18% growth compared to the 2023 results. With the achievements in the first seven months, the corporation has already fulfilled 55% of the revenue plan and 56% of the profit target.

The overseas IT Services segment continued its impressive growth trajectory, generating revenue of VND 17,202 billion, a 29.9% increase compared to the same period in 2023. During the first seven months of 2024, FPT secured 28 large-scale projects with a value of over USD 5 million each, underscoring the rising global demand for technology investments and FPT’s capabilities in technology provisioning.

FPT aims for its GPU cloud services from AI Factory, a key component in its AI partnership with NVIDIA, to generate revenue of up to USD 100 million by 2027. However, a recent report by SSI Research suggests that it will take time for this strategic partnership to significantly impact FPT’s overall operational performance.

In addition to the optimistic business outlook, FPT’s consistent dividend policy has also contributed to the steady rise in its share price. Recently, FPT approved an interim cash dividend of 10% for 2024, expected to be paid out in the fourth quarter. Earlier in June, the company distributed a final cash dividend of 10% for 2023, totaling VND 1,460 billion.

Meanwhile, PV Gas, which FPT surpassed in market capitalization rankings, will finalize its shareholder list on September 16 to distribute 2023 dividends at a rate of 60% in cash. With nearly 2.3 billion shares currently in circulation, PV Gas is expected to disburse approximately VND 13,780 billion for this dividend payout. This record-high amount underscores the strong cash flow and financial health of Vietnam’s stock market.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.