The VN-Index closed the past week’s trading session at 1,285.32 points, a rise of 33.09 points or 2.64% from the previous week’s close. This improvement was accompanied by enhanced liquidity, with the average trading value across all three exchanges reaching VND 19,868 billion per session. Specifically, the matched orders trading value averaged VND 17,658 billion per session, marking an increase of 18.1% from the prior week and a 4.6% rise compared to the five-week average.

There was only one session with a decline during the past week, and buying momentum saw a significant enhancement compared to the week before.

Foreign investors offloaded a net VND 750.7 billion, and in terms of matched orders, they net sold VND 689.8 billion.

The main sectors that foreign investors net bought on a matched orders basis were Information Technology and Banking. The top stocks they net bought included FPT, CTG, VCB, STB, VNM, DPM, DGC, TCH, PDR, and BID.

On the selling side, their main focus was on Basic Materials. The top stocks they net sold via matched orders were HPG, VHM, HSG, TCB, VPB, PVD, MSN, OCB, and VGC.

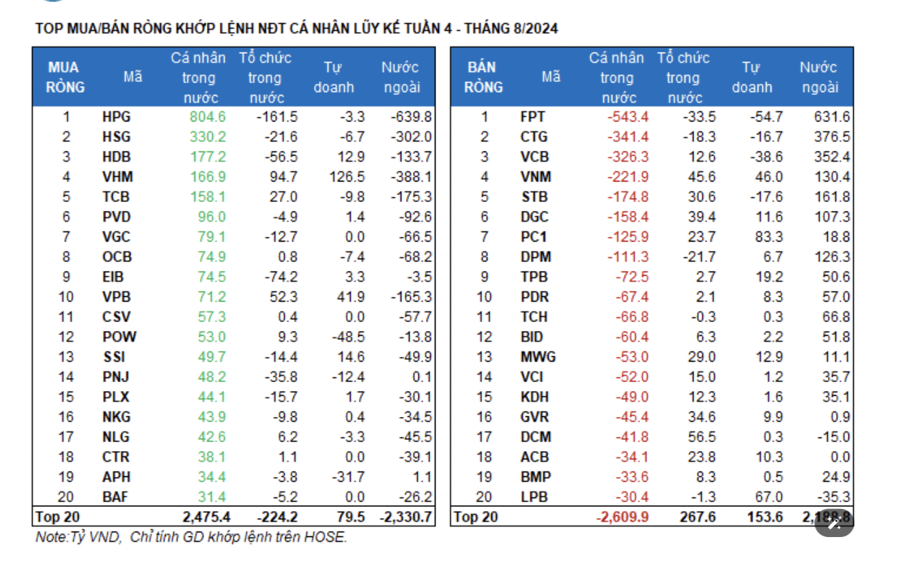

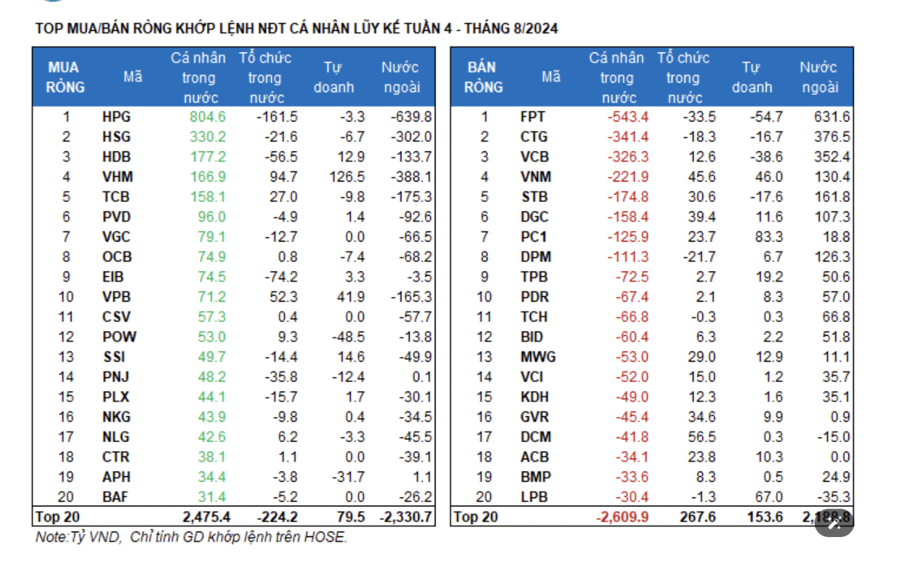

Individual investors net sold VND 1,164.5 billion, of which VND 110.3 billion was net bought through matched orders. Looking at matched orders only, they net bought 9 out of 18 sectors, mainly Basic Materials. Their top net purchases included HPG, HSG, HDB, VHM, TCB, PVD, VGC, OCB, EIB, and VPB.

On the selling side via matched orders, they net sold 9 out of 18 sectors, primarily Information Technology and Banking. The top net sales included FPT, CTG, VCB, VNM, STB, DGC, DPM, TPB, and PDR.

Domestic institutional investors net bought VND 1,518 billion, and their matched orders net purchases stood at VND 147.6 billion. When considering only matched orders, domestic institutions net sold 8 out of 18 sectors, with the largest value in Basic Materials. The top net sales included HPG, EIB, HDB, PNJ, FPT, REE, FRT, DPM, HSG, and NAB.

The sector with the highest net buying value was Real Estate. The top net purchases included VHM, DCM, VPB, VNM, DGC, DIG, FUESSVFL, GVR, STB, and MWG.

Proprietary trading arms of securities firms net bought VND 397.2 billion, and their matched orders net purchases reached VND 431.9 billion.

Focusing on matched orders only, they net bought 10 out of 18 sectors. The sectors with the strongest net buying were Real Estate, Food and Beverage. The top net purchases via matched orders by proprietary trading arms this week included VHM, PC1, LPB, MSN, VNM, VPB, DXG, SAB, TPB, and E1VFVN30.

The top net sales were in the Information Technology sector. The top stocks net sold included FPT, POW, VCB, APH, FRT, NHH, STB, HCM, CTG, and PNJ.

Looking at the weekly framework, the distribution of money flow increased in Real Estate, Banking, Steel, Personal Goods, and Oil Equipment Services while decreasing in Food & Beverage, Chemicals, Retail, and Information Technology. The money flow proportion remained stable in Securities and Construction.

Sectors with an improving or peak money flow proportion over the past 10 weeks include Real Estate, Steel, Securities, Personal Goods, and Oil & Gas Distribution. These sectors witnessed relatively positive price performance last week.

On the other hand, sectors with a declining money flow proportion from the peak include Food & Beverage, Oil & Gas Production, and Retail. These sectors experienced a gradual deterioration in money flow proportion, along with a less positive index price movement compared to the overall market last week.

Money Flow Strength: On a weekly basis, the money flow proportion continued to decrease in the large-cap VN30 group while increasing in the mid-cap VNMID and small-cap VNSML groups.

During the past week, the money flow proportion maintained a similar trend to the previous week, declining in the large-cap VN30 group and slightly increasing in the mid-cap VNMID and small-cap VNSML groups. Specifically, the money flow proportion in VN30 decreased to 48.2% from 49.9% in week 33 and 53.5% in week 32. Meanwhile, the VNMID and VNSML groups slightly increased to 39.2% and 10.3%, respectively.

In terms of money flow size, the average trading value increased in all three groups, with the most significant rise in VNMID, surging by VND 1,322 billion or 23.4%. This was followed by VN30, which rose by VND 1,116 billion or 15%, and VNSML, which climbed by VND 349 billion or 23.5%.

Regarding price movements, the VNMID index gained +2.86% in week 34, while VN30 and VNSML posted lower increases of +2.28% and +1.25%, respectively.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.