Property Prices Expected to Continue Rising

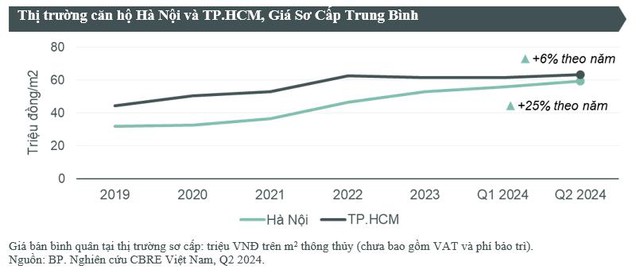

A strong upward trajectory in property prices is the overarching narrative from real estate research firms analyzing Hanoi’s property market in the first half of the year. CBRE Vietnam’s recent report highlights some notable data points. Specifically, for the condominium segment, primary property prices in Q2 2024 rose by 6.5% quarter-on-quarter and a substantial 25% year-on-year. Meanwhile, secondary condominium prices increased by 5% quarter-on-quarter and 22% year-on-year.

Despite this price escalation, absorption rates have also surged. According to CBRE, in Q2 2024 alone, the number of units sold in the Hanoi market reached 10,170, a fivefold increase from Q1 2024. The total number of units sold in the first half of 2024 surpassed the total for the entire year of 2023.

Illustrative image

Data from OneHousing paints a similar picture. Both primary and secondary condominium prices have witnessed significant increases. The Hanoi market recorded more than 52,000 transactions, with condominiums accounting for 54% of these.

Market research firms attribute this trend to low mortgage interest rates and attractive policies, which have incentivized buyers to take the plunge. Additionally, the desire for homeownership, or even purchasing property as an investment, shows no signs of abating, further fueling the rise in successful transactions.

The decision to commit to a purchase also stems from the fear of missing out, as buyers anticipate further price increases in the future. According to PropertyGuru Vietnam’s analysis, escalating land prices have, in turn, driven up condominium prices. If land prices increase by 20-30% annually, condominium prices are projected to rise by approximately 9-10%.

Given the current landscape, industry experts advise young people to consider purchasing property now, as prices are expected to continue climbing amid shrinking supply. Taking advantage of favorable mortgage interest rates can alleviate financial pressure and enable young buyers to secure their dream homes sooner.

The Financial Equation of Buying a Home

For many young couples, the question, “How much income is needed to buy a house?” is front and center. In reality, the financial calculus of buying a home depends on various factors, including the desired location, the price of the prospective home, existing financial resources, the amount to be borrowed, and the cost of living.

Let’s consider an illustrative example of a young couple planning to purchase a 2 billion VND condominium located 10-12km from the center of Hanoi. They have 1 billion VND in savings, which could be a combination of their personal savings and financial support from family. Consequently, they need to borrow 1 billion VND from a bank.

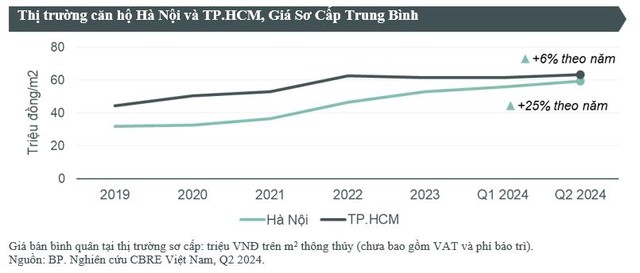

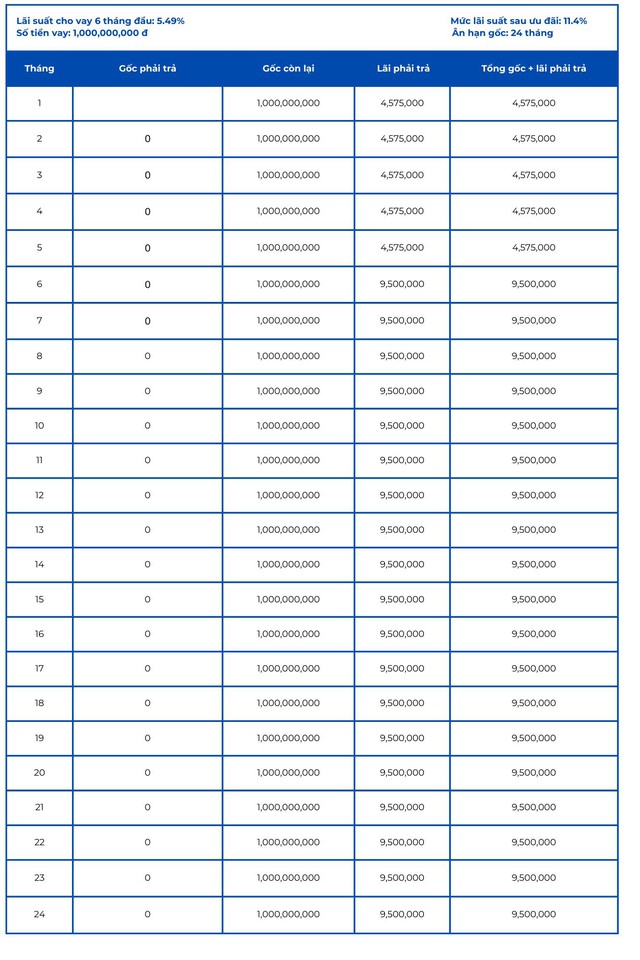

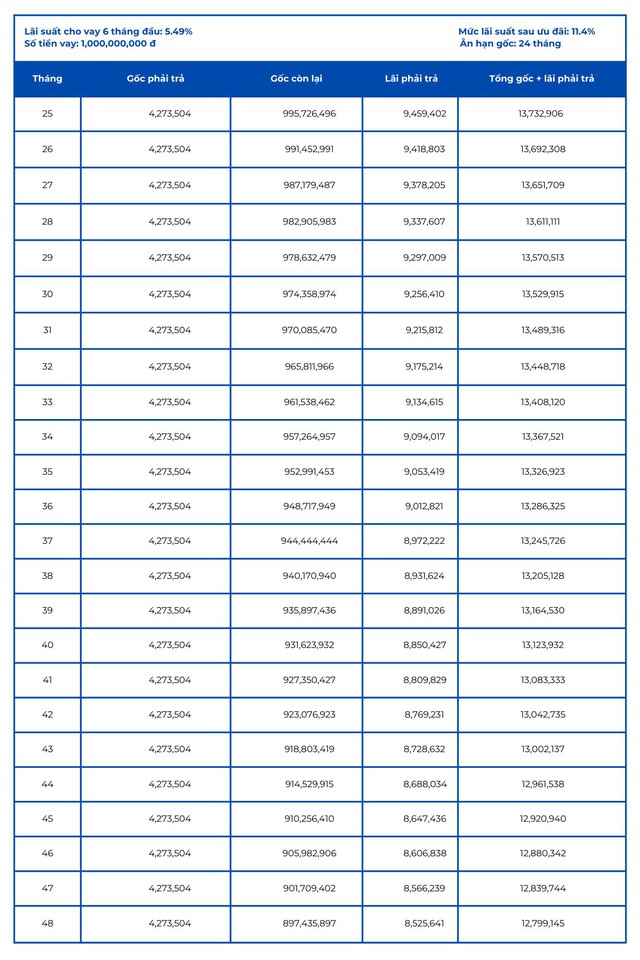

Assuming they opt for BVBank’s promotional home loan package, they can benefit from a maximum loan term of 20 years. The promotional interest rate for the first six months is set at 5.49% per annum, after which it is expected to adjust to 11.4% per annum. Recognizing the financial burden of young homebuyers, BVBank offers a 24-month grace period for principal repayment, ensuring that during the first two years, the couple only needs to pay interest on the loan, amounting to a minimum of 4.5 million VND per month. From the second year onward, their monthly repayment obligation would be approximately 13 million VND, gradually decreasing over time. Considering a monthly household expense of 15 million VND, a combined income of 30 million VND would suffice to cover their expenses and loan obligations without significant strain on their lifestyle.

Estimated principal and interest payments for the first year

Estimated principal and interest payments for the second year

The Ever-changing and Adaptive, Affordable Housing Drought to be “Alleviated” by 2024?

Developing affordable housing will create an opportunity to address the supply-demand imbalance, thereby reducing the overall housing prices in the market. If the market collectively contributes and implements market-driven housing policies, then affordable housing will thrive alongside social housing.

What is the cost of apartments in different provinces?

As we enter 2024, the prices of apartments in Hanoi and neighboring provinces range from 20 to 60 million Vietnamese Dong per square meter. However, in the Central region, the prices are nearly double, with limited liquidity overall.