The current Value-Added Tax (VAT) Law, in effect since 2014, exempts households and individuals with an annual revenue of 100 million VND or less from the business license fee and VAT and personal income tax (PIT) payments. However, many households report that they hardly receive any tax exemptions as their revenue often exceeds this threshold.

“Outdated”

Ma Thi My Huong, owner of the Banh Mi Pate – Pleiku Flavor bakery on Pham Viet Chanh Street, Binh Thanh District, Ho Chi Minh City, believes that a monthly revenue of 100 million VND, regardless of profit or loss, is too low a threshold for taxation. Her bakery currently pays an estimated tax of 900,000 VND per month on direct sales revenue and is expecting additional tax of 4% on sales made through delivery apps like GrabFood and ShopeeFood.

Ms. Huong shared that her bakery’s monthly revenue exceeds 100 million VND, and after deducting expenses, the profit is slightly over 15 million VND. However, this does not include the owner’s salary. “At the moment, I’m making just enough to get by, but my tax payments are higher than the income of hired employees, who also enjoy dependent deductions,” she compared.

A dried food stall at Ben Thanh Market, Ho Chi Minh City. Photo: Tan Thanh

Therefore, Ms. Huong suggested that the revenue threshold for taxation for households should be higher than the PIT threshold for employees. For example, a household business with an annual revenue of 132 million VND (equivalent to 11 million VND per month) should be tax-exempt, and only the excess amount should be taxed.

To Thi Nhu Ngoc, owner of Nhu Ngoc Facility, a specialist in purchasing and distributing Ninh Thuan apples, shared that since her business is not a company, it cannot deduct input costs and must pay a lump-sum tax of 1.5% of monthly revenue. Whether the business makes a profit or a loss, this tax must be paid.

“Doing business nowadays is challenging; we have to be very careful with our expenses to balance our finances. Apple prices have increased, and so have transportation, packaging, and labor costs, but we cannot raise our selling price. Sometimes, expenses are so high that we make no profit. I hope the government will reconsider its tax policies soon to support businesses like mine in accumulating profits for reinvestment and growth,” Ms. Ngoc confided.

According to foodservice industry expert Do Duy Thanh, Director of FnB Director – Horeca Business School, most foodservice households opt for lump-sum taxation due to its simplicity, and they rarely issue electronic invoices to customers. Of the 4.5% tax that these households pay, 3% is VAT, and 1.5% is PIT. Currently, the media has only mentioned the increase in the VAT revenue threshold and not the PIT revenue threshold.

“At present, employees are exempt from PIT on an annual income of 132 million VND, while most household businesses barely break even, yet they are taxed on an annual revenue of 100 million VND. This threshold has been in place for almost ten years and needs to be adjusted for inflation,” Mr. Thanh remarked.

Mr. Dau Anh Tuan, Vice Secretary-General of the Vietnam Chamber of Commerce and Industry (VCCI), also pointed out the inconsistency in the current VAT revenue threshold. He illustrated that employees are currently entitled to a dependent deduction of 132 million VND per year for those without dependents, 184.8 million VND for those with one dependent, and 237.6 million VND for those with two dependents.

Assuming that the average employee has one dependent, their taxable income threshold is higher than that of individual businesses. To generate revenue, individual businesses must incur input costs, whereas employees do not have such expenses. Therefore, VCCI proposed raising the VAT revenue threshold for individuals and households.

Could be raised to 200-300 million VND per year

In light of the shortcomings of the current tax law, the Ministry of Finance has proposed two options regarding VAT exemption for individuals and households in the draft Law on VAT (amended).

Option 1: Individuals and households trading in goods and services with an annual revenue of 200 million VND or less will be VAT-exempt. If the consumer price index (CPI) increases by more than 20%, the Government will propose to the National Assembly’s Standing Committee to adjust the revenue threshold accordingly, considering economic development and social factors. Option 2: The revenue threshold for VAT exemption will be determined by the Government.

At a recent specialized session of the National Assembly’s Standing Committee, Le Quang Manh, Chairman of the Finance and Budget Committee, stated that with the current economic growth rate, the average revenue of households has increased to 285 million VND per year. Therefore, the Committee proposed that individuals and households with an annual revenue below 200 or 300 million VND should be VAT-exempt and requested the National Assembly’s Standing Committee to adjust the threshold accordingly.

According to Mr. Le Quang Manh, both options – 200 million and 300 million VND – have been thoroughly evaluated for their impact. If the threshold is raised to 200 million VND per year for individuals and households, the state budget revenue will decrease by approximately 2,630 billion VND per year. If the threshold is set at 300 million VND per year, the revenue reduction will be about 6,383 billion VND.

“However, if we adopt the 300 million VND threshold, we will gain three advantages. First, we will relieve the tax burden on the people, especially in the context of business difficulties. Second, we will have a relatively stable policy for a certain period. Third, with 97% of enterprises currently being small and medium-sized, this policy will benefit this group. Therefore, I believe that a threshold of 300 million VND per year is more appropriate,” Mr. Le Quang Manh asserted, emphasizing the benefits of the higher threshold.

Attorney Vo Dan Mach, Ho Chi Minh City Bar Association, agreed that, given Vietnam’s economic challenges, raising the VAT revenue threshold to 200 million VND per year is appropriate, considering inflation and socio-economic development. This adjustment also aims to bring transparency to the management and taxation of approximately 5.5 million households nationwide, avoiding situations where tax officials impose lump-sum taxes based on their relationships with business households.

“Household businesses typically operate on a small scale, providing goods and services directly to end consumers, and they pay lump-sum taxes without dependent deductions or input cost deductions. The current law allows household businesses to transition to an enterprise model if they have substantial revenue to enjoy the benefits of an enterprise,” Mr. Vo Dan Mach emphasized.

Mr. Nguyen Tien Dung, Deputy Director of Ho Chi Minh City Tax Department, opined that, given the rising commodity prices in recent years, doubling the VAT revenue threshold for households to 200 million VND per year is reasonable. This will reduce the number of households subject to taxation. Many households currently have revenues above 100 million VND but below 200 million VND, especially those engaged in small-scale trading and leasing accommodations…

However, Mr. Dong Minh Hong, Director of DVL Accounting Tax Service Company, argued that a VAT exemption threshold of below 200 million VND per year would be outdated by the time the law is enacted, as household revenues are already much higher. Therefore, he proposed that the government increase the VAT exemption threshold to below 300 million VND per year, with provisions for adjustments based on actual circumstances.

Attorney Nguyen Duc Nghia, Director of Viet Tin Nghia Law Company (tax expert), pointed out that household businesses typically have a profit margin of only about 10%. Therefore, he suggested that the VAT revenue threshold should be increased to 30 million VND per month (360 million VND per year). At this level, these households would strive to achieve a minimum profit of 3 million VND per month (36 million VND per year), and it would be reasonable to impose taxes on them.

200 million VND is still too low?

From a taxpayer’s perspective, Ms. Xuan Hang, owner of an online and offline clothing store in Ho Chi Minh City, believes that the proposed increase in the VAT revenue threshold to 200 million VND per year is still inadequate. She explained that the clothing industry often has revenues two to four times higher than this threshold, but profits are slim due to various expenses.

“My store’s revenue can reach up to 1 billion VND per year, but after deducting costs such as capital, personnel, rent, and platform fees, the profit may be only 150 million VND per year, mainly breaking even, not accounting for the risk of defective or unsold inventory. Therefore, I propose that the VAT revenue threshold should be above 600-700 million VND per year. If taxes are imposed on revenues above 200 million VND, businesses like mine will struggle to survive,” Ms. Hang worried.

Sales should be invoiced for tax calculation

Regarding the VAT revenue threshold for households, Mr. Nguyen Huu Nam, Deputy Director of VCCI Ho Chi Minh City Branch, suggested that the immediate solution is to increase the threshold as prices rise. “In the long run, the tax industry needs to ensure that all goods and services sold are invoiced, regardless of the business type. Based on this and legal provisions, the tax authority can decide whether or not to tax household businesses, ensuring fairness for taxpayers,” Mr. Nam commented.

Elevate your tax threshold for small business owners

Individuals and businesses with an annual revenue of 180 – 300 million VND or more are required to pay value-added tax.

“Tightening the Reins: Bắc Giang’s Stern Approach to Curbing Tax Arrears and Safeguarding Fiscal Revenue”

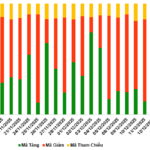

The province of Bac Giang has seen impressive results in its tax revenue collection for the first seven months of the year, amassing nearly VND 9.7 trillion, a substantial 22.3% increase compared to the same period last year. This remarkable achievement can be attributed to the Bac Giang Tax Department’s proactive efforts in conducting inspections and audits to combat tax evasion and avoidance, coupled with their stringent management of tax debts, including the implementation of temporary exit bans for delinquent businesses.