Starbucks Reserve Hàn Thuyên

Starbucks Reserve Hàn Thuyên, a popular coffee chain outlet, has recently announced its closure after seven years of operation due to a rent increase from 700 million VND to 750 million VND per month. This news has sparked various speculations and interests, including the landlord’s intentions and the cafe’s profitability.

Amidst discussions about the landlord’s motives and potential money laundering, a fascinating aspect that has captured public attention is how Starbucks can turn a profit while paying such high rent.

With a daily rent of 23 million VND, Starbucks would need to sell at least 230 cups of coffee, assuming an average price of 100,000 VND per cup, just to break even on the rent.

However, Starbucks’ success goes beyond coffee sales. Their primary sources of profit lie in brand management and a clever disguise as a coffee shop-turned-bank.

Brand Management

Similar to luxury fashion brands like Apple, Starbucks focuses on brand management by positioning itself as a premium choice for affluent customers. Investing in prime locations and promoting the brand as an exclusive destination for the wealthy is essential to this strategy.

This approach mirrors the appeal of brands like Apple, Louis Vuitton, and Chanel, where consumers are attracted not only by quality but also by the social status these names convey.

While brand management is crucial, it is just the first step. Starbucks must also ensure sales to turn a profit. This is where their strategy of masquerading as a bank comes into play.

Imagine a modest street-side coffee stall asking you to pre-pay 1 million VND for ten future cups of coffee at 100,000 VND each. Would you agree? Now, what if that coffee stall was a Starbucks? Would your decision change?

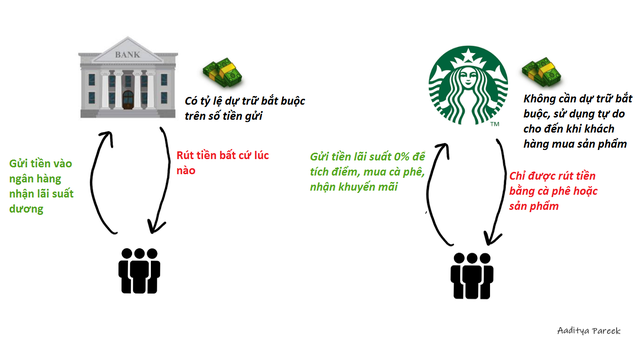

This is the power of brand positioning. Starbucks leverages its reputation to convince consumers to trust them with pre-payments, even in expensive locations. In the given example, if a customer loads 1 million VND onto their Starbucks membership card and only redeems one cup of coffee, Starbucks effectively has access to 900,000 VND in interest-free loans. They can freely invest this money or earn interest by depositing it in a bank, with the profits going straight to Starbucks.

Now, consider this on a larger scale, with millions of Starbucks membership cardholders worldwide, and the picture of how they turn a profit with a 700 million VND monthly rent takes on a whole new perspective.

Clearly, Starbucks has no intention of solely relying on coffee sales to cover their rent.

The 385th Bank

According to the Wall Street Journal (WSJ), Starbucks operates like a bank, quietly amassing significant amounts of customer funds.

Through its Starbucks Rewards membership program, the coffee chain has accumulated a substantial amount of cash from customers who voluntarily load money onto their cards.

From a consumer’s perspective, the program seems harmless, offering the convenience of pre-payment and reward points. Members enjoy the perks of not carrying cash or a wallet, and they even receive free drinks with frequent use. The program also offers incentives like bonus points and stars to redeem for free drinks or discounts.

However, from Starbucks’ perspective, the membership program provides valuable consumer insights, boosts sales, and offers an easy way to access interest-free capital.

WSJ reports that approximately 44% of transactions at Starbucks are made through the membership program, a percentage that rose to 80% during the COVID-19 pandemic. As of the end of 2019, Starbucks held $1.5 billion in “pre-paid” customer funds through this program.

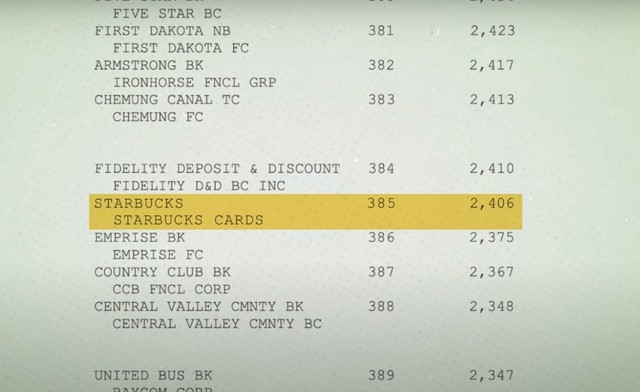

According to WSJ, this figure reached $2.4 billion by the end of 2022, ranking Starbucks as the 385th largest bank out of 4,236 in the US.

To put this into context, the Federal Deposit Insurance Corporation (FDIC) reports that over 3,900 banks in the US have less than $1 billion in total assets.

Additionally, Medium estimates that the Starbucks Rewards loyalty program accounts for 30-40% of the company’s global sales.

Starbucks’ third-quarter 2022 report revealed that there were 27.4 million active Starbucks Rewards members in the US alone. This number nearly doubled from 14.2 million at the end of 2017.

The company also shared that Starbucks Rewards members tend to spend three times more than regular customers. It’s no surprise, then, that Starbucks Rewards revenue in the US accounted for 53% of total revenue in 2023.

With a trusted brand and a “craze” for Starbucks as a symbol of affluence, many customers feel confident loading money into their membership accounts, believing they will eventually use it.

Voluntary Deposits

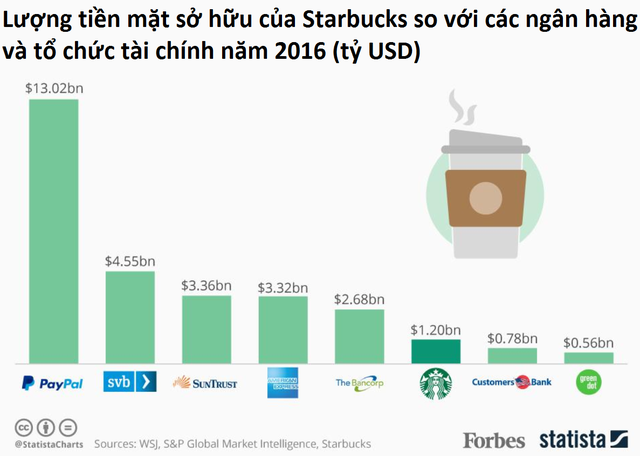

WSJ reports that Starbucks customers in the US regularly “deposit” around $1-2 billion into their membership accounts. This figure far surpasses the deposit amounts of some US banks, such as Customers Bank ($780 million) and Green Dot Corporation ($560 million).

Moreover, these deposits are intended for consumption rather than investment, giving Starbucks free rein over this interest-free capital.

With this favorable loan arrangement, Starbucks can invest or expand its business without sharing profits with customers.

According to Medium, approximately 10% of these deposits are often forgotten or left unused, providing Starbucks with an unexpected revenue stream.

From 2017 to 2019, the coffee chain recorded revenues from forgotten customer deposits of $104.6 million, $155.9 million, and $125 million, respectively, in its financial reports.

“We should call Starbucks an uncontrolled bank disguised as a coffee chain,” lamented Kim Jung Tai, chairman of South Korea’s third-largest financial group, Hana Financial Group, as Starbucks in South Korea held 70 billion won ($60.2 million) in customer deposits.

Legal Action

According to Fortune, a US consumer protection organization has accused Starbucks of exploiting its online payment platform, trapping customers in a spending trap where they are unable to exhaust their balances.

Specifically, the Washington Consumer Protection Coalition (WCPC) has urged Washington state prosecutors to investigate whether Starbucks’ policies violate consumer protection regulations.

“Starbucks has designed its membership card platform to encourage customers to leave money in the app. While a few dollars in each account may not seem like much, the cumulative effect has resulted in Starbucks holding nearly $900 million of customer funds over the past five years, boosting its revenue, profits, and executive bonuses,” said WCPC leader Chris Carter.

A Starbucks spokesperson told Fortune that they would cooperate with Washington state authorities to ensure compliance with local regulations and laws.

However, WCPC’s 15-page report alleges that Starbucks intentionally designed its membership card platform to hold onto customer funds.

Customers can only load a minimum of $5 and make online payments of at least $10, making it challenging to fully utilize the balance.

While Starbucks acknowledges that customers can pay in cash at traditional stores to clear their balances, the inconvenience of this option suggests that Starbucks doesn’t want customers to fully deplete their accounts.

Even small amounts left in accounts contribute to the hundreds of millions of dollars Starbucks has held over the years, enhancing its financial reports and providing capital for other purposes.

In response to these allegations, Starbucks argues that customers are free to spend as they wish and can clear their balances by paying in cash at traditional stores.

However, the numbers don’t lie, and it is evident that Starbucks benefits significantly from its customers’ “deposits.”

Sources: Fortune, WSJ, Medium

Techcombank joins hands with Starbucks Vietnam to bring “Warm Tet from the heart” to customers

Techcombank, one of the leading commercial banks in Vietnam, has announced a comprehensive partnership with Starbucks Vietnam to provide an exclusive experience for customers from both sides. In addition to accepting membership cards and cash, customers can now make seamless payments for products and services at Starbucks Vietnam using Techcombank Visa cards, with attractive benefits.

Mixue becomes the 4th largest F&B chain in the world, threatening to dethrone Starbucks with its under $1 bubble tea.

Mixue is regarded as the first Chinese brand to enter the Top 5 largest F&B chains in the world – a realm traditionally dominated by American brands.